Good Earnings, Sales and Ind. Data Next

Markets opened higher on Monday, gapping up 0.52% in the SPY, gapping up 0.62% in the DIA, and gapping up 0.42% in the QQQ. Then the Bulls followed through in all three major index ETFs, reaching the highs at about 10:30 a.m. in the QQQ and about 11 a.m. in both large-cap ETFs. From there, SPY and QQQ traded sideways the rest of the day while DIA traded sideways with a slight bearish trend. This action gave us gap-up, white-bodied candles in all three major index ETFs. The DIA could maybe be seen as a Morning Star-type signal that crossed back up through its 200sma. At the same time, QQQ printed a Bullish Harami candle that crossed back up through its 50sma. The SPY and QQQ also crossed back up through their T-line (8ema). This all happened on above-average volume in the DIA and below-average volume in both the SPY and QQQ.

On the day, all 10 sectors were in the green with Consumer Cyclical (+1.63%) out front leading the way higher. Meanwhile, Energy (+0.63%) lagged behind the other sectors. At the same time, the SPY lost 1.05%, the QQQ gained 1.13% and DIA gained 0.94%. VXX plummeted 9.36% to close at 22.95 and T2122 jumped back up to the top half if its mid-range at 22.95. 10-year bond yields rose again to 4.71% while Oil (WTI) fell almost nine-tenths of a percent to close at $86.92 per barrel. So, it was the Bull’s day. Talking heads and market analysts seemed to think the reason was optimism over earnings given the big bank blowout results last Friday. I don’t know if that is true, it could be optimism from a lack of Israeli ground invasion as of Monday or it could have just been a fluke. Regardless of the cause, the DIA printed a higher high to go with its recent higher low, and the other two major index ETFs seem to be considering doing the same. That is the start of a bullish trend.

The only economic news reported Monday was the NY Fed Empire State Mfg. Index which came in better than expected but still low at -4.60 (compared to a forecast calling for -7.00 and a September reading of 1.90). So, according to that value, manufacturing conditions in the NY Fed area aren’t improving (anything above zero means improving conditions) but a higher-than-expected value is seen as bullish. In Fed Speak news, we did hear from Philly Fed President Harker twice on Monday. He told a Mortgage Bankers Assn event that the current level of interest rates has killed off access to the housing market for first-time buyers. He went on to say the housing market could be summed up in seven words: “There are no first-time time buyers.” Later, Harker made a point to reiterate his stance that (outside of a dramatic change in data) the current Fed Funds rate should be maintained to give markets time to adapt to the higher rates and give the ongoing disinflation process time to work.

In Autoworker contract talks and strike news, the Executive Chair of F, Bill Ford, appealed to UAW workers to end their 32-day strike. Ford said, “I call on UAW colleagues…We need to come together to bring an end to this acrimonious round of talks.” Ford went on to say competitors TM, HMC, and TSLA “are loving this strike because the longer it goes on, the better it is for them.” No new offer came with the public plea and it comes after F negotiators said they were at the limit of what they can afford to spend on wages and benefits. (If I were really speaking to blue-collar factory workers, I’m not sure “acrimonious” is a term I’d use but then again what do I know.) In response to Ford’s statement, UAW President Fain pointed out a 1,500% increase in the money spent on share buybacks by the Big 3 over just the last four years. For example, GM has put a $5 billion buyback plan in place in August 2022 (up from $3.3 billion prior to that point).

In stock news, on Monday, TRU warned an industry conference of both increased cost of mortgages as well as many applicants being disqualified with Fannie Mae and Freddie Mac policy change reducing the number of credit reports needed from three to two. (TRU said it may disqualify nearly two million loan applicants, even though TRU hasn’t tested to verify their claims. I’m also not sure they realize that they are claiming their product isn’t trustworthy.) At the same time, NVO announced it is set to acquire a new blood pressure drug from KBP Biosciences for $1.3 billion. Later, MRNA reiterated its guidance despite rival PFE drastically reducing its COVID-19 vaccine forecast last week. MRNA still anticipates $6 billion – $8 billion from its own vaccine sales this fall. Later, Bloomberg reported that PRTA is exploring a potential sale prior to the release of key data on its Alzheimer’s disease clinical trials in the coming months. Elsewhere, PCTI spiked on the announcement it is being acquired by APH in an all-cash $139.7 million deal. At the same time, SNAP popped Monday after leaked internal user number targets exceeded industry analyst estimates. In layoff news, MSFT’s LinkedIn division said it will lay off 668 employees (3% of its workforce) Monday. At the same time, Sky News reported that RYCEY (Rolls-Royce) will lay off 2,500 employees as soon as today as part of a cost-cutting drive. After the close, TM suspended production in at least five Japanese factories after a fire at a major supplier. Also after the close, Bloomberg reported that analyst surveys show AAPL iPhone 15 sales in China are down almost 5% from the same time after the iPhone 14 release.

In stock government, legal, and regulatory news, the Washington Post reported that the Biden Administration has agreed to terms to ease sanctions on Venezuela’s oil industry. This comes after Venezuela agreed to a competitive, internationally-monitored presidential election in 2024. At the same time, ESTA was given FDA approval for its “tissue expander” product. Later, the NHTSA announced that F is recalling 238,364 2020-2022 Ford Explorers due to parking brakes not engaging and risking them rolling away. Elsewhere, Reuters reports BTI, PM, and IMBBY are working on “heat sticks” infused with nicotine (inhalable) as a way to get around an incoming EU ban on flavored burning tobacco products. The sticks “heat but don’t burn” to get around the new regulations. At mid-afternoon, the NHTSA announced that CAR had agreed to pay a $150k fine after an investigation found the Zipcar subsidiary was allowing customers to rent vehicles with uncompleted recall notices. Meanwhile, GM, TM, F, STLA, and nearly all other major automakers sharply criticized the Biden Administration CAFÉ standards increasing significantly. The automakers claim the higher NHTSA CAFÉ standards will result in a boost in average vehicle prices by $3,000 by 2032. (For reference, that is about the normal average ANNUAL price increase of the average