In the last 3-trading days, we’ve received a reminder that bears still exist despite a very favorable Fed and massive governmental intervention. Although the futures point to a nice relief bounce at the open, let’s not forget that the 50-day average may still get tested in the days ahead. Be careful rushing back into highly volatile price action with the buy the dip mantra ringing in your ears. Stay focused and consider carefully how this wild price action takes away a trader’s edge.

Asian markets closed in the red across the board overnight as tensions with the US continues to grow. European market point to a modest bounce at the open, and the US futures point to a little relief rally ahead of earnings and the JOLTS number at 10:00 AM Eastern. Expect the wild price volatility to continue.

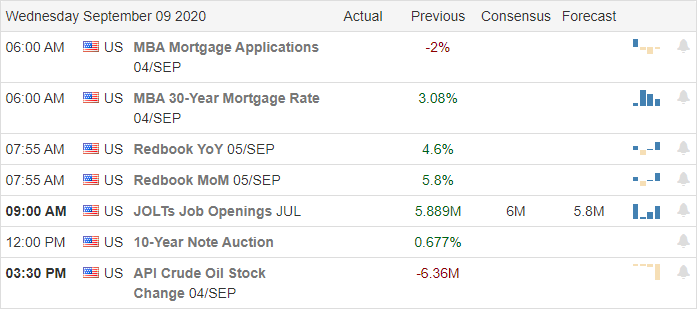

Economic Calendar

Earnings Calendar

On the Hump day earnings calendar, we have 20 companies stepping up to report quarterly results. Notable reports AVAV, ABO, GIII, GME, NAV, RH, VRNT, & ZS.

News and Technical’s

After a 3-day nasty selloff, futures point to a modest bounce this morning. With the Dow closing just 1.2% above its 50-day average and SP-500 hovering less than 1% above this critical technical indicator, traders should be cautious with the buy the dip mantra and rushing into positions. Although there has been nothing typical about this year’s market, we must consider the possibility that 50-day averages may still experience a test of support. Market pullbacks most certainly provide buying opportunities; however, the violence of this selloff adds the tremendous risk head fakes and fast intraday reversals with the VIX so elevated. A bounce may, in fact, provide an opportunity to take some risk off the table rather than add—something to consider as you plan your day forward.

Technically speaking, the indexes were so overextended they have yet to experience any significant technical damage even though the psychological damage has been rather extreme. Fast moves like this make traders very jittery so prepare for considerable price volatility in the days ahead. If this pullback has hurt, you guard yourself against revenge trading. Stay focused on your plan and your rules. The market is a high-risk proposition at the moment, so carefully consider this question. Are you gaining or losing your edge when trying to trade an extremely volatile market. Plan carefully!

Trade Wisely,

Doug

Comments are closed.