PG, HCA, and SLB Lead Earnings News

On Thursday, markets gapped lower again (opening down 0.69% in the SPY, down 0.43% in the DIA, and down 0.97% in the QQQ). At that point, all three major indices began a long, slow, meandering rally until they reached the highs of the day at about 1:30 pm. From there, a quicker selloff took the SPY, DIA, and QQQ back to the lows of the day with only some last-minute profit taking closed all the major indices out just up off the lows. This action gave us indecisive, white-bodied, Spinning Top or Doji-type candles that gapped below their T-line, retested it, and closed just below. That tends to tell us that markets have not made up their mind yet. Again, this all happened on lower-than-average volume (much lower in the large-cap indices).

On the day, eight of the 10 sectors were in the red with Communications Services (-2.09%) leading the way lower (by over a percent) while Consumer Defensive (+0.32%) held up better than other sectors. At the same time, the SPY lost 0.56%, DIA lost 0.31%, and QQQ lost 0.76%. VXX gained 2.2% to 39.95 and T2122 fell further into the mid-range to 63.13. 10-year bond yields plummeted to close at 3.538% while Oil (WTI) dropped another 2.36% on the day to $77.29 per barrel. So, Thursday was the second consecutive day that was teed up for the bears, they just could not get their job done. However, unlike Wednesday, the Bulls also couldn’t keep momentum once they did step in to “buy the dip” at the open. Accordingly, you could see this as just continued consolidation or as a hesitant start of a pullback within a bullish trend. That trend is still intact with the 3ema > 8ema > 17ema > 50sma > 200sma in all but the QQQ, where the 3ema crossed just below the 8ema by a few pennies Thursday.

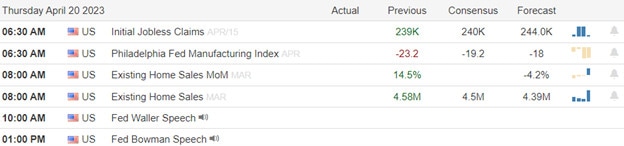

In economic news, Weekly Initial Jobless Claims came in a bit above expectation at 245k (compared to a forecast of 240k and the prior week’s reading also of 240k). At the same time, the Philly Fed Manufacturing Index came in well below the anticipated number at -31.3 (versus a forecast of -19.2 and even below the March value of -23.2). Meanwhile, March Existing Home Sales also came in a little light at 4.44 million (versus an expected 4.50 million and the February reading of 4.55 million). After the close, the Fed Balance Sheet was reported at $8.593 trillion (as of April 20), which is down $22 billion from the prior week. At the same time, Bank Balances with the Federal Reserve were reported at $3.165 trillion (as of April 20), which was down $185 billion from the prior week and was the third consecutive weekly decline.

SNAP Case Study | Actual Trade

In economic speak news, Treasury Sec. Yellen told a Johns Hopkins University audience that “the US banking system remains sound and the (US) government will take any necessary steps to keep it the strongest and safest financial system in the world.” Later, Fed Governor Waller said that the Fed needs to consider the possible use of AI (which he said offers opportunities and risks) as a way to offset the speed at which customers can pull money out of banks. “If they are going to have deposit flows being faster we need to think how do we (Fed) do pricing faster, how do we assess the collateral, that’s got to be faster…to make the discount window more effective, we have to be able to do things faster as well.” Waller said. He also went on to mention that “things have kind of calmed down (in the banking sector).” Then, at mid-afternoon, Cleveland Fed President Mester (non-voter) told a community roundtable that the Fed has interest rate increases ahead of it, but also said the aggressive move to boost the cost of borrowing to quash inflation is near an end. (You have to love the doublespeak.) However, she did go on to say she expects a “soft landing” when she said, “I do think we’re going to have very slow growth – I think growth will be well below 1%.” Finally, she expects unemployment to top out at 4.5% to 4.75% (it is currently 3.5%) and expects inflation to get down to the Fed’s 2% target in 2025.

In stock news, the CEO of UNP said Thursday that the railroad will slow its pace of hiring in the second half of the year amid a cloudy economic outlook. In IPO news, UCAR had an eventful first day, including several halts due to volatility. The announced IPO pricing was $6.00/share, while the stock opened at $8.10, reached a high of $75.00, and then closed at $43.18 in its first day of trading…on volume of 3.4 million shares. (That is interesting since only 2.4 million shares were offered for sale.) Elsewhere, LMT announced a new partnership with German defense industry leader RNMBF (Rheinmetall) to produce HIMARS rocket launching systems. The production will take place in Germany but will include both US and German-made components. Later, NOVA announced the US government would provide a partial loan guarantee of $3 billion to back financing of its solar rooftop systems. The Dept. of Energy will give an indirect guarantee of 90% for $3.3 billion in customer solar panel installation loans. Meanwhile, AMZN announced it has launched a program to identify and track sellers in its marketplace who sell counterfeit goods and share that information with the US Customs and Border Protection agency. After the close, CLX announced it will cut about 4% of its non-production workforce (about 200 jobs) after having cut 100 jobs from the same non-production category in 2022.

