Finding and Understanding Liquidation Breaks – Member Malcolm Myles

In this video, one of our great members shares what he has learned from Market Profile Theory related to Liquidation Breaks, How to See Them, and What to Know About Them

In this video, one of our great members shares what he has learned from Market Profile Theory related to Liquidation Breaks, How to See Them, and What to Know About Them

Though recent market data such as yesterday’s negative durable goods orders hint at a slowing economy, the bulls ignored the data charged forward on Thursday. Big tech led the way yesterday, surging sharply upward, but new European regulations that may curb their dominance could slow their rally today. This morning we will get another reading on the already weak Consumer Sentiment and Pending Home Sales. Plan your risk carefully as we slide into the uncertainty of the weekend with indexes at or near significant price resistance levels.

Asian markets traded mixed overnight, with the volatile HSI leading the selling dropping 2.47% to wrap up their trading week. After striking a natural gas deal with the U.S, European markets trade with modest gains with monetary policy data pending. Finally, with a light day of earnings reports, the U.S. futures point to a modestly bullish open hoping to extend the winning streak a second week. However, expect price volatility to remain challenging in the days ahead as continued geopolitical and inflationary pressures weigh on world markets.

As we wrap up the week, we have a light day on the earnings calendar with about 30 companies listed, with the vast majority unconfirmed. Notable reports include DOOO, DCTH, MOV, PNT, & TRUHY.

U.S. President Joe Biden and European Commission President Ursula von der Leyen announced the formation of a joint task force to bolster energy security for Ukraine and the EU for next winter and the following one. The primary goals of the task force, the U.S. and EU said in a joint statement, would be to diversify LNG supplies in alignment with climate objectives and reduce demand for natural gas. It comes amid heightened concern that energy-importing countries continue to top up President Vladimir Putin’s war chest with oil and gas revenue on a daily basis. In addition, the European Parliament and EU member states reached a historic deal on the Digital Markets Act. The reforms aim to prevent tech giants from abusing their market position to harm smaller rivals. So-called “gatekeepers” that violate the DMA face potential fines of up to 10% of their global revenues. Neon is required for the lasers used in a chip production process known as lithography, where machines carve patterns onto tiny pieces of silicon made by the likes of Samsung, Intel, and TSMC. These machines are produced by Dutch firm ASML. According to Peter Hanbury, a semiconductor analyst at research firm Bain & Co, more than half of the world’s neon is produced by a handful of companies in Ukraine. This marks the first high-level visit between the two sides since bloody clashes on their contested border led to the deaths of 20 Indian and 4 Chinese soldiers in June 2020. Both governments are mum on the agenda and expectations from the visit, which remained cloaked in unusual secrecy. As the host of the annual BRICS summit later this year, China is also believed to be seeking India’s presence at the forum, putting India, China, and Russia at the same table. Treasury yields tick higher in the early Friday trading, with the 10-year rising to 2.3630% and the 30-year pricing up to 2.5182%.

The bulls ignored the worse-than-expected Durable Goods orders as they worked hard to rally the tech giants on Thursday. Unfortunately, new European regulations targeting the tech giants may hamper their efforts a little today. Nevertheless, index chart technicals continue to improve as the bulls work to hold higher lows and finish the week strong. This morning we will turn our attention to the Consumer Sentiment reading and the Pending Home sales. Finally, with earnings winding down and only four days next week to wrap up the 1st quarter of trading, watch for the possible end-of-quarter window dressing. Price volatility is likely to remain high, with the world seemingly becoming a more and more dangerous place filled with uncertainty. So, plan your risk carefully as we move toward the weekend.

Trade Wisely,

Doug

Markets gapped up on Thursday and then proceeded to put in a slow, all-day rally that closed near the highs. This left us with large white candles in all 3 major indices and a lower-high for our new trend. On the day, SPY gained 1.51%, DIA gained 1.05%, and QQQ gained 2.22% (led by a banner day by NVDA). The VXX fell 1% to 25.20 and T2122 rose back deeper into the overbought territory at 87.15. 10-year bond yields pulled back from early-day highs to close up at 2.364% and Oil (WTI) fell 3% to $111.37/barrel.

On the Russian invasion story, NATO and the European Union sanctioned 400 more individuals (300 of which are Russian Parliamentarians) as well as Russian defense companies. The US Treasury Dept. and UK PM Johnson both threatened to sanction Russian-owned gold. President Biden publicly said that if Russia used chemical or biological weapons, we would respond and the response would depend on the nature of the use (which implies a proportionate military response). Later, at a meeting of the G7, Biden went on to say he believes that Russia should be removed from the G20. Overnight, as expected, the US and EU reached a natural gas supply deal that will cut or eliminate the need for Russian natural gas.

