With last week’s strong bullish performance, the Dow finally pushed through its 50-day average, rising more than 1100 points in just 5-trading days. It will not be interesting how it deals with its downtrend resistance as the SPY and QQQ push for more records with big tech leading the way. As we slide toward the end of the quarter and the 4th of July holiday, can the bulls keep up the pace, or will they need a rest this week? Logic would say yes, but in this all-or-nothing high emotion market, I’m not sure logic applies. Stay with the trend all long as it continues but avoid complacency in this very stretched condition.

Asian markets saw red across the board overnight though the losses were modest. European markets are also showing modest declines across the board as the rise in pandemic infections weigh on sentiment. Ahead of a light day, earnings and economic data futures indicate a mixed but modest open as we slide toward the end of the 2nd quarter.

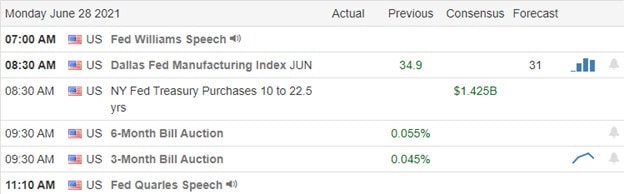

Economic Calendar

Earnings Calendar

We have a light day on the earnings calendar with just four verified reports to kick off the week. The only somewhat notable report is MLHR.

News & Technicals’

Britain’s Financial Conduct Authority said that Binance Markets Limited “is not permitted to undertake any regulated activity in the U.K.” It’s the latest sign of a growing crackdown on the crypto market from regulators around the world. After losing a confidence vote in parliament on June 21 after the left party withdrew its support, the Swedish prime minister resigned after losing a confidence vote in parliament. The 10-year treasury is easing slightly this morning, declining to 1.516% and the 30-year slipping to 2.143%. U.S. Senator Rob Portman, R-Ohio, said Sunday that the bipartisan infrastructure deal could move forward, following President Joe Biden’s clarification that he’ll sign the bill even if it comes without a reconciliation package. The president last week said that he would refuse to sign the deal unless the two bills came in tandem, a remark that angered and surprised Republican lawmakers.

After rising more than 1100 points in last week’s bullish surge, the Dow recovered its 50-day average and is now testing its downtrend as resistance. The rally led by strong bullishness big tech seems unconcerned about inflationary pressures, supply chain challenges, and antitrust efforts in Europe and those moving forward in the U.S. Though technically a bit stretched out, the trends in the SPY and QQQ showed no signs of slowing down by the close on Friday. After such a strong bull run, one has to wonder, can it continue this week, or will we need a little rest or even a profit pullback to check support levels. We have a light earings calendar as we slide toward the end of the 2nd quarter, with not much on the economic calendar to begin the week to inspire. Moreover, it is possible by mid-week that volumes may begin to decline as trader extend their 4th of July holiday.

Trade Wisely,

Doug

Comments are closed.