Another day another overnight gap as the market reacts to a chemical tanker fire in the Gulf of Oman creating a surge in oil prices. The cause of the fire is still unknown but has sparked fears of an attack after apparent sabotage of another tanker just a few weeks ago. US futures are pointing to a gap up open reversing the modest selling yesterday and holding the key psychological 50-day moving averages of both the DIA and SPY.

The QQQ is also getting a lift this morning an looks as if it will once again challenge its 50-day average resistance. Short traders expecting more of a pullback after the sharp rise could find themselves in a short squeeze. Expect price volatility to remain high challenging even the most experienced traders with the hypersensitivity to US/China trade rhetoric.

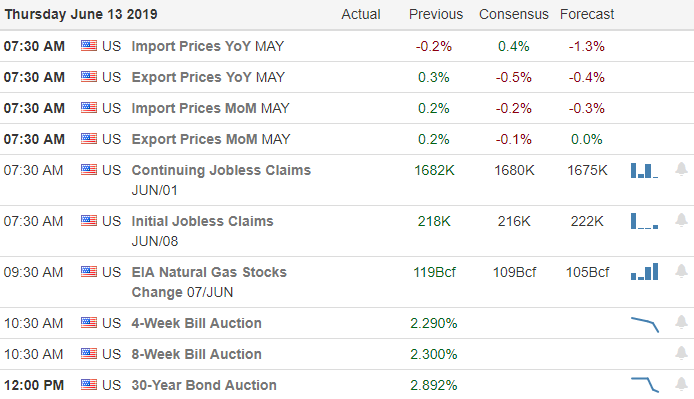

On the Calendar

On the Earnings Calendar we have the biggest day of the week with 28 companies reporting. However, the only notable report is DLTH.

Action Plan

Oil prices are surging this morning after a tanker incident in the Gulf of Oman. The cause of the fire remains unclear, but is raising fears of an attack just weeks after an apparent sabotage of another tanker. Futures traded modestly lower as Asian market closed mostly lower overnight but rallied significantly with the surge in oil prices.

As I write this Dow futures point to a gap up open of more than 75 points reversing yesterday’s modest selling and holding the DIA and SPY above their 50-day averages. The QQQ looks to challenge its 50-day average as resistance at the open. Could this create another pop and drop day? Yes, but it could also create just enough catalyst to squeeze short traders out pushing the indexes higher.

Trade Wisely,

Doug

Comments are closed.