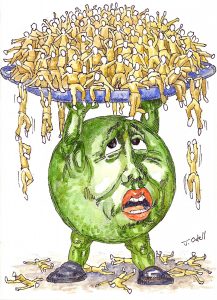

A lot on its plate.

With trade negotiations seemly on shaky ground and a Wednesday afternoon, FOMC interest rate decision looming the market has on its plate as we begin this trading week. On the positive side, the four major indexes are in current up-trends with the momentum favoring the bulls at the moment. Speculation that the FOMC could end its balance sheet reduction program earlier than expected also favors the bulls because the market loves a relaxed FOMC policy.

With trade negotiations seemly on shaky ground and a Wednesday afternoon, FOMC interest rate decision looming the market has on its plate as we begin this trading week. On the positive side, the four major indexes are in current up-trends with the momentum favoring the bulls at the moment. Speculation that the FOMC could end its balance sheet reduction program earlier than expected also favors the bulls because the market loves a relaxed FOMC policy.

On the negative side, we have all the political jitters of shaky trade negotiations and the upcoming summit with North Korea. The market hates uncertainty and as world leaders continue a public battle of words the market is justifiably nervous of about the possible outcome. Politically driven markets are challenging because they can suddenly reverse overnight. Have a prepared plan, try to say flexible and unbiased and focused on price action for clues.

On the Calendar

There are only bond announcements and bond auctions on the Economic Calendar today. The begin at 11:00 AM Eastern and close out the calendar day at 1:00 PM. They are of course very unlikely to move the market.

On the Earnings Calendar, we have only 38 companies reporting results today, and I don’t see any that would market-moving reports. However, make sure your checking earnings dates against current holdings and have a plan to deal with the risk.

Action Plan

After a bumpy G7 where it looks as if trade negotiations in the North American agreement have taken an ugly turn for the worse. However, with speculation that the FOMC may stop reducing its balance sheet much sooner than expected appears to have evened out the market jitters. Currently, the Dow Future’s are pointing to a flat open, but with all the political uncertainty brewing traders should be prepared for just about anything.

With the DIA, SPY, and QQQ all at or near new levels of price resistance, traders will have stay focused on price action for clues. Momentum currently favors the Bulls, but after such a strong rally last week it would not be a big surprise if profit takers begin to step in at any time. The trend of the overall market continues to be bullish thus a consolidation or light pullback that holds the trend could easily attract more Bulls. With trade war jitters and an FOMC meeting interest rate decision on Wednesday afternoon, traders will have to stay flexible. Remember the market has three directions of possible movement; up, down or sideways. Light choppy price action would not be out of the question as we wait for the FOMC decision.

Trade Wisely,

Doug

Comments are closed.