Bearish Candle Patterns

In reaction to weekend uncertainty, profit-takers dominated the price action leaving behind some potentially bearish candle patterns on the DIA, SPY, and IWM. The QQQ held up as the strongest index, while the poor under-loved IWM proved the weakest printing a lower high. As concerns, economic impacts, and supply chain issues begin to weigh on the market; we have a very big week of earnings reports that continue to provide short-term inspiration to the bulls. Expect the volatile price action to continues and remain flexible as anything is possible as we sort through the uncertainty.

Asian market closed mixed with China finding the inspiration to rally with the government fronting 10 billion to help virus victims with medical costs. European markets are modestly lower across the board as the outbreak continues to expand, and the UK reports four new cases. US futures are trying to put on a brave face but as I write this report, the open appears relatively flat.

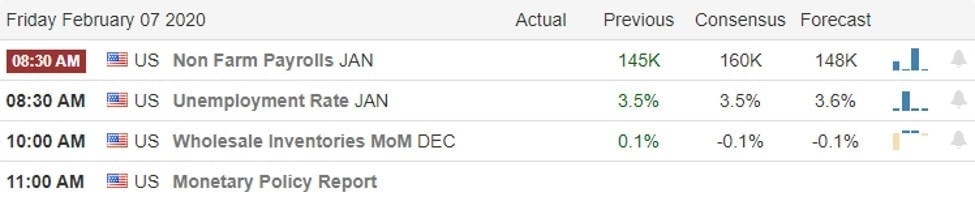

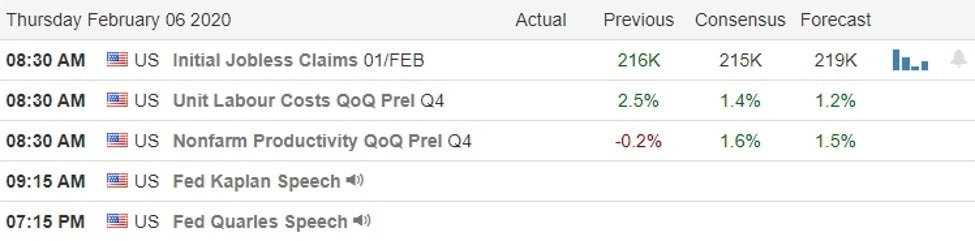

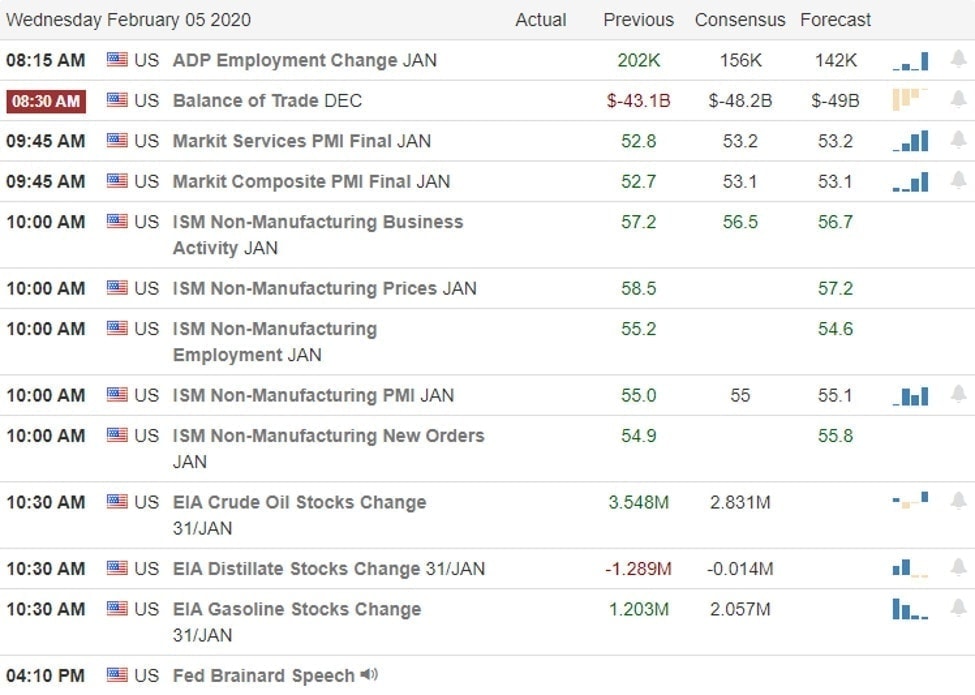

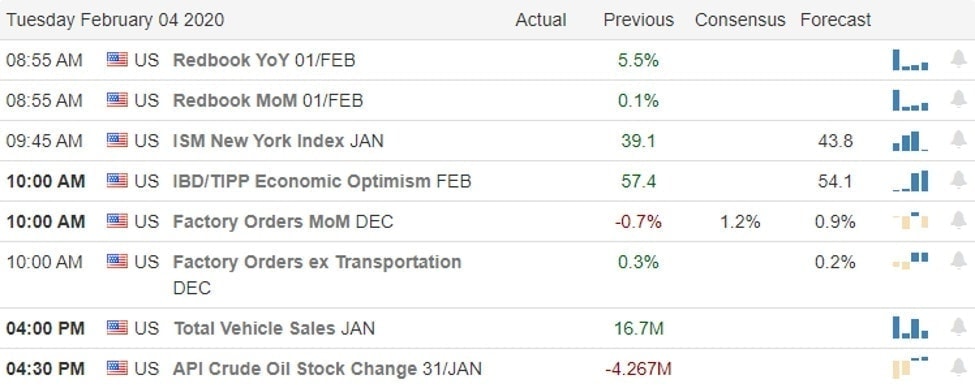

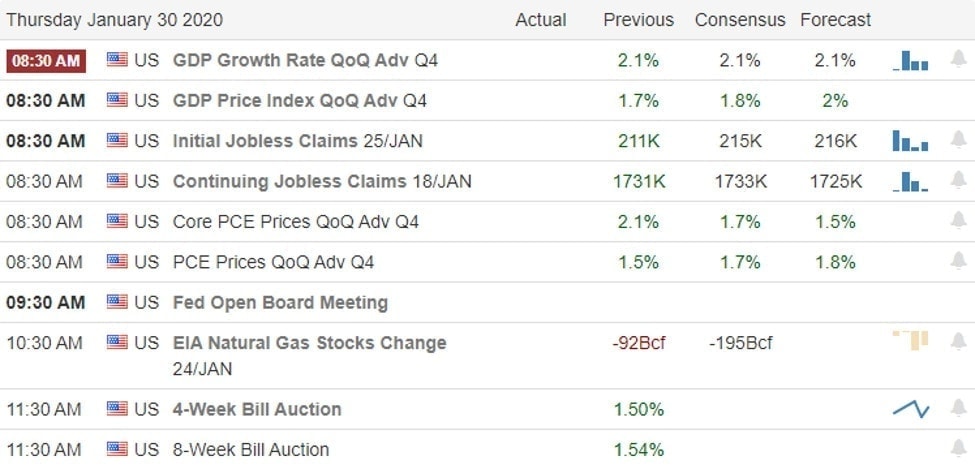

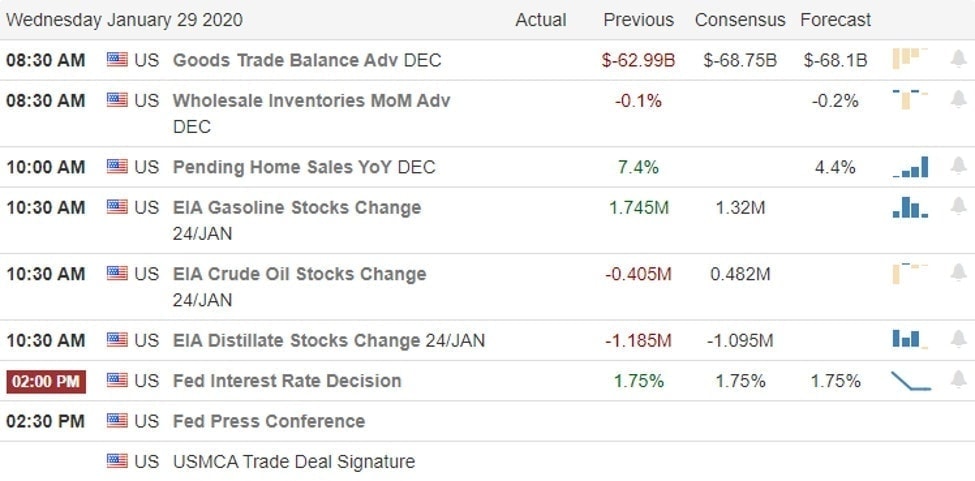

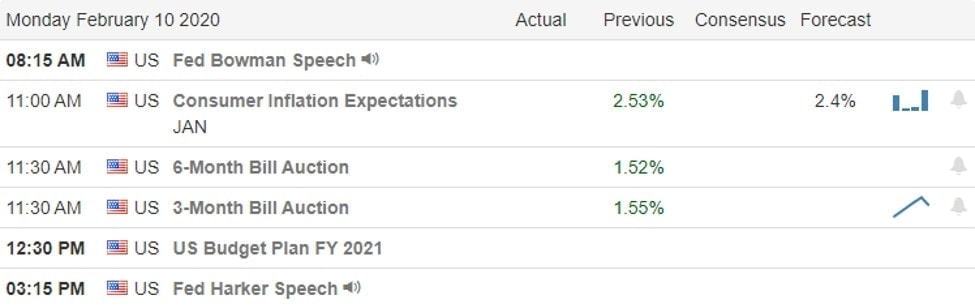

On the Calendar

On the Monday earnings calendar, we have just over 100 companies fessing up to results today. Notable reports include AGN, BIP, ELY, DVA, RE, FRT, JCOM, L, MELI, OMF, PSEC, QSR, STE, & VOYA.

Action Plan

Friday saw a pullback on weekend worries printing evening star patterns no the DIA, & SPY. The QQQ holds up as the strongest index with help from some big techs like MSFT and AMZN while IWM continues to prove the weakest index leaving behind a lower high on Friday. Over the weekend, the outbreak death toll rose to 908, with more than 40,000 confirmed cases. Some businesses will resume work today, but many have extended closures until March 1st raising serious supply chain concerns for may US Business. However, the market may once again choose to ignore that as traders react to more than 500 earnings reports scheduled for this week. Tuesday and Wednesday at 10 AM Eastern Jerome Powell speak and of course, could move markets if there is anything new gleaned from his comments.

Instead of the wild futures driven gaps we witnessed last week, the pre-market activity is taking a much more subdued approach this morning as concerns of economic impacts from the outbreak grow. Technically speaking, there is a reason for traders to be a bit pensive with possible bearish patterns printed on the index charts at or very near price resistance highs. What comes next is anyone’s guess! Will we take our queues from the big week of earnings events or will the virus impacts take center stage. One thing for sure traders should plan for more volatility, remain flexible, and guard against over-trading.

Trade Wisely,

Doug