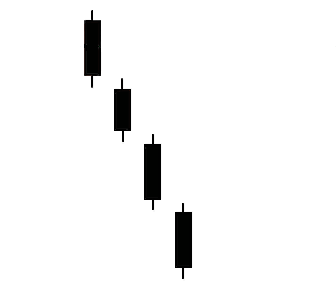

Isn’t it convenient when a candlestick pattern’s name corresponds directly with its appearance? The Three Gaps Down pattern has (fittingly) three distinct gaps that appear within a downtrend. The pattern is sometimes known by the Japanese word sanku, but do yourself a favor and use the English name to ensure that you remember it! This signal indicates that a reversal is on the way, and although it isn’t terribly well known, it is certainly worth adding to your repertoire. To get started, scroll down and review the signal’s formation and meaning.

Three Gaps Down Pattern

Formation

To spot the Three Gaps Down pattern, you will need to be patient, as it requires at least four days. Despite what you may have assumed, the three gaps do not need to be consecutive either, giving the signal flexibility. To ensure that you truly have spotted a Three Gaps Down pattern, look for the following criteria:

First, a clear and well-defined downtrend must be in progress. Second, there must be three gaps (as you might have guessed) within the downtrend. A gap is an unfilled space or interval between the bodies of two candlesticks, and it tells you that no trading has occurred within that specific window of time.

Most signals have more requirements, but these two criteria are all that you need to establish the presence of a Three Gaps Down pattern. Take a look at the picture above to see an example of the pattern in which all three gaps are consecutive.

As we’ve already discussed in a previous blog post, the Three Gaps Down has a brother: the Three Gaps Up pattern. Although both signals have four (or more) candles and three gaps, and they both signal a reversal in the current trend, the Three Gaps Down pattern moves downward while the Three Gaps Up pattern advances (you guessed it!) upward.

Meaning

So that’s all well and good, you might be thinking, but what does it mean? For four days, the bears are in control and the price is dropping. The three gaps show the force of the descent. However, after this strong display, it should come as no surprise that the bears have exhausted themselves. The market is now expected to reverse, allowing the bulls to take control.

To improve the Three Gap Down pattern’s reliability, combine it with other technical indicators that also point toward a reversal.

_____

As always, we urge you to check for confirmation before proceeding. When you notice a Three Gaps Down pattern, look for the price to rise, reaching at least the midpoint of the last body, to confirm the trend’s reversal. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.