The Price of Disappointment Was Clear

The bulls were in a great mood early in the premarket Tuesday…too great of a mood. Then the August CPI came in hotter than forecast (and much hotter than the bulls had expected that it would come in well below forecast) and at that point, it was “Katy bar the door.” So, instead of gapping up two-thirds of a percent, all 3 major indices flipped in premarket and gapped down very significantly (between 2% and 3%) at the open. From that open, we saw follow-through by the bears until 11:30 am. Next came a two-hour mid-day pause with the bears finally stepping back in with gusto at 1:30 pm to steadily sell off the 3 major indices the rest of the day. This action left us with Bearish Kicker candles, which gapped down through the T-line (and downtrend line) and kept going south in the SPY, DIA, and QQQ.

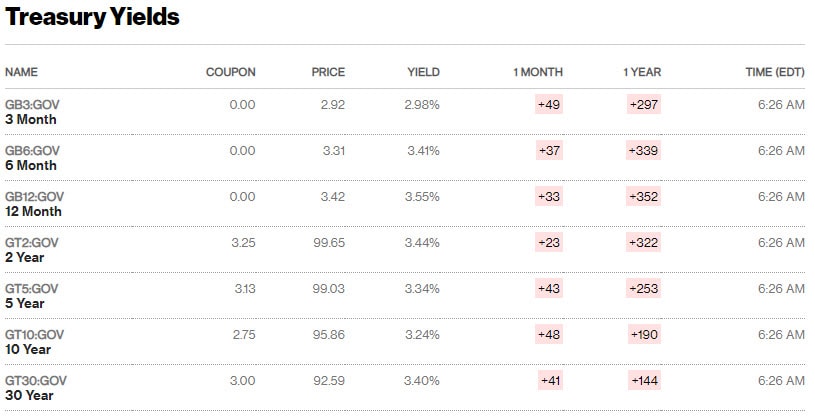

On the day, all 10 sectors are down hard with Energy (-2.52%) and Utilities (-2.57%) as the laggards and Technology (-5.00%) leading the way lower. The SPY fell 4.31%, the DIA fell 3.96%, and the QQQ fell 5.48%. Meanwhile, the VXX is up 5% to 19.04 and T2122 dropped all the way from overbought to oversold at 13.21. After being down in the premarket, 10-year bond yields have spiked up to 3.423%, and Oil (WTI) is just on the red side of flat at $87.58/barrel. Overall, this was the worst day since 2020 across all 3 major indices.

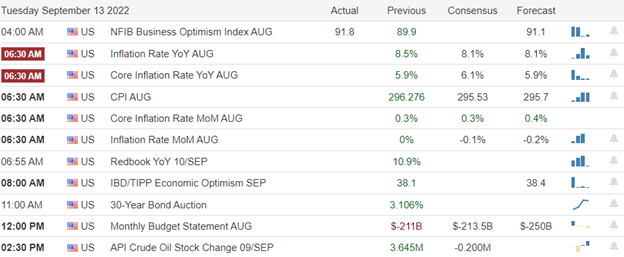

In Economic news, as mentioned above, August CPI came in at an annual rate of 8.3% when 8.1% was forecast and there had been a lot of talk in the last few days expecting 8.0% based on the continued drop in gas prices. With that said, the August CPI Annual Rate was still better than the 8.5% in July. (As a result, Feds Fund Futures now show that traders give a 35% probability of a Fed hike of 1% next week.) Later in the afternoon, the August Federal Budget Balance also came in worse than expected at a $220 billion deficit versus a $213.5 billion deficit forecast and the July level at a $211 billion deficit. Elsewhere, the Dollar rallied 1.48%, bringing the Euro back below parity and gaining 1.2% against the Yen. Finally, after the close, API reported that US Oil Inventories rose just over 6 million barrels last week (compared to a 3.6 million barrel build the week before). However, the same group reported a gasoline drawdown of 3.23 million barrels for the same week.

SNAP Case Study | Actual Trade

In TWTR news, Republican Senator Lindsey Graham proposed Tuesday that TWTR, META and other major social media platforms should face increased regulation and be required to obtain a renewable license to operate. The Senator said he was working on legislation to do this along with other senators from both sides of the aisle. At the same hearing, the TWTR whistleblower (best known as “Mudge”) informed the Senate that the FBI previously told the company about Chinese government agents working for Twitter. However, the company was struggling internally to weigh the cost of protecting user data versus losing the Chinese advertising revenue if they were to take action against the Chinese. In the end, the company decided not to jeopardize the very lucrative revenue stream.

