The price action on Friday struggled then held Thursdays low, and we now have a triple test bottom with the past four candles suggesting the sellers have control. With price action below the daily 50-SMA and weekly 200-SMA on top of the three failed highs, I would have to say the market is not looking so good. Short term relief rallies are normal just not likely to produce large bullish moves until price crosses levels. Three important key levels are $270.64, $277.25. 281.25.

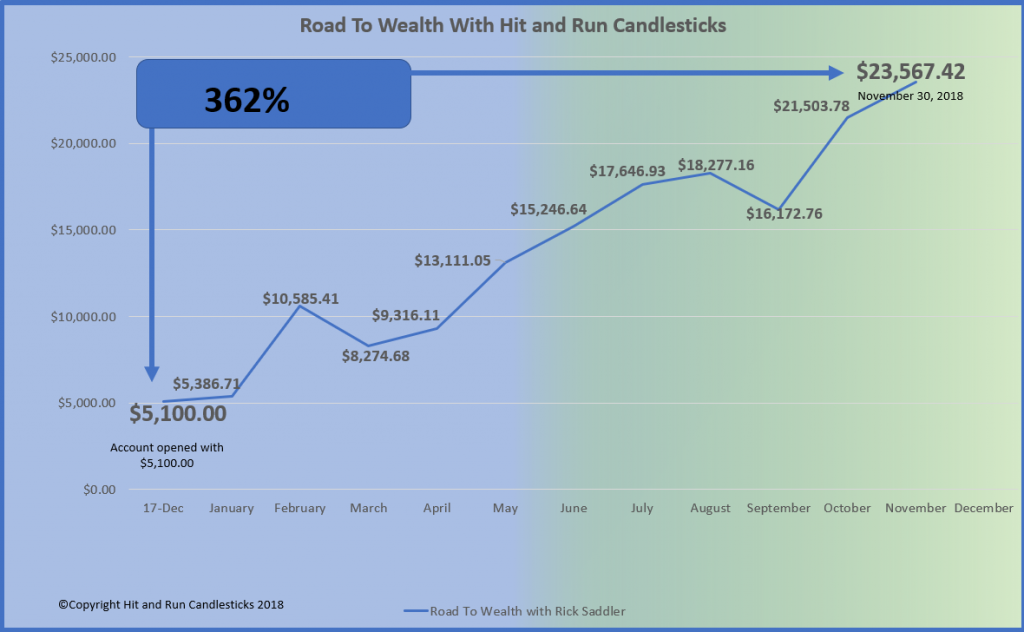

Friday I went to all-cash taking a pro-active stance on protecting the 362% we are up this year on the “Road To WealthAccount.” Going forward into the end of the year I will be trading like I am walking on thin lake ice. The game is to create wealth not pick

Today’s Trade-Idea Thoughts

We have not increased our “Road To Wealth Account” simple by trading willy-nilly and don’t intend to start today. Today we will talk about trades in the trading room when we see the attitude of the market and not before.

362% November Statement

Rick uses three main trading tools and has dialed them in for max performance. Rick also freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

Trading Services We Offer

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing/ Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by it and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

Comments are closed.