Premarket Up – Durable Goods This AM

Markets gapped lower at the open Friday (down 1.29% in the SPY, down 1.14% in the DIA, and down 1.76% in the QQQ). However, at that point, Mr. Momentum seemed to take off for the weekend. After that open, all three major indices traded the rest of the day in a tight range bobbing around above and below the open. This action gave us gap-down, indecisive Doji or Spinning Top candles in all three major indices. The SPY crossed below its 50sma and then both the SPY and QQQ retested their 200sma from above…and held (at least for the day). DIA is not far above (and looks headed toward) its own 200sma.

On the day, nine of the 10 sectors were in the red as Technology (-1.89%) led the way lower and Energy (+0.13%) held up better than the other sectors. At the same time, the SPY was down 1.07%, the DIA was down 1.07%, and QQQ was down 1.67%. The VXX climbed 3.90% to 12.25 and T2122 has dropped back down just into the oversold territory at 19.66. 10-year bond yields are back up to 3.947% and Oil (WTI) rose 1.50% higher to $76.52 per barrel. So, overall, on Friday we saw a strong gap lower at the open, but then indecision the rest of the day. All this took place on a greater-than-average volume.

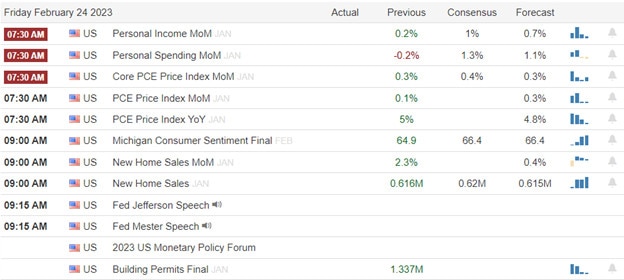

In economic news, the January PCE Price Index (the Fed’s favorite inflation indicator) came in hotter than expected at 5.4% (compared to a forecast of 5.0% and the Dec. reading of 5.3%). At the same time, January Personal Spending also came in much hotter than expected at +1.8% (versus a forecast of +1.3% and the December value of -0.1%). This was the biggest monthly gain since March 2021. Together these two readings were seen as indications that inflation may still be increasing (or at least is not falling) and the consumer is spending like crazy. Both of those are more likely to lead the Fed to tighten more and faster, raising the probability of a half percent hike in March. Hence, our gap down to start the day. Later in the morning, the Michigan Consumer Sentiment came in slightly better than forecast at 67.0 (compared to an expectation of 66.4 and decently improved from the January value of 64.9). At the same time, January New Home Sales came in significantly better than expected at 670k (versus a forecast of 620k and a December value of 625k)

SNAP Case Study | Actual Trade

In stock news, on Friday META announced its own AI named LLaMA (short for Large Language Model Meta AI). The new AI is aimed at researchers and academia and is the first step in META figuring out how it can use AI in its products. Meanwhile, Reuters reported that several more companies are cutting dividend sizes in an effort to save cash. As of Friday, these include HBI and VFC. Elsewhere, Reuters also reported on food companies culling slow-selling product lines as another way to cut expenses. These companies include KHC, CAG, UL, K, and MDLZ and will affect product selection and especially different sizes (smaller and larger quantities) of the same products available at WMT (Sam’s Club) and COST. The food companies claim it will save them billions of dollars over the year. At the same time, sources have told Bloomberg that GM has cut the production of pickup trucks due to growing inventories at dealerships and despite a continued increase in car sales this month. This implies that, while sales are good now, GM is expecting a downturn. Finally, hedge fund mgr. and major TSLA investor Ross Gerber told Reuters he was ending his bid for a TSLA board seat two weeks after his very public announcement of running for a seat in order to “reign in” Elon Musk.

In stock legal and regulatory news, the 2nd US Circuit Court rules that a tiny ($11,000) fine, which OSHA had levied on WMT for requiring pallets of boxes to be improperly stored, causing serious injury to an employee. (The multiple appeals over a minuscule fine have been an attempt by WMT to avoid liability in a lawsuit filed by the employee.) Elsewhere, WBD filed a lawsuit against PARA over the streaming rights to the animated comedy show South Park. At the same time, the US CDC hit PFE, BNTX, and MRNA when it said Friday afternoon that there isn’t enough evidence to recommend multiple annual (ongoing) COVID-19 booster shots. This comes as the government funding for such shots has or is expiring and the companies had announced major increases in the price of those vaccines. Meanwhile, GS announced Friday that it expects to incur $2.3 billion more in losses from legal proceedings during the remainder of the year. However, a CA Judge dismissed an antitrust suit that had been filed against CSGP by a rival real estate firm. After the close, MS told Reuters that it was cooperating with investigations by the US District Attorney for the Southern District of NY into block trading practices. At the same time, BLK told reporters it was cooperating in SEC investigations into electronic communications among its investment advisors (i.e. using encrypted communications to collude).

In miscellaneous news, US equity funds suffered massive outflows in the seven days ending last Wednesday. Lipper data shows investors withdrew almost $7 billion during that week. Meanwhile, Lipper data shows that investors exited US bond funds as well as they withdrew $1.67 billion during the week. Elsewhere, the US Dollar closed Friday at a seven-week high after hotter-than-expected inflation data. This came as we saw the largest weekly gain (0.6%) by the Dollar since September. On Saturday, Warren Buffett sent out his annual BRKB shareholder letter. In it, he said the company will continue to hold “a boatload of cash and treasury bonds.” He went on to report BRKB earnings were down 54% year-on-year for Q4 and down 125% year-on-year for all of 2022 (to a net loss of $22.819 billion). So, if you think you had a rough trading year in 2022, consider that BRKB reported a $53.6 billion loss from investments and derivative trades. BRKB share repurchases were down from $27 billion in 2021 to $8 billion in 2022. No new plan for 2023 was announced, but BRKB is sitting on $130 billion in cash.

