Yesterday ended with a mixed bag on index results heading into a big day of economic data that includes an FOMC statement and the chairman’s press conference. With the indexes closing at or very near price resistance levels, today’s data may well inspire the bulls higher or bring bears out of hiding depending on how investors digest the results. With an elevated VIX and futures pointing to gap up open, it seems an understatement to say anything is possible. Stay focused, and flexible.

Asian markets closed mixed in a rather falt session after Japan reported a disappointing plunge in exports. European markets trade mixed, cautiously awaiting the central bank decision. Overnight futures struggled to gain ground, but as the open near the pre-market pump up has begun suggesting another bullish morning gap. Buckle up.

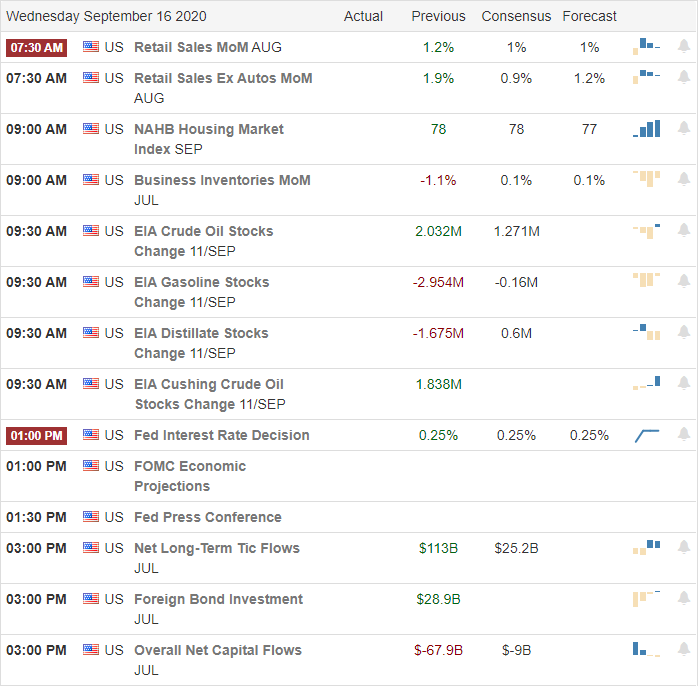

Economic Calendar

Earnings Calendar

On the Hump Day earnings calendar, we have just 16 companies reporting quarterly results. Notable reports include BRC & MlHR.

News & Technicals’

Though there was a lot fo bullish energy at the open yesterday, we ended with a mixed bag of results. The SPY and IWM mostly chopped in a narrow range, with the DIA giving up early gains to close essentially flat. The QQQ and big tech struggled to hold the morning gap in the morning session, but the bulls fought back, closing the index with solid gains near price resistance levels. After the bell, FEX and ADBE produced strong earnings, with both stocks indicating substantial gains at the open today. However, during the night, US Futures seemed to struggle, often dipping into negative territory until early morning pump up began, which seems to have become the standard operating procedure for this year. Blackstone’s Tony James is warning this morning of a possible lost decade where market returns become anemic in a low-interest-rate environment but facing significant headwinds moving forward. During the night, Hurricane Sally strengthened to a Category 2 storm that made landfall at high tide, shutting down power and threatening widespread flooding. What a year! To much water in the south while the Pacific coast burns, suffering from drought.

The FOMC will be in focus today as we wait for there interest rate decision, and of course, all eyes will be on the Jerome Powell at the press conference that follows. If that’s not enough, we keep investors guessing we also have Retail Sales, Business Inventories, Housing Market Index, and a Petroleum Statis report to digest before the 2 PM eastern statement release. Add to that index charts testing price resistance levels and an elevated VIX, and I think it’s safe to say anything is possible. As I write this report, futures point to a gap up open; however, I would not be at all surprised to see very anemic and choppy price action ahead of the FOMC decision. Becare not to chase with a fear of missing out if the morning gap does unfold.

Trade Wisely,

Doug

Comments are closed.