Turns Out Breaking Up Isn’t So Hard to Do

Markets gapped higher at the open Thursday, but then drifted sideways back inside the gap the rest of the day on light holiday volume. DIA was the exception as it opened flat and traded down all day as traders punished DIS for their terrible report the night before. This left us with black candles in all 3 major indices. On the day, SPY gained 0.04%, DIA lost 0.45%, and QQQ gained 0.28%. The VXX fell 2% to 21.14 and T2122 rose a little but remains solidly in the mid-range at 63.51. 10-year bond yields rose to 1.57% and Oil (WTI) fell to $81.17/barrel.

This morning, JNJ announced plans to split into two companies, one focused on consumer healthcare products and the other being its pharmaceutical and medical device business units. (This is the second version of such a scheme in months.) The logic behind this plan is to move all liability from the Johnson’s Baby Powder cancer lawsuits into the consumer products business, insulating the larger business unit from liability. The move came just days after the company’s attempted “Texas two-step” (to split off just the talc business alone and choose its own bankruptcy court to limit company liability) failed and the courts ruled that the JNJ bankruptcy will be heard and litigated in the company’s home state of New Jersey. Hence the company is looking to divide to protect what parts of the company it can. JNJ stock is soaring in premarket on the news.

Continuing the conglomerate breakup theme started by GE and followed (for different reasons) by JNJ, Toshiba announced overnight that it is also breaking up. This one is a breakup into 3 companies. TOSYY will spin off its “device and storage” business which makes chips (now branded as Kioxia) as well as its “energy and infrastructure” units into their own companies. This split comes after a 5-month strategic review that was spawned by a governance scandal. The company hoped the reorganization is completed by the second half of 2023. Toshiba closed 1% lower on the news in Japan.

So far this morning, SPB reported a beat on both lines and AZN beat on revenue but missed on earnings. In other business news, Elon Musk took a back-handed shot at new rival RIVN. In a tweet last night, Musk said “I hope they (RIVN) are able to achieve high production and breakeven cash flow. That is the true test.” He went on to say TSLA is the only American carmaker to do so in the past 100 years. RIVN is up 58% from its IPO price in two days of trading (and up 4% in premarket). TSLA is up about 8% over the same time and is flat in premarket trading.

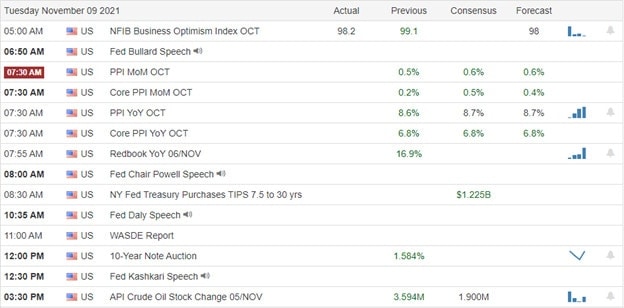

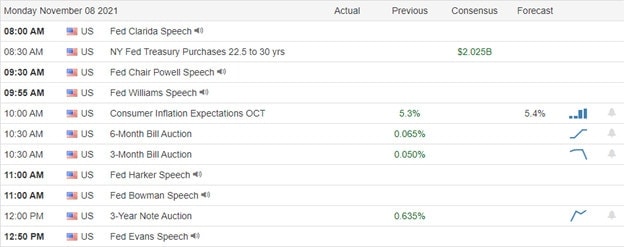

Overnight, Asian markets were mostly green. South Korea (+1.50%), India (+1.28%), and Japan (+1.13%) led the way. However, gains were widespread and only New Zealand (-0.91%), Indonesia (-0.60%), and Singapore (-0.30%) were in the red in the region. In Europe, markets are more mixed at mid-day. The FTSE (-0.39%), DAX (+0.16%), and CAC (+0.35%) are typical of the continent in early-afternoon trading. As of 7:30 am, US Futures are pointing toward a modestly green start to the day. The DIA is implying a +0.28% open, the SPY implies a +0.22% open, and the QQQ implies a +0.25% open at this hour. Bonds are up off overnight lows to 1.568% and Oil (WTI) is down almost 2% in early trading.

The major economic news scheduled for release Friday is limited to Sept. JOLTS and Michigan Consumer Sentiment (both at 10 am) as well as a Fed speaker (Williams at 12:10 pm). Major earnings reports scheduled for the day are limited to AZN and SPB before the open. There are no major earnings reports after the close.

With no economic news before the open and coming off a slow holiday session, markets are seeming to want to drift higher. While the trend of “rationalizing conglomerates” (breaking into actually related units) will get a lot of talk, that is not enough to move markets. Remember that the short-term trend is down, but the longer-term trend is very bullish and we sit near all-time highs.

Watch your current positions before looking to add any new trades. Focus on your trade rules and on managing the things you can control. That should include consistently taking profits when you have them and moving your stops in your favor. Trade carefully and think twice about holding through earnings.

Ed

Swing Trade Ideas for your consideration and watchlist: WISH, VUZI, CSIQ, CRSR, FAST, LUMN, ROOT, FCX, QS. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service