The bearish engulfing candle patterns left behind on the DIA, SPY and IWM yesterday suggest the wild bullish rally may have run out energy but I would not expect the bulls to give easily. Logic alone would suggest after such an energetic rally that little rest or pullback is likely. However, if the bulls can defend the reclaimed 50-day morning averages as support a case for attacking all-time market highs is possible.

Unfortunately tough talk between US/China is not suggesting that a trade deal between the countries is unlikely at the G20 meeting seems to have given the bulls a little pause this morning. Asian markets closed lower as their consumer prices hit a 15 month high and food prices spiked 7.7% in the May report. European markets are also seeing some bearishness this morning with all indexes pointing modestly lower. As the bulls and bears battle for control expect higher price volatility and sensitivity to trade news.

On the Calendar

On the Wednesday Earnings Calendar we have just 15 companies stepping up to the plate. Notable reports include LULU & TLRD.

Action Plan

Tough talk suggesting that a US/China trade deal is very unlikely at the G20 seems to have dampened the bullishness we have seen in the last week of price action. During the night China released consumer inflation numbers showing a 15 month high and food prices spiking 7.7% in May. Asian markets closed lower across the board overnight as a result. European markets are also seeing red this morning across their major indexes.

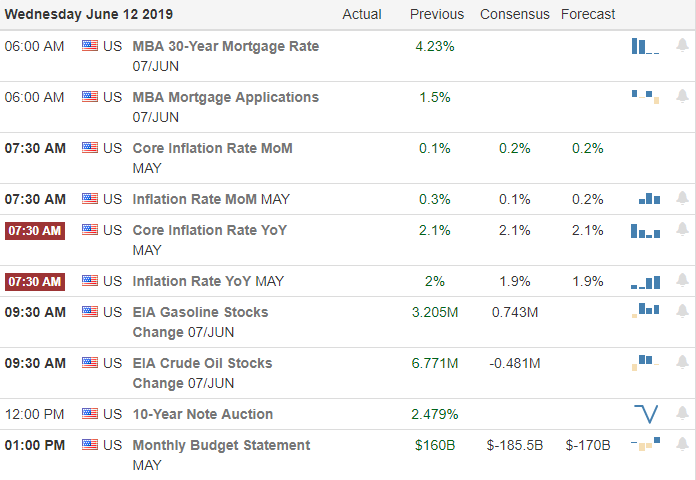

As I write this US futures are modestly lower bouncing off the overnight lows but the CPI number at 8:30 AM Eastern has the potential to move the market before the open today. The DIA, SPY and IWM all left behind bearish engulfing patterns yesterday suggesting a lower print but I would not expect the bulls to give up control easily. Expect high price volatility and the possibility of quick intraday reversals as they duke it out. We should be just fine if the bulls defend the reclaimed 50-day moving averages as support but if these key psychological levels fail the bears could be emboldened.

Trade Wisely,

Doug

Comments are closed.