SNAP Case Study | Actual Trade

Related to energy, US average gasoline prices have also fallen about 10 cents in the last week according to AAA. However, in some places like CA, gas has reached $7 at some stations. Meanwhile, oil prices declined globally Thursday after the EU decided to not sanction Russian oil…at this point. On the other hand, US natural gas producers are meeting with German gas buyers today in support of the LNG deal mentioned above. US producers will supply the EU with 15 billion cubic meters on LNG this year and up to 50 billion cubic meters each year until at least 2030. It is unclear if this is in addition to the 6.5 billion cubic feet of LNG per day the US already supplies the EU. Meanwhile, the Russian Duma is discussing taking Bitcoin in payment for their oil from “friendly” countries like China and Turkey in order the avoid sanctions.

In other European developments, the EU and European Parliament have reached a deal on their “Digital Markets Act.” The law is aimed at curbing global (US for all intents and purposes) tech giants from abusing their position to hurt smaller rivals. If any “gatekeeper” company is found guilty of doing so, they can be fined 10% of their global revenue (repeat offenders can be fined 20% of global revenue). The law will immediately impact FB, AAPL, AMZN, and GOOG who operate “walled gardens” that limit customer choices and make it hard or impossible for outside companies to reach those “captured customers” without paying dearly for the privilege. It also creates a massive set of rules the companies must comply with in order to do business in the largest combined consumer market.

Overnight, the Asian markets were mixed to end the week. Hong Kong (-2.47%), Shenzhen (-1.89%), and Shanghai (-1.17%) were the only real movers as the rest of the region was split on modest moves. In Europe, stocks are leaning to the upside at mid-day, with the notable exceptions of Russia (-3.66%) and Greece (-1.38%). The FTSE (+0.25%), DAX (+0.80%), and CAC (+0.78%) are leading the region higher in early afternoon trading. As of 7:30 am, US Futures are pointing toward a modestly green start to the day. The DIA implies a +0.27% open, the SPY is implying a +0.40% open, and the QQQ implies a +0.49% open at this hour. 10-year bond yields are flat at 2.363% and Oil (WTI) is down almost 2% in early trading.

Major economic news scheduled for release on Friday includes Michigan Consumer Sentiment and Feb. Pending Home Sales (10 am) and two more Fed speakers (Williams at 10 am and Waller at noon). The major earnings reports scheduled before the open are limited to DOOO. There are no earnings scheduled for after the close.

The natural gas deal likely means great days for the Us natural gas suppliers and shippers. However, it may be too late to chase that trade if you didn’t take the hint when I mentioned the potential earlier this week. Beyond that, the European Digital Markets Act impacts may hold sway today. However, US traders may well ignore that story, counting on tech giant litigation to mitigate future damage. With that said, the Russian invasion is likely to hold the mindshare of traders as we head into the weekend news cycle. The bias is clearly bullish with the strong rally and now a higher-low, especially if we can get some follow-through. However, be careful of volatility and quarter-end window dressing starting to happen.

Trade with the trend, don’t chase, keep consistently taking profits when you have them, and move your stops in your favor. The first rule of making big money in the market is to not lose big money in the market. Don’t be stubborn, and protect yourself from yourself. If you are wrong, just admit it and take your loss. Stick to those trading rules and manage the things that you can control while trying not to worry about the things you have no control over at all. Trading is a marathon, not a sprint. So, focus on the process and enjoy yourself.

Ed

Swing Trade Ideas for your consideration and watchlist: CGNT, JBT, BNTX, ROKU, ZG, PYPL, NFLX, HUBS, PINS, CRM, QS, PLTR, HOOD. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

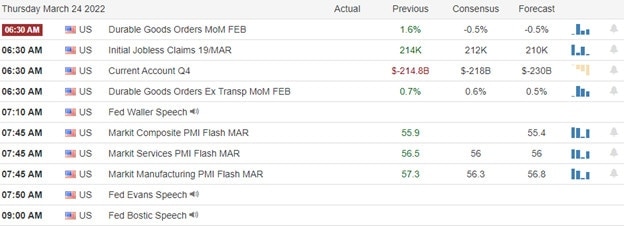

The bears reemerged yesterday, snapping the six-day winning streak and pushing the DIA below its 50- day average. However, the bulls held the SPY, QQQ, and IWM above the critical technical level. This morning we will turn our attention to Durable Goods, Jobless Claims, PMI, and the news coming out of the NATO meeting. As commodities prices continue to rise, so does inflation and the chances that the Fed will be forced to act more aggressively in May, keeping traders on edge and price action challenging. Plan your risk carefully.

