End of Q3, 2nd Ian Landfall, and EU Prices

Markets gapped lower at the open Thursday (0.65% in the DIA, 1% in the SPY, and 1.25% in the QQQ). All 3 major indices made a strong follow-through move for the first hour. Then we saw a sideways meander until Noon. However, the Bears stepped back in at that point to continue the wavy, gradual ride lower until 2:30 pm when the bulls tried to form a bottom. From there we saw a sideways grind that bobbed along in a channel for the last hour before slightly breaking back out to the upside. This action has given us gap-down, black candles (with a large lower wick).

On the day, Utilities (-3.71%) and Consumer Cyclical (-3.37%) led the charge lower. (Utilities is a very odd leader to the downside as one would think that sector would be a destination for a flight to safety.) Meanwhile, Energy (-0.59%) was the laggard in the decline. The SPY has lost 2.08%, DIA lost 1.52% and QQQ lost 2.81%. The VXX was up almost 3% to 20.62 and T2122 is again deeply oversold at 3.22. 10-year bond yields are back down to 3.778% and Oil (WTI) is down three-quarters of a percent to $81.55/barrel. Overall, just a bearish day in a choppy week all in the middle of a strong bearish trend.

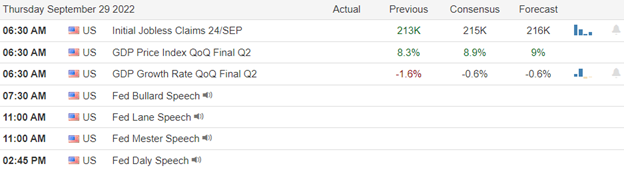

In economic news, the Q2 GDP (2nd revision) came in exactly as expected at -0.6% (compared to Q1 -1.6%). However, the Q2 Price index was revised up to 9.1% (higher than the 8.9% expected this revision) and the 8.3% in Q1. The Weekly Initial Jobless Claims also came in better than expected at 193k (versus 215k forecast and 209k last week). This all means the economy continues to be stronger than expected and inflation remains undaunted by the Fed’s 3 “super-sized” rate hikes this year.

SNAP Case Study | Actual Trade

Speaking of the Fed, in Fed news, St. Louis Fed President Bullard said Thursday that the Us is mostly insulated from the turmoil in UK stock and currency markets. The mixed signals the BoE and UK government are sending are essentially a UK problem that will only effect US markets on the edges according to Bullard. Meanwhile, Cleveland Fed President Mester reiterated that “at some point” the Fed will start to consider (economy) growth prospects against inflation. However, she said this will not be until inflation is clearly heading back down toward 2%. Then at the end of the day, Sand Francisco Fed President Daly said the Fed does not need to trigger a recession in order to take the heat out of high inflation. She went on to say that slowing down growth was the right path, but that inducing a deep recession was not necessary.

In stock news, after the close META announced it has paused hiring and warned that it will be restructuring in the face of an uncertain economic outlook. It was also reported that BCS was fined $361 million by the SEC over internal control failures related to the unregistered sale of a massive and unprecedented quantity of securities. Elsewhere, the FTC sued two top pesticide makers for price-fixing through distributors to keep the prices farmers pay artificially high for generic pesticides, herbicides, and fungicides. Privately-owned Syngenta was one and CVTA was the other and the FTC estimates the collusion cost farmers 20% more for the company’s generic products every year. Reuters reports that a senior supply chain exec at AAPL is leaving the company after making an inappropriate remark about fondling women in a TikTik video. Meanwhile, the FCC has asked for more information regarding the sale of TGNA (TV station operator) to hedge fund Standard General (which already owns a number of TV stations). Finally, AMZN (and 5 large book publishers) won a dismissal of two antitrust lawsuits that had accused them of price-fixing on books and e-books.

In energy news, OPEC+ have begun discussions ahead of their production level announcement at the Oct. 5 meeting. Reuters reports that some members question the logic of doing a major production cut (as posed by some) to maintain high oil prices when Russia continues to sell oil at near full capacity (at discounted prices) to major importers China, India, and Turkey. Elsewhere, the 10% of US oil production that was shut down due to Hurricane Ian is expected to reopen in the next day or so after the storm missed the critical energy facilities in the Gulf and in Florida. Meanwhile, in Florida itself, one in four gas stations are out of fuel Thursday afternoon. However, the KMI pipeline and CVX fuel terminal are expected to resume operation Friday. And nearly 200 fuel tanker trucks are already on the road heading toward Southern Florida where the shortages are worse.