In stock legal and regulatory news, the US Dept. of Justice announced it has reached a settlement with MU to resolve the company’s discrimination against a US citizen when it hired a temporary visa worker over the citizen for non-pertinent reasons. The penalty was not specified but MU will pay the affected worker $85,000 and will be subject to DOJ monitoring for two years. Elsewhere, in a reversal of an announcement earlier in the week, the US Treasury has made vehicles from RIVN and VLKAF (Volkswagen) eligible for the full $7,500 US Tax Credit for electric and hybrid vehicles. Meanwhile, a US Bankruptcy Judge in New Jersey has halted most, but not all, liability lawsuits against JNJ (over cancer allegedly caused by tac products). The judge stopped 38,000 of the liability cases while JNJ seeks to reach a settlement with the claimants. (JNJ filed for Chapter 11 bankruptcy for the unit it transferred all talc business to a second time after having had the first filing invalidated as an obvious attempt to avoid liability.) The ruling in JNJ’s favor gives the company more leverage against the 80,000 claimants who must weigh their portion of JNJ’s proposed $8.9 billion over 30 years settlement against the possibility the unit’s bankruptcy is approved (in which case JNJ is basically free of all liability). 75% of the claimants would need to accept the offer for the JNJ proposed settlement to go into effect. At the same time, in New York, PARA has counter-sued WBD in the case involving royalty fees for streaming rights of the “South Park” animated comedy. After the close, RIDE received a delisting notice from Nasdaq and is now exploring a “reverse split” to get the stock price above the exchange minimum requirement. (The company has until October 16 to regain compliance.)

After the close, PPG, CSX, VMI, and ASB all reported beats on both the earnings and revenue lines. Meanwhile, SEIC, OZK, and WRB reported beats on the revenue line while missing on earnings. Unfortunately, KNX missed on both the top and bottom lines. It is worth noting that PPG raised its forward guidance while KNX lowered its forward guidance.

Overnight, Asian markets leaned heavily to the red side with only New Zealand (+0.40%) and Singapore (+0.25%) managing to stay green. Meanwhile, Shenzhen (-2.28%), Shanghai (-1.95%), and Hong Kong (-1.57%) led most of the region lower. In Europe, the bourses are mixed but lean lower on modest moves at midday. The DAX (-0.33%), CAC (-0.10%), and FTSE (+0.08%) are typical and lead the region in early afternoon trade. In the US, as of 7:30 am, Futures are pointing toward a modestly red start to the day. The DIA implies a -0.10% open, the SPY is implying a -0.22% open, and the QQQ implies a -0.42% open at this hour. At the same time, 10-year bonds are flat at 3.538% and Oil (WTI) is also flat at $77.40/barrel in early trading.

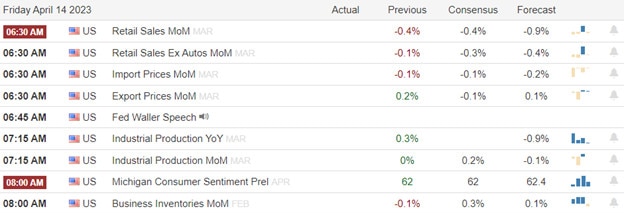

The major economic news events scheduled for Friday are limited to Mfg. PMI, S&P Global PMI, and Services PMI (all at 9:45 am). The major earnings reports scheduled for the day include ALV, FCX, HCA, PG, RF, SDVKY, SAP, and SLB before the open. There are no major earnings reports scheduled for after the close on the day.

So far this morning, PG, HCA, VLVLY, SLB, SDVKY, and ALV have all reported beats to both the revenue and earnings lines. Meanwhile, SAP missed on revenue while it beat on earnings. On the other side, RF beat on revenue while missing on earnings. (FCX is scheduled to report at 8 am.) It is worth noting that both PG and HCA have raised their forward guidance. The only significant surprises were HCA with a 24% and SAP with a 12% upside earnings surprises.

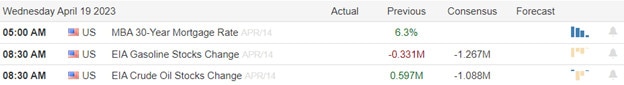

In miscellaneous news, the EIA reported a much higher-than-expected Natural Gas inventory build for last week. Nat Gas storage increased 69 bcf, compared to 25 bcf the prior week and a 5-year average of 41 bcf stockpile build for this week of the year. Total inventories are 34% higher than a year ago and 21% higher than the 5-year average. Elsewhere, in late news, AMZN’s Whole Foods unit informed corporate employees that it will lay off several hundred people (only about 0.5% of its total workforce). Finally, in a sign of a company that doesn’t know what it’s doing, TSLA reversed course overnight. One day after it lowered prices (for the sixth time in less than four months), reported disappointing earnings (which caused the stock to fall 10%) and signaled that price cuts would continue…TSLA announced overnight it will increase prices for its Model S and Model X cars.

With that background, it looks like the large-cap indices are continuing their test of the T-line (8ema) level this morning. Meanwhile, QQQ is falling a bit further below its own T-line. With no economic news scheduled prior to the open, it looks like earnings will set the mood until at least 9:45 am. Clearly, there is a consolidation or a so-far weak pullback underway. If you look at the candle shapes in the DIA, it is obvious traders are pretty unsure of what will happen next. Regardless, the bullish trend remains in place but is also looking like it is losing steam. Over-extension is obviously not a problem in terms of the T-line or the T2122 indicator. SPY and QQQ seem to be testing a potential support level but DIA does not have that obvious level helping it below. Right now, the chart tells us to maintain a long bias but be wary of weakening bulls and keep an eye out for trend breaks. Also, remember this is Friday. So, pay yourself, lock-in some profits, and prepare your account for the weekend news cycle.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service