During the night Asian market closed, mixed easing Covid restrictions but concerned about rising energy prices. European markets trade near the flatline this morning, focusing on the NATO meeting results today. U.S. futures markets are doing the standard premarket pump up ahead of economic data that could bring an extra dose of volatility should the durable goods number disappoint.

As usual, Thursday is the biggest earnings day of the week, with about 80 companies listed with several unconfirmed. Notable reports include AMPS, CODX, DRI, FDS, MCW, NEOG, NIO, SGLB, SMRT, TITN, TMDI, & UFAB.

Russian President Vladimir Putin has been in power for more than two decades and, during that time, has carefully cultivated an image of himself as an authoritarian, strongman leader. Now, analysts say his decision to invade Ukraine is the biggest mistake of his political career and has weakened Russia for years to come. As a result, both economically and geopolitically, Russia’s position looks increasingly isolated and vulnerable. Three pressing threats loom large over the summit, requiring the alliance to determine its response and whether military intervention would be needed. That includes mistaken fire on an allied nation, cyberattacks on a NATO member state, and the possibility of chemical or biological warfare within Ukraine. NATO leaders are also expected to announce more humanitarian aid to Ukraine, particularly the embattled port city of Mariupol, a fresh round of sanctions and new pressure on Moscow’s energy sector. In addition, it is the first suspected launch of an ICBM since November 2017 during heightened tensions between North Korea’s Kim Jong Un and former U.S. President Donald Trump. While North Korea has conducted a flurry of ballistic missile tests in recent months, Thursday’s suspected launch of an ICBM represents a significant escalation. Clean energy and low-carbon-emitting companies would stand to benefit. Fossil fuel production companies stand to lose. Higher carbon footprint companies such as heavy manufacturing and industrial chemical companies will not be expected to decarbonize overnight, but they will need to disclose their emissions data. Compliance and auditing service companies will see a surge in demand, as will software companies that automate the processes. Treasury yields are back on the rise again this morning, with the 10-year trading up to 2.39% early Thursday morning and the 30-year rose slightly to 2.5313%.

The bears reemerged yesterday to relieve the recent rally’s short-term overextension slightly. While the DIA closed the day back below its 50-day average, the bulls were able to defend this critical technical level in the SPY, QQQ, and IWM. With no significant market-moving earnings report this morning, we will turn our attention to the Durable Goods number that analysts expect to come in with a negative reading. Nevertheless, it may give us some insight into the inflationary impacts on consumers and if it suggests a slowing of our economy is underway. Commodities prices continue to surge, with Brent crude topping 121 a barrel yesterday, but the national average gas prices stood firm at $4.24 and diesel at $5.14. We may also be sensitive to today’s NATO meeting with the U.S. sending more troops and leveling more sanctions against Russia with fears of chemical weapons rising. So, expect price volatility to remain challenging and keep an eye on the bond yields as they inch closer and closer toward inversion.

Trade Wisley,

Doug

Markets gapped down 0.7% – 0.9% and then followed through with a long, slow all-day selloff, closing near the lows. This left us with black candles in all 3 major averages and the first appreciable pullback in well over a week. Even so, none of the 3 major indices even tested their T-lines (8ema) and the QQQ was just an inside day (Bearish Harami) candle. On the day, SPY lost 1.29%, DIA lost 1.36%, and QQQ lost 1.44%. The VXX was flat at 25.49 and T2122 dropped, but remains just inside the overbought territory at 81.95. 10-year bond yields fell to 2.293% and Oil (WTI) spiked another 4.5% to $114.23 as Russia said storm damage could put a major pipeline out of service for a month or more.

On the Russian invasion story, the US formally charges Russia with war crimes on Wednesday, and NATO announced it is expanding the number of troops in Eastern Europe by adding 4 battle groups (only about 500 additional troops) in that area. In response, Russia is expelling 12 American diplomats and is demanding that “unfriendly countries” pay for Russian Natural Gas in rubles, with Gazprom (Russian LNG firm) ordered to make changes to contracts within a week. The news caused the Ruble to rally. (However, existing contracts could not be changed. So, the impact in the short term is questionable.) The Russian stock market partially reopened today as well.

SNAP Case Study | Actual Trade

In another Russian Sanctions-related story, it appears the US and EU are close to a deal on cutting European use of Russian natural gas. Sources told Bloomberg it would be announced Friday. The agreement is expected to result in a large surge of US-produced LNG being sent to Europe starting as soon as a few months from now. The largest US natural gas producers are LNG, CQP, XOM, and CVX.