After the close, NKE reported beating on both the revenue and earnings lines. However, MU missed on revenue while beating on earnings. MU also lowered its forward guidance. It is also worth noting that despite beating on both lines, NKE reported that they have way too much inventory (44% globally and 65% too much in North America) across multiple seasons of apparel) due to severe supply chain problems. The company said it will be forced to aggressively discount in order to liquidate the excess inventory. Later this morning, CCL reports (9:15 am).

Overnight, Asian markets were mostly in the red. Japan (-1.83%), Shenzhen (-1.29%), and Australia (-1.23%) led the way lower. Meanwhile, India (+1.64%), Singapore (+0.49%), and Hong Kong (+0.33%) were in the green. In Europe, with the exception of Russia (-1.41%), we see green across the board at mid-day. The FTSE (+0.27%), DAX (+0.14%), and CAC (+0.68%) are leading the region higher with Norway (+2.10%) being an outlier to the upside in early afternoon trade. As of 7:30 am, US Futures are pointing toward a modestly green start to the day. The DIA implies a +0.24% open, the SPY is implying a +0.36% open, and the QQQ implies a +0.27% open at this hour. At the same time, 10-year bond yields are back down to 3.698% and Oil (WTI) is up a third of a percent to $81.42/barrel in early trading.

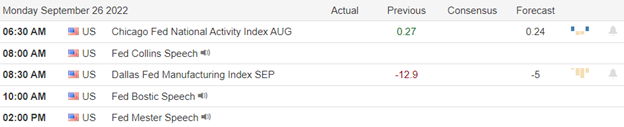

The major economic news events scheduled for Friday include August PCE Price Index and August Personal Spending (both at 8:30 am), Chicago PMI (9:45 am), Michigan Consumer Sentiment (10 am), and several Fed Speakers (Mester at 9 am, Williams at 9 am, Bowman at 11 am, and Williams at 4:15 pm). The major earnings reports scheduled for the day are limited to CCL before the open. There are no earnings scheduled for after the close.

In late-breaking news from across the pond, the British pound has managed to hold onto the gains it made after BoE intervention (3 days ago, buying long-dated bonds and stopping the reduction of its balance sheet). This comes amid wide speculation that the new government will be forced to back down from its radical shift to large-scale tax cuts and “trickle down” economics. This came as a report showed that Eurozone inflation has hit a record 10% (well above the 9.7% projections and 9.1% reading in August). If there is any good news in the report, it is that “core inflation” rose only 4.8% with energy (+40.8%) and “Food Alcohol, and Tobacco” up 11.8% doing most of the lifting. (The good news idea being that eventually, energy prices will come under control as replacement sources for Russian oil and gas begin to materialize in the next couple of months.)

With this backdrop, and as the Quarter comes to a close, it again looks like we will see a modest gap higher, inside of Thursday’s candle to start the day. So, this is not showing a major change in sentiment. It just looks like more chop in this week’s consolidation (albeit more volatile consolidation yesterday). The strong bear trend remains in place in all 3 major indices. Expect more volatility and even though everything looks bearish early, do not forget that we still need over-extension relief. Also, do not be surprised if we see some window dressing at the end of Q3 as funds get their portfolios in shape for their Q4 marketing campaigns. Finally, keep in mind that it’s Friday (and that Russia will announce it has annexed parts of Ukraine today). So, prepare your account for the weekend news cycle, which will include the second landfall of Ian.

Keep in mind that trading is our job. It’s not a hobby. So, treat it that way. Do the work and follow the process. Stick with your trading rules, trade with the trend, and take those profits when you have them. Demonstrate patience and wait for confirmation. Don’t be stubborn. If you have a loss, just admit you were wrong, respect your stop, and take the loss before it grows. When price does move in your direction, always move your stops in your favor (remember the “Legend of the man in the green bathrobe“…it is NOT HOUSE MONEY, it’s all OUR MONEY!). Lastly, remember that you get rich slowly and steadily in Trading…not by striking it rich on one or two trades. So, give up that lottery ticket mentality.

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: No Trade Ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service