A mightly shove in the tech giants got the job done for new records in the QQQ and SPY while at the same time, the number of stocks falling below their 50 and 200-day moving averages grew. That’s awesome, but it also begs the question, what happens if big tech buying reaches an exhaustion point? With parts of Europe re-entering pandemic lockdowns, very little earings inspiration, and only Fed speak on the economic calendar, price action could become very choppy if the bears remain lethargic. In addition, next week, heading into the Thanksgiving holiday, may see declining volumes as travel picks up, so plan your risk carefully.

Asian markets close trading mostly higher, with Hong Kong shedding 1.07% after disappointing results from Alibaba. European markets see nothing but red this morning as sentiment declines due to more pandemic lockdowns and restrictions grow. Finally, with a very light day on the earnings and economic calendar, U.S. futures suggest a mixed open industrial’s declining sharply while the tech sector continues to surge.

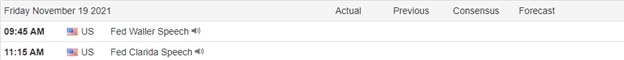

Economic Calendar

Earnings Calendar

Our Friday earnings calendar is very light, with just nine confirmed reports. Notable reports include BKE & FL.

New & Technicals

Democrats moved toward a vote on President Joe Biden’s social safety net and climate plan. A Congressional Budget Office estimate said the Build Back Better Act would add $367 billion to budget deficits over a decade but did not account in the topline for revenue raised by increased IRS enforcement of tax laws. Five Democratic holdouts wanted to see a CBO score before they voted for the bill. If the House passes the legislation, the Senate will likely approve a different version of it. Thursday evening President Biden suspends enforcement of business vaccine mandate due to court mandate and escalating legal challenges companies and states. Austria announced this morning they would re-enter a total national lockdown while Germany added more restrictions on Thursday. Treasury yields declined in early Friday trading, with the 10-year dipping to 1.5565% and 30-year falling to 1.9405%.

With a mightly shove by the tech giants, the Nasdaq closed at a new record high, and the SP-500 squeaked out a new closing high in the process. Unfortuntually, at the same time, the number of stocks slipping below their 50 and 200-day averages grew. With parts of Europe re-entering Covid lockdowns, futures that were bullish during the night have taken a bearish turn. With little on the earnings calendar to provide inspiration and nothing but Fed speak on the economic calendar, it could be an interesting day if the bears start to show some interest. If the bulls find the energy to defend, I would expect a choppy price action day as we slide into the weekend. Keep in mind as you plan forward that next week, we could see light volumes as traders get some post-Covid restriction family time travel for Thanksgiving.

Trade Wisley,

Doug

Comments are closed.