After the close, FUL and TCOM reported beats on both revenue and earnings. Meanwhile, OLLI missed on revenue while beating on earnings. Unfortunately, KBH missed on both lines. So far this morning, MOMO beat on both lines while TITN beat on earnings and missed on revenue. However, DRI reported missing on both revenue and earnings.

Overnight, the Asian markets were mixed but leaned to the downside. Hong Kong (-0.94%), Shenzhen (-0.83%), and Shanghai (-0.63%) paced the losses while Singapore (+1.05%) led gainers. In Europe, markets are also mixed as Russia resumed trading with short-selling banned and foreign investors prohibited from selling at all (at least until April). It is also suspected that the Russian government is a buyer of last resort placing a floor under the market. As a result, the Russian MOEX is up 4.37%. However, the FTSE (+0.14%), DAX (-0.31%), and CAC (-0.04%) are more typical of the region at mid-day. As of 7:30 am, US Futures are pointing toward a green start to the day. The DIA implies a +0.48% open, the SPY is implying a +0.64% open, and the QQQ implies a +0.74% open at this hour. 10-year bond yields are back up to 2.379% and Oil (WTI) is flat in early trading.

The major economic news scheduled for release on Thursday include Feb. Durable Goods Orders, Q4 Current Account, and Weekly Initial Jobless Claims at 8:30 am, Mfg. PMI and Services PMI (both at 9:45 am) and more Fed speakers (Waller at 9:10 am and Bostic at 11 am). The major earnings reports scheduled before the open include DRI, MOMO, HEPS, SNX, and TITN. Then after the market close, NIO reports.

The major indices look to be pointing higher early, but for the first time in days we have economic news this morning. In addition, news out of the meetings President Biden is attending in Europe has the potential to roil markets. So, be careful not to ignore volatility. With that said, a minor, one-day pullback is the best bulls could have hoped for in the recent rally and if yesterday was our “higher low” the bulls may be ready to run up to at least the next resistance level. The bias is clearly bullish in the short term.

Trade with the trend, don’t chase, keep consistently taking profits when you have them, and move your stops in your favor. The first rule of making big money in the market is to not lose big money in the market. Don’t be stubborn, and protect yourself from yourself. If you are wrong, just admit it and take your loss. Stick to those trading rules and manage the things that you can control while trying not to worry about the things you have no control over at all. Trading is a marathon, not a sprint. So, focus on the process and enjoy yourself.

Ed

Swing Trade Ideas for your consideration and watchlist: QS, JBT, BNTX, PLTR, NFLX, FDX, CRM, HOOD, RBLX, PINS. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

With another mighty push, the bulls managed the sixth day of gains, testing resistance levels even as traders now price in a 50 basis point rate increase for May. Inflation continues to impact consumer activity, with Mortgage Applications falling by -8.1% while Brent Crude passed 118 a barrel this morning. Jerome Powell will be speaking again before today’s open, with housing and petroleum numbers coming out during the morning session. So, be careful chasing already extended stocks even though we may still experience some end-of-quarter window dressing.

Asian markets closed green across the board led by the Nikkei surging 3.00% higher. European markets trade mixed but mostly lower this morning with U.K. inflation hitting multi-decade highs and Ukraine war pressures. U.S. futures point to lower open as they assess the impacts of inflation and more hawkish Fed willing to sacrifice growth to fight the rapidly rising consumer prices.

We have less than 50 companies listed on the Wednesday earnings calendar. Notable reports include AWH, CTAS, CRBLF, FWRG, GIS, FUL, JKS, KBH, OLLI, SOL, SIEN, SCS, TCEHY, COOK, TCOM, WGO, & WOR.

Transportation Secretary Pete Buttigieg on Wednesday announced $2.9 billion for new competitive grants designed to improve U.S. transportation infrastructure. The sum, part of the bipartisan $1 trillion infrastructure law President Joe Biden signed into law, is intended to bankroll highway, bridge, and freight projects. State, regional and local governments will be able to contend for the grant funding through three separate programs with a single application. As a result, Tencent reported its slowest quarterly revenue growth on record in the fourth quarter of 2021. Revenue came in at 144.18 billion yuan ($22.62 billion), up 8% year-on-year. The Chinese technology giant continues to feel the impact of Beijing’s regulatory tightening on the domestic technology sector. The delisting of U.S.-listed Chinese stocks may come in the next two to three years, according to Jamie Allen of the Asian Corporate Governance Association. Dual-listed Chinese stocks were recently in the spotlight after delisting fears reemerged following a U.S. Securities and Exchange Commission announced that U.S.-listed securities for five Chinese companies are at risk of delisting. Following an initial plunge, the shares later saw a sharp reversal after Chinese state media reported that the U.S. and China regulators are progressing toward a cooperation plan on U.S.-listed Chinese stocks. CNBC’s Jim Cramer on Tuesday warned investors against buying unprofitable stocks due to unwarranted optimism about the stock market. “Right now, we need to bow down to the Fed and the forces of inflation,” the “Mad Money” host said. Treasury yields turned slightly lower in early Wednesday trading, with the 10-year dipping less than a basis point to 2.3753%, while the 30-year moved slightly higher to 2.932%.

