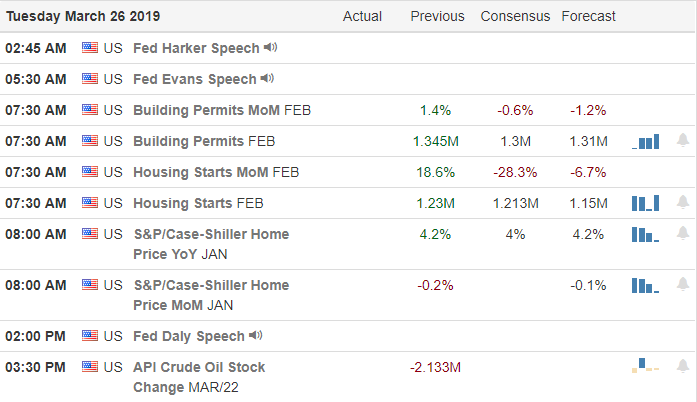

While the market keeps a close eye on possible interest rate inversion and possible economic slowdown the US Futures point to a bullish open and a welcome relief to last Friday’s selloff. Currently the Dow futures point to more than a 100 point gap up as I write this but still has to clear the Housing Starts hurdle at 8:30 AM Eastern. A miss of consensus estimates could fuel the fire of economic slowdown while a beat could clear the way for a bullish morning gap.

As nice a relief rally may be please remember it will take a huge effort by the bulls to clear the technical damage created in last Friday’s selloff. The DIA and IWM still the lower high and are technically in a downtrend. The SPY while technically stronger still has significant resistance to deal with while the QQQ continues to enjoy the benefits of market leadership. Be careful not to get caught up in fear of missing out and chasing into positions as the market tests price resistance.

On the Calendar

We have just under 60 companies reporting quarterly earnings today. Notable reports today include CRON, OLLI, CCL FDS, INFO, KBH, MKC & VALE.

Action Plan

After a very indecisive price action day the DIA finished up a whopping $0.11, SPY down $0.21, QQQ down $0.31 and IWM up $0.66 we have a substantial change of attitude this morning. First Asian markets closed mixed but the NIKKEI and HIS posted solid gains lifting the US Futures. The good vibes continue this morning with European markets bullish across the board with modest gains. As I write this Dow futures suggest a gap up of more than 100 points but we still have some economic hurdles to cross before the open.

Besides some notable earnings the 8:30 AM Housing Starts number will be important this morning amidst the worries of an economic slowdown. Consensus estimates of 1.213 million units which is just slightly less than the previous reading. Although a gap up will be a nice relief remember we still have substantial technical issues to overcome particularly in the DIA and IWM so we must still keep a close eye on price resistance levels above. However, the QQQ is still technically sound holding higher lows and continues as the market leader at the moment.

Trade Wisely,

Doug

Comments are closed.