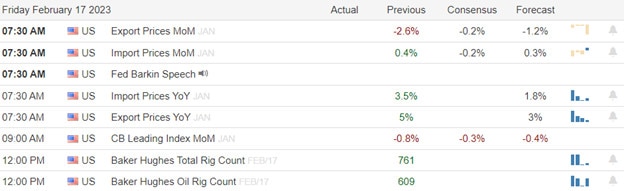

Overnight, Asian markets were red across the board. Australia (-1.12%), South Korea (-0.87%), Shenzhen (-0.73%), and Taiwan (-0.71%) led the region lower. Meanwhile, in Europe, with the lone exception of Greece (-0.53%), the entire region is strongly green at midday. The FTSE (+0.77%), DAX (+1.52%), and CAC (+1.57%) are typical and lead the region higher in early afternoon trade. As of 7:30 am, US Futures are pointing toward a modest gap higher. The DIA implies a +0.43% open, the SPY is implying a +0.50% open, and the QQQ implies a +0.61% open at this hour. At the same time, 10-year bond yields have climbed to 3.959% and Oil (WTI) is down by a fraction of a percent to $76.18/barrel in early trading.

The major economic news events scheduled for Monday are limited to Jan. Durable Goods Orders (8:30 am) and January Pending Home Sales (10 am). Major earnings reports scheduled for the day include AES, BRKB, WTRG, GLP, HSC, KOP, KOS, LI, PNW, and VTRS before the opening bell. Then after the close, ACHC, ARGO, BMRN, CAPL, DAR, HEI, ICUI, MKSI, OXY, OKE, OVV, PRGO, PRIM, RRC, TWI, TTEC, UHS, WDAY, and ZM report.

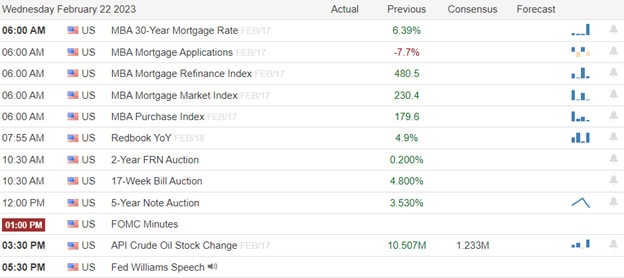

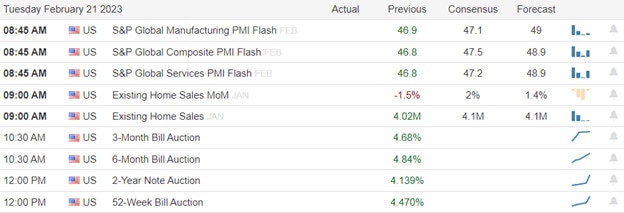

In economic news later this week, on Tuesday we get Jan. Durable Goods, Jan. Retail Inventories, Chicago PMI, Conference Board Consumer Confidence and API Crude Oil Stocks Report. The Wednesday, Mfg. PMI, ISM Mfg. PMI, and EIA Crude Oil Inventory are reported. On Thursday, we get Q4 Nonfarm Productivity, Q4 Unit Labor Cost, and Weekly Initial Jobless Claims. Finally, on Friday, Services PMI, S&P Global Composite PMI, and ISM Non-Mfg. PMI are reported.

In terms of earnings later in the week, on Tuesday, we hear from AHCO, ADT, AAP, AMWD, APG, AZO, BMO, BNS, BLDR, CHS, CCO, CLOV, CBRL, DQ, DK, XRAY, IGT, SJM, JLL, KTB, NFE, NXST, NCLH, OMI, PLTK, PRVA, SRE, FOUR, TGT, VRTV, VTNR, A, AMC, BGS, COMP, CPNG, EDR, EXPI, FSLR, FRG, GO, HPQ, ICFI, IHRT, JXN, MASI, MNST, RIVN, RKT, ROST, SKWD, SWX, URBN, VRSK, and VZIO. Then Wednesday, ANF, BHG, CLVT, CLH, DLTR, DCI, DY, FWONK, HGV, HZNP, JACK, KSS, LSXMA, LOW, EYE, NIO, ODP, PBR, QRTEA, RY, SGRY, VST, WB, WEN, AAN, ADV, AGL, AEO, CANO, SQM, CODI, ERIE, GEF, JAZZ, LNW, OKTA, PFG, CRM, SNOW, SPLK, and VEEV report. On Thursday, we hear from AER, AMRX, BUD, BBY, BIG, BILI, BURL, CPG, GMS, HRL, KR, M, PDCO, SFM, STGW, TD, AVGO, COO, COST, DELL, HPE, MRVL, JWN, VVX, and VSCO. Finally, on Friday, HIBB reports.

So far this morning, AES, KOS, HSC, and NE all reported beats on both the revenue and earnings lines. At the same time, VTRS missed on revenue while beating on the earnings line. On the other side, WTRG beat on the revenue line while missing on earnings. Unfortunately, LI missed on both the top and bottom lines. It is worth noting that HSC has also lowered forward guidance.

With that background, it looks like the bulls want to gap markets back up toward their T-lines (8ema) this morning. (At least prior to the durable good number.) Still, this leaves all three major indices basically in a downtrend although the premarket price is getting close to challenging the downtrend line (but certainly not starting a new uptrend at this point). Extension is not a problem either in terms of T2122 or the T-line. It looks like the bulls are trying to get back above a potential support level that was tested and appeared to fail Friday. Also, keep in mind that the norm recently has been to see large intraday swings. So, be prepared to weather such a whipsaw or look to shorter or longer trade horizons to handle that problem.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service