Indexes surged higher with the SPY and QQQ making it the sixth day of gains in the relief rally even as volume continued to decline. However, with traders now pricing in a 50 basis point increase in May, the bulls may find it challenging to keep the pace. Before the bell, Jerome Powell delivers another speech, but it seems unlikely he will change his hawkish tough talk in light of the rapidly rising commodity prices. Then we will turn our attention to New Home Sales figures and the Petroleum status report before the 20-year bond auction at 1:00 PM Eastern. Consumers worldwide are feeling the pinch of inflation, and more and more, we hear about the possibility of a recession, so be very careful chasing already extended stocks. Though we could see a more bullish end-of-quarter window dressing, it is hard to imagine 2nd a vigorous round of 2nd quarter earnings with food and energy prices restricting consumer activity.

Trade Wisley.

Doug

Markets gapped modestly higher and followed through the first hour of the day in all 3 major indices. However, from that point, markets ground sideways in a tight range the entire rest of the day. This left us with gap-up white candles with small upper wicks in all 3 cases. It is worth noting that the volume was very light across the board. On the day, SPY gained 1.16%, DIA gained 0.77%, and QQQ gained 1.95% as stocks continue to be extended to the upside. The VXX fell over 2% to 25.44 and T2122 rose slightly to a very-extended 96.08. 10-year bond yields continue to spike, closing at 2.388% and Oil (WTI) fell a fraction to $111.30.

Even after markets have digested Chair Powell’s more hawkish position from Monday, the stock market seems to have accepted a more aggressive Fed. However, bond markets continue to spike, and futures markets are now beginning to expect a half-percent hike in both May and June (now reading a 66% chance, up from 50-50 on Monday afternoon). This is in line with GS raising its own forecast Tuesday to an expectation of a 50-basis-point hike at both meetings. Buckle up as Chair Powell speaks again this morning.

SNAP Case Study | Actual Trade

On the Russian story, the FBI provided more background on President Biden’s warning to US companies about cyberattacks. The Cybersecurity and Infrastructure Security Director told industry executives that 5 major US energy companies and at least 18 other major companies in the Banking and Defense industries have had their networks probed by hackers from Russian IP addresses within the last few days. These probes are a typical prelude to a coordinated hacking attack. (She refused to name the companies involved.) Meanwhile, President Biden will be traveling to an emergency NATO summit, a meeting of the Group of 7, and a session of the European Council on Thursday. He is expected to announce another round of sanctions in coordination with members of the NATO and EU, to increase pressure and crackdown on sanction evasion. How “the West” will respond if China provides more assistance to Russia is also set to be on the agenda. Elsewhere, French oil company TTE has also announced that it will stop buying Russian oil by the end of 2022 at the latest.

After the close, ADBE, AIR, and WOR reported beats on bother revenue and earnings. In other after-hours news, it was announced that the Chairman of GME bought another 100,000 shares of the stock, which brings his ownership to just below 12% of the stock. This caused GME to soar 20% in post-market trading on the heels of a 31% rally during the day. So, meme stock wild rides are back baby! This morning, TCEHY beat on revenue while missing badly on earnings. This same despite it being the slowest revenue growth in company history amidst Chinese tech industry regulation tightening. Other notable premarket reports include GIS beating on earnings while missing on revenue, WGO beating on the top line while missing on the bottom line, and JKS missing on both lines.

Overnight, the Asian markets were mostly green. Japan (+3.00%) was an outlier to the upside with Hong Kong (+1.21%), Taiwan (+0.98%), and South Korea (+0.92%) leading the gains. Only New Zealand (-1.18%) and India (-0.50%) were down. In Europe, stocks lean to the downside on modest moves at mid-day. The FTSE (+0.28%) is an outlier with the DAX (-0.32%) and CAC (-0.32%) typical of the rest of the continent. (Besides the FTSE, only Switzerland and Norway are slightly above flat in early afternoon trading.) As of 7:30 am, US Futures are pointing toward a modestly lower open. The DIA implies a -0.27% open, the SPY is implying a -0.33% open, and the QQQ implies a -0.51% open at this hour. 10-year bond yields are slightly lower and Oil (WTI) is up another 2.6% in early trading.

