With the indexes in a short-term overextended condition and a mixed bag of earnings results, the bears began probing for weaknesses breaking the 4-day rally. BAC disappointed this morning, reversing early futures bullishness, but with several more potential market-moving reports this morning, we could easily flip-flop several more times before the open. Anything is possible, and keep in mind how quickly market emotion can shift on any stimulus news.

Asian markets, in reaction the Xi’s speech, closed with mixed but modestly higher results. European markets are chopping around the flatline this morning as virus worries weigh on investor sentiments. US Futures seem uncertain this morning, but asf earings roll out, anything is possible, so prepare for another day of price volatility as a hopeful market awaits more government deficit spending.

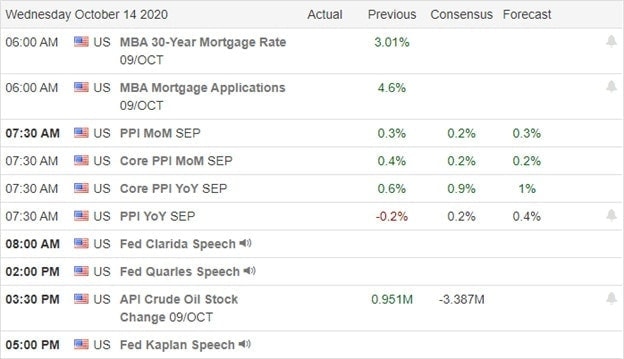

Economic Calendar

Earnings Calendar

On the hump day earrings calendar, we have 12 verified reports, and several are considered market-moving. Notable reports include AA, ASML, BAC, GS, INFY, PNC, SNBR, USB, UNH, & WFC.

News & Technicals’

With a mixed bag of earnings results yesterday and the indexes significantly extended, the bears made a half-hearted appearance breaking a 4-day winning streak. However, after spending considerable time reviewing charts last night, I feel like I saw this kind of price action before in 1999. Instead of wild speculation on dot.com companies, this time, there seems to be a willingness to throw money at the market, betting on government stimulus. Let’s face it the actual economy is struggling, and with coronavirus cases rising again, the economic challenges business face this winter could be substantial. Like in 1999, the markets could continue to zoom higher, ignoring the massive national debt, but the consequences of doing also increase the risk. Long story short, follow the price action higher but don’t drink the kool-aid. This wild-eyed bullishness party will eventually end, and I suspect the hangover it has the potential to produce will be very painful and destroy a lot of accounts as it did in 1999. Stay frosty and focused.

Technically speaking, the bulls remain in substantial control of the indexes, but they are short-term overextended, and the bears are beginning to probe for weaknesses in their defenses. BAC reported disappointing results this morning, reversing futures that at one point suggested a gap up open but now indicate a slightly bearish open. However, many more notable reports for the market to react to before the open anything is possible. Remain flexible and remember the market is sensitive to stimulus news and could become increasingly sensitive to virus numbers once again.

Trade Wisely,

Doug

Comments are closed.