Today’s Featured Trade Idea is OMI.

Rick had a family emergency today and cannot do a morning blog post. However, members can listen to his detailed analysis in the trading room at 9:10am Eastern.

Nonetheless, for now, here is my analysis and a potential trade plan made using our Trader Vision 20/20 software.

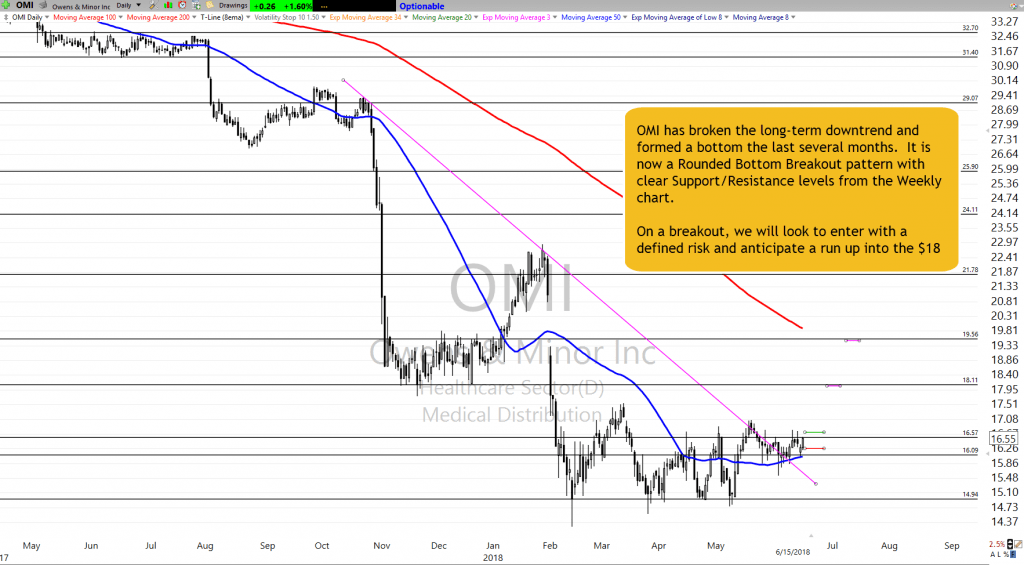

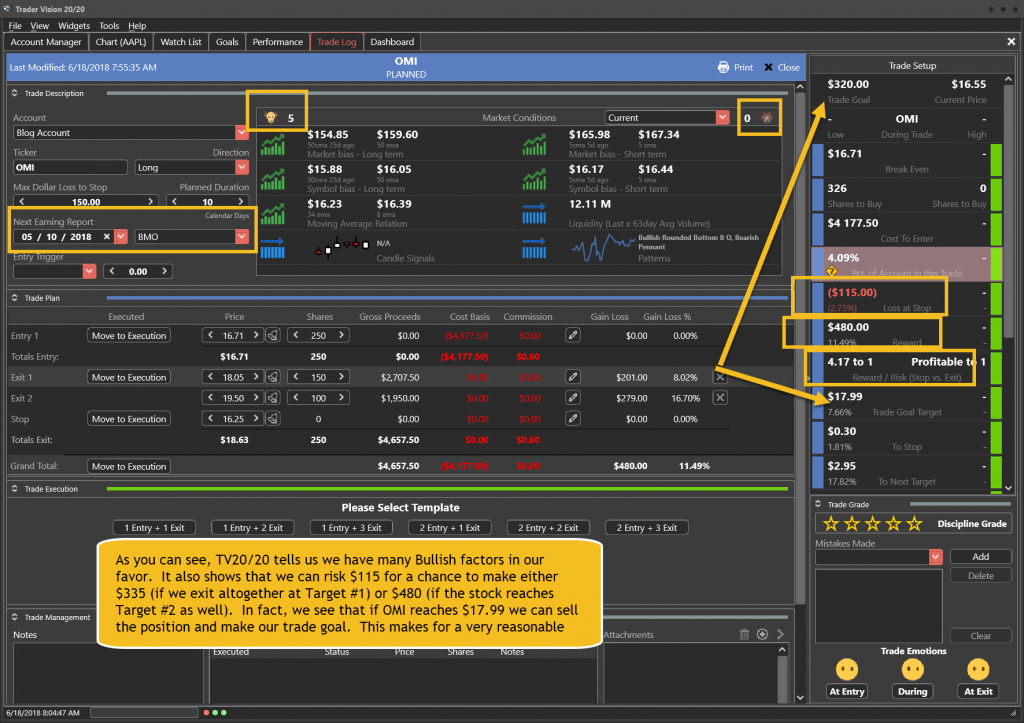

OMI has formed a bottom over the last few months. It has broken into an RBB pattern and is right at the next potential Resistance level. On a breakout, we can have a defined, small risk looking for a run up into the next potential resistance level (defined on the Weekly chart). Below is my markup of the chart and the trade plan as laid out by Trader Vision 20/20. As a bonus, if you click the green button below, you’ll be able to watch a video of the chart markup and trade planning process.

The OMI Trade Setup – As of 6-15-18

The OMI Trade Plan

Note how Trader Vision 20/20 does so much of the work for you. As we see above, Trader Vision shows you that the stock only needs to move 7.61% to make the Goal for the trade, while the anticipated first Target price is 10.37%. We also see that the Risk is very low and the potential Reward quite nice. Knowing the Risk, Reward and how far a stock must move to reach our goal…before a trade…really takes the pressure off. No guesswork. No surprises. No emotional roller coaster.

To see a short video of this trade’s chart markup and trade planning, click the button below.

[button_2 color=”light-green” align=”center” href=”https://youtu.be/IOGWsmZfFXg” new_window=”Y”]Trade Plan Video[/button_2]

If you’re interested in putting the power to Trader Vision 20/20 to work for you, click below.

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/product/trader-vision-20-20-monthly-subscription2/” new_window=”Y”]TV20/20 Software[/button_2]

Testimonial

Trader Vision immediately simplified the process…immediately it provided that information and guidance to me. I knew what I would risk for how much reward, I began taking trades off at the 1st target, 2nd target, I was no longer holding all my trades for the homerun. I also began implementing the stop losses if and when they were reached, not just hoping the stock would recover. It then became easier to see what patterns were working for me and which were not. It provided a much more relaxed and stress-free environment. –Joan G

***************************************************************************************************

Investing and Trading involve significant financial risk and are not suitable for everyone. Ed Carter is not a licensed financial adviser nor does he offer trade recommendations or investment advice to anyone. No communication from Hit and Run Candlesticks Inc. is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

***************************************************************************************************

Comments are closed.