The major economic news scheduled for release on Wednesday includes Feb. New Home Sales (10 am), Crude Oil Inventories (10:30 am), and a couple of more Fed speakers (Chair Powell at 8 am and Daly at 11:45 am). The major earnings reports scheduled before the open include CTAS, CL, GIS, HTHT, JKS, TCEHY, and WGO. Then after the market close, FUL, KBH, and TCOM report.

The major indices look to be opening as inside candles this morning. However, Fed Chair Powell will speak again shortly (8 am) and it is unclear if he will return to his moderate tone of the past or stay with the more hawkish tone from Monday. It would not be a surprise if traders really parse his every word and inflection at this point. So, beware of volatility. Also remember that even if a bottom has already been put in, rest and consolidation are clearly in order. However, we can’t predict the market. So, just follow the chart and be careful of chasing at this point of the recent run, but we do need to recognize that the longer-term downtrend has been broken. At this point, we need to see a higher low hold and bulls to step in to establish the new uptrend.

Trade with the trend, don’t chase, keep consistently taking profits when you have them, and move your stops in your favor. The first rule of making big money in the market is to not lose big money in the market. Don’t be stubborn, and protect yourself from yourself. If you are wrong, just admit it and take your loss. Stick to those trading rules and manage the things that you can control while trying not to worry about the things you have no control over at all. Trading is a marathon, not a sprint. So, focus on the process and enjoy yourself.

Ed

Swing Trade Ideas for your consideration and watchlist: GP, ZG, ZION, JBT, CGNT, HES, QS, ASPN, RBLX, FUBO. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

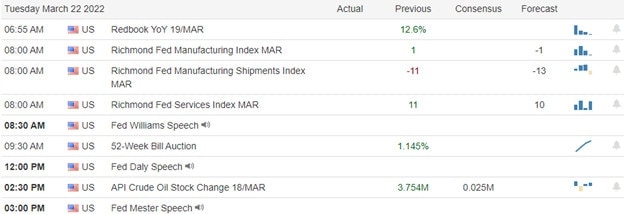

After the dramatic surge in the indexes last week, yesterday’s pause and pullback at technical and price resistance levels should not have been a big surprise. However, with another light day on the earnings and economic calendars, the rally in overnight futures suggests a willingness to continue to test those resistance levels’ strength. So, the question is, can we shake off the sharp rally in commodity prices, bond yields, and the tough talk from the Fed, or could it set up another pop and drop at resistance? We will soon find out.

Asian markets saw green across the board during the night, with Alibaba shares surging 11%. European markets are also trying to resume the relief rally showing green across the board this morning though somewhat muted as Ukraine weighs on investors. U.S. futures reversed overnight losses suggesting a bullish open testing overhead price resistance levels.

As we head for the end of the quarter, the number of earnings continues to diminish. As a result, we have just short of 40 companies listed on the Tuesday calendar, with several unconfirmed. Notable reports include ADB, ACH BZFD, CCL, RAIL, GAN, HQY, HUYA, JILL, PAYS, POSH, STRR, & SUNL.

Russia’s purported use of hypersonic missiles in Ukraine shows that the military could be resorting to using more destructive weaponry. It has developed hypersonic missiles over several years, unveiling a handful of them in 2018. The country’s defense ministry said it had deployed “Kinzhal” (“Dagger”) hypersonic aeroballistic missiles in two attacks in Ukraine. Fed Chairman Jerome Powell vowed tough action on inflation, which he said jeopardizes the recovery. Powell said the Fed would continue to hike rates until inflation comes under control and could get even more aggressive than last week’s increase, which was the first in more than three years. He noted those rate rises could go from the traditional 25 basis point moves to more aggressive 50 basis point increases if necessary. A slew of Chinese real estate developers this week said they cannot release their financial results on time or have yet to set board meetings. Among them was troubled property developer Evergrande, which hit markets last year with its debt crisis. In a filing to the Hong Kong exchange on Tuesday, Evergrande said that due to the “drastic changes” in its operational environment since the second half of 2021, its auditor added “a large number of additional audit procedures” this year. According to Japanese bank Nomura, other developers cited the resignation of auditors for failing to issue their financial year 2021 earnings on time. Thanks to robust North America demand, Nike’s fiscal third-quarter results to analysts’ estimates. But with lingering uncertainties around inflation, a war overseas, and clogged supply chains, Nike is holding off on giving an outlook for the upcoming year. “We are focused on what we can control,” said Chief Financial Officer Matthew Friend on a post-earnings conference call. “Several new dynamics are creating higher levels of volatility.” Treasury yields continued to rise in early Tuesday trading, with the 10-year moving up to 2.3478% and the 30-year trading higher at 2.5672% after the tough talk from Jerome Powel yesterday.

After the dramatic surge in index prices last week, the pause and pullback at technical and price resistance levels was not a big surprise. However, with little to inspire on both the earings and economic calendar, futures have decided to try and press higher in the premarket despite the rising commodities prices. Average gas prices moderated slightly last week, now at $4.24 per gallon for gasoline and $5.14 for diesel. Food prices are also pressuring the consumers as ag inputs continue to surge and questions of future food shortages the possible result. That said, the bulls seem intent on shaking off the consumer woes and tough talk coming from Jerome Powell yesterday that would not rule out 50 basis point increases to curb inflation. As a result, traders will have to keep a close eye on overhead resistance levels that may conceal entrenched bears. In addition, I think it would be wise to keep in mind we have more talk coming from the Fed Chair on Wednesday morning with a Durable Goods number Thursday that consensus estimates suggest a negative number is possible.

Trade Wisely,

Doug

Markets were relatively (by recent standards) stable on Monday. After opening flat, the major indices traded in a less volatile manner all day long. All 3 major indices printed a Doji-type indecisive candle with only the DIA having a Black Spinning Top candle. On the day, SPY lost 0.05%, DIA lost 0.52%, and QQQ lost 0.40% (on a modest gap-down). The VXX gained 4% t o 26.01 and T2122 remains deep in the overbought territory at 95.65. 10-year bond yields spiked hugely higher to 2.299% following FOMC Chair Powell’s hawkish remarks. It was the worst day in decades in the bond market. Oil (WTI) spiked 7.4% to $112.36/barrel on the day as the EU Parliament was debating the banning of Russian oil imports.

During the day, Fed Chair Powell made a speech explaining his personal position (as opposed to his press conference last Wednesday when he was speaking for the FOMC consensus). During the speech, Powell said that “inflation was much too high” which jeopardizes an otherwise strong recovery. He went on to vow the Fed will take tough action in the months ahead, including half percent hikes as soon as May if that becomes more appropriate. (Futures are now pricing in a 50% chance of a 50-basis-point hike at the next meeting in May.)

SNAP Case Study | Actual Trade

On the invasion story, Russia continues to bombard the city of Mariupol after the Ukrainians refused to surrender the city. That port city is the last holdout preventing the Russians from having unquestioned control of a land route across the southern border from Russia to Crimea. The EU Parliament continues to debate banning Russian oil and Germany has reached out to UAE as a source of Natural Gas shipments. President Biden also cited “evolving intelligence” that Russia will be launching cyberattacks on the US. He urged private sector companies to work with Homeland Security to harden their company cyber security immediately. Elsewhere, S&P has pulled the credit ratings on all Russian firms, making them uninvestable by most funds.

On the business front, after the close, NKE reported beats on both lines and cited strong demand throughout North America. This was despite only recovering sales in China, where boycotts of western brands had caused pain and are now rebounding. The SEC also approved new rules by a 3-1 vote requiring corporations with more than $700 mil in shares to disclose how operations affect carbon emissions (including the offsets they purchase to remain compliant) and how climate change may impact their business starting in 2023. This follows the same rules in the EU, Britain, and several other countries. (Public comment of 60-days now starts before the final vote and it is likely to be challenged in court by business interests and associated politicians such as the WV state government.) Overnight BABA stock spiked as the company announced it is increasing its share buyback plan to $25 billion (from $15 billion previously) over the next 2-year period (by March 2024).

Overnight, the Asian markets were mostly green. Hong Kong (+3.15%) was an outlier with Japan (+1.48%) and India (+1.16%) leading gainers. Shenzhen (-0.49%) was by far the biggest loser on the day as most losses were closer to flat. In Europe, stocks lean heavily to the upside with just a couple of exchanges in the red at mid-day. The FTSE (+0.47%), DAX (+0.75%), and CAC (+0.61%) lead the continent higher in early afternoon trading. As of 7:30 am, US Futures are pointing to a modestly green open. The DIA implies a +0.45% open, the SPY is implying a +0.27% open, and the QQQ implies a +0.14% open at this hour. 10-year bond yields are up briskly again to 2.342% and Oil (WTI) is basically flat at $112.02/barrel in early trading.

The only major economic news scheduled for release on Tuesday are a trio of Fed speakers on Tuesday (Williams at 10:35 am, Daly at 2 pm, and Mester at 5 pm). The only major earnings report scheduled before the open are CCL and HUYA. Then after the market close, ADBE, PAGS, and WOR report.

More “Fed speak” today is the closest we will get to economic news with no earth-shattering earnings reports on the day either. So, the Russian story is likely to continue holding center stage. Monday’s indecision was not much rest after the strong rally the prior 4 days. So, markets remain extended. Even if a bottom has already been put in, rest and consolidation clearly remain in order. However, don’t try to predict the market. Just follow the chart. Remember the market can remain “wrong” a lot longer than we can stay solvent being “right too early.” So, be careful of chasing optimism at this point, but recognize that the longer-term downtrend has been broken. We just need to see a higher low hold and bulls to step in to establish the new uptrend.

Stick to your trading rules and manage the things that you can control. Remember that you don’t have to trade every day (or even week) and you definitely don’t need to chase gaps and moves. Trading is a marathon, not a sprint. Trade with the trend, don’t chase, keep consistently taking profits when you have them, and move your stops in your favor. The first rule of making money in the market is to not lose big money in the market. So, don’t be stubborn, and protect yourself from yourself. If you are wrong, just admit it and take your loss. (That’s why we set stops in the first place.)

Ed

Swing Trade Ideas for your consideration and watchlist: NKE, WFC, F, SBUX, GM, AMD, RTX, MSFT, X, XLE, HAL, UPST. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Last week, bulls created significant improvement in the indexes as they found reason to rally with falling mortgage applications, rising producer prices, declining retail sales, and more hawkish fed willing to sacrifice growth to fight the out-of-control inflation. As a result, downtrends breached, but now comes the tricky part, can the bulls hold a higher low to confirm an uptrend? With commodities rising again, the uncertainty is likely to keep price action volatile and challenging. So, focus on price action, watching for head-fakes, whipsaws, and reversals.

Overnight Asian markets traded mixed as oil once again surges higher. European markets trade mixed and muted as the fighting in Ukraine intensifies. U.S. futures are well off the overnight highs as surging commodity prices dampen bullish sentiment and again raise the ugly head of economic uncertainty. With oil up more than 4.50% this morning, prepare for another wild price action day.

On the Monday earnings calendar, we have about 72 companies listed, but many of them are unconfirmed. Notable reports include KERN, HRT, JAGGF, MRNS, NKE, PDD, & TME.

Berkshire Hathaway said Monday morning it agreed to buy insurance company Alleghany for $11.6 billion, or $848.02 per share, in cash. The conglomerate said the deal “represents a multiple of 1.26 times Alleghany’s book value at December 31, 2021,” as well as a 16% premium to Alleghany’s average stock price in the past 30 days. A Boeing 737 has crashed in China with 132 people on board. The authority said that contact was lost with the flight over Wuzhou in the Guangxi region. It was scheduled to fly from Kunming to Guangzhou in the country’s southeast. The number of casualties is currently unknown. China’s Civil Aviation Administration said it had “activated the emergency mechanism and dispatched a working group to the scene,” according to a translation. Crude futures were up more than 3% on Monday morning during Asia trading — international benchmark Brent crude was at $111.46, and U.S. futures at $108.25. Oil prices have been volatile in recent weeks – soaring to record highs in March before tumbling more than 20% last week to touch below $100. They jumped again in the latter half of last week. Ukrainian and Russian officials have met intermittently for peace talks, which have failed to progress to key concessions. Tight supply continued to worry markets, sparking the International Energy Agency (IEA) call on Friday for “emergency measures” to reduce oil usage. The price hit $31,380 a metric ton of nickel as it opened for trade on the London Metal Exchange, according to Refinitiv data. The 145-year-old exchange, which still has some open outcry trading, has had a wild couple of weeks of nickel trading, with price surges, technical glitches, and trading suspensions. Treasury yields rose in early Monday trading, with the 10-year trading at 2.888% and the 30-year moving up slightly to 2.4429%.

Last week, there was a significant improvement in the indexes as the bulls used the falling mortgage applications, rising producer prices, declining retail sales, and a hawlkish Fed as a reason to rally. Although the bulls breached the downtrends, now comes the most critical test, can they hold a higher low? With commodities again surging higher as the fighting intensifies in Ukraine, nothing has changed regarding the economic uncertainty on consumers. The rally pushed the T2122 indicator into a short-term overbought condition, so traders should watch closely for the potential of a pullback that could begin at any time. That said, it’s nice to see the substantial relaxation in the VIX, but keep in mind that emotions are high, and consumer sentiment remains very low. Not exactly an ideal situation as we wind down the first quarter of the year wondering how the consumer impacts will play out in the second-quarter earnings. It would not be surprising to see some end-of-quarter window dressing, but we should continue to expect significant price volatility. So watch carefully for head-fakes, whipsaws, and overnight reversals in the days and weeks ahead.

Trade Wisely,

Doug