In other stock news, in contrast to GS (which announced coming job cuts on Monday), on Tuesday, both JPM and BAC both told media and investors that said they were more optimistic, would be cautious about doing any layoffs, and are fine with their current headcounts for now. Elsewhere, SBUX told investors that has plans to open 9,000 new stores in China by 2025. Meanwhile, the US Dept. of Commerce announced a deal with GOOGL to produce chips that researchers can then use to develop both nanotechnologies and other semiconductor chips. These chips will be produced by SKYT. (This is part of the spending from the recent Chips bill.) Finally, after the close, AAPL announced it is creating a new Ad division and will launch ads within the AAPL App Store before the holiday season.

In miscellaneous news, Bloomberg reported that the US will begin refilling its strategic petroleum reserves once oil falls below $80/barrel. So, that may put a floor under oil to some extent and for a while after oil prices reach that level. Elsewhere, President Biden’s National Security Advisor Sullivan told the press that they are preparing another aid package for Ukraine to help follow on to counteroffensive that country has used to liberate more than 2,300 sq. miles of Ukraine from Russian occupation in the last week. Meanwhile, European Commission President von der Leyen said they would raise an additional $140 billion (on top of the $225 billion of leftover Covid Relief funds that were approved by the EU) for use in cushioning consumer cost-of-living increases. On related news, Germany will increase its stake (and may fully nationalize) the country’s largest gas importer (Uniper SE). Finally, US mortgage demand fell again last week as interest rates rose. The national average 30-year fixed-rate mortgage for a conforming loan (20% down) went from 5.94% to 6.01%. At the same time, loan applications fell 4% for refinancing loans and were flat on the week for new purchase loans.

Overnight, Asian markets were down across the board. Japan (-2.78%), Australia (-2.58%), and Hong Kone (-2.48%) led the region lower. In Europe, with the exception of the FTSE-MIB (+0.57%), the same story is taking shape, just with less gusto. The FTSE (-0.96%), DAX (-0.48%), and the CAC (-0.32%) are leading the region lower on smaller moves in early afternoon trade. Even Russia (-1.62%) has not seen the bearish momentum we saw in the US yesterday. As of 7:30 am, US Futures are pointing toward a modestly green start to the day…ahead of data. The DIA implies a +0.28% open, the SPY is implying a +0.34% open, and the QQQ implies a +0.33% open at this hour. 10-year bond yields are up slightly to 3.442% and Oil (WTI) is flat at $87.24/barrel in early trading.

The major economic news events scheduled for Wednesday are limited to August PPI (8:30 am) and EIA Weekly Oil Inventories (10:30 am). The only major earnings report scheduled for the day is DOOO before the open.

In economic news later this week, on Thursday, we get August Import/Exports, Weekly Jobless Claims, NY Empire State Mfg. Index, Philly Fed Mfg. Index, August Retail Sales, August Industrial Production, July Business Inventories, and July Retail Inventories. Finally, on Friday, we get Michigan Consumer Sentiment. Friday is also Quadruple Witching.

In terms of earnings later this week, Thursday ADBE reports. However, there are no earnings reports scheduled for Friday.

Yesterday showed just how binary events can cause markets to react like a jilted lover. Small disappointments can sometimes lead to a face-ripping storm. Those of you who were very short the market had a glorious day (just don’t forget that event could have gone the other way) and those of you who were too long the market learned a valuable lesson about binary risk events. In either case, we’ve now had that zag I’ve been telling you was coming. The good news is that the market always overreacts, re-reacts, and reacts again. In other words, we know another zig is coming sometime soon.

With that backdrop, we should note that all 3 major indices are back below their downtrend lines and below their T-lines. The market bias is bearish. However, while the bears have control on the daily chart, the bulls have support just below to help them fight that momentum. The PPI news should not be such a binary risk as the CPI, but we may still see a reaction. So, keep an eye on that in the premarket. Beyond that, trade the chart (the actual price action) and not what you predict will happen. We can’t be first or last over the hill if we want to succeed.

Remember that trading is our job, not a pastime or hobby. So, treat it that way. Do the work and follow the process. Stick with your trading rules, trade with the trend, and take those profits when you have them. Demonstrate patience and wait for confirmation. Don’t be stubborn. If you have a loss, just admit you were wrong, respect your stop, and take the loss before it grows. When price does move in your direction, always move your stops in your favor (remember the “Legend of the man in the green bathrobe“…it is NOT HOUSE MONEY, it’s all OUR MONEY!). Lastly, remember that you get rich slowly and steadily in Trading…not by striking it rich on one or two trades. So, give up that lottery ticket mentality.

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: No trade ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service