Early bullishness faded quickly on Tuesday after the JOLTS report came in hot, re-engaging the bears with the expectation of an aggressively hawkish Fed. Yesterday added to the technical damage of index charts with the DIA, SPY, and QQQ closing the day below their 50-day moving averages. Sadly the 9.1% inflation report out of Europe is piling on to the bearish attitude this morning and could make it difficult for the bulls to begin an overdue relief rally. We face a lot of economic data the rest of the week as we slide toward the uncertainty of a 3-day weekend.

Ason markets closed mixed overnight, with China’s declining factory activity adding to the worry of their slowing economy. European markets see red across the board as they struggle with rate tightening fears after hearing their inflation rate hit 9.1%. U.S. futures have seesawed in pre-market trading, wanting a relief rally despite the piling on of adverse economic data from here and around the world. Expect the volatile and challenging price action to continue with earnings and economic reports just around the corner.

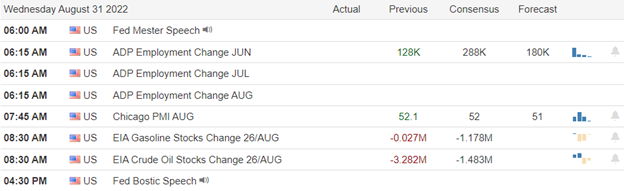

Economic Calendar

Earnings Calendar

The mid-week earnings calendar has a few more companies listed than Tuesday, with around 20 confirmed. Notable reports include BF.B, COO, DBI, FIVE, MDB, OKTA, PSTG, SMTC, VEEV, & VRA.

New & Technicals’

Eurozone inflation hit a new record high in August at 9.1%. The rate was above expectations, with a Reuters poll of economists anticipating a rate of 9%. It is expected that gas flows via Nord Stream 1, which runs from Russia to Germany via the Baltic Sea, will be suspended from Aug. 31 through to Sept. 3. The temporary supply halt reflects a deepening gas dispute between Russia and the European Union. It underscores both the risk of a recession and a winter shortage. “Europe is in full bunkering mode and taking no chances with Russian supplies heading into the winter,” said Wei Xiong, senior analyst at energy consultancy Rystad Energy. In addition, analysts told CNBC that Iraq’s political turmoil could bring about a considerable risk to global oil markets. “While Iraqi production is usually fairly resilient to unrest, the current political environment is extraordinarily toxic and poses a considerable risk to the oil sector,” said Fernando Ferreira, a director at Rapidan Energy Group. Those concerns come on the heels of escalated protests in Iraq on Tuesday after powerful Shiite Muslim cleric Muqtada al-Sadr announced his resignation from politics. EV maker BYD falls more than 12%, dragging down Hang Seng Index on Wednesday. According to a filing, Warren Buffett’s Berkshire Hathaway trimmed its stake from 19.92% to 20.04%. Yang Liu of Atlantis Investment says this is a “common trend,” warning “maybe we’ll see more” of such trims. Treasury yields tick higher in early Wednesday trading, with the 12-month at 3.42%, the 2-year at 3.48%, the 5-year at 3.30%, the 10-year at 3.14%, and the 30-at 3.25%.

Futures began the morning pushing for some gains, but after the jobs-opening report came in hot, the bears returned to work expecting an aggressive hawkish Fed. Unfortunately, the selling created more technical damage in the index charts closing the DIA, SPY, and QQQ below their 50-day averages. If there is a silver lining in the clouds, it would be that the T2122 indicator suggests a short-term oversold condition, and a relief rally could begin at any time. However, the bearish data is beginning to pile on as world economies slow and inflation remains persistent. Though I will be watching for clues of an oversold rally, the 9.1% inflation reading out of Europe has reversed early bullishness and could keep the bears engaged. We have a lot of economic reports coming our way the rest of the week, so plan carefully and remember we also face the uncertainty of a 3-day weekend.

Trade Wisley,

Doug

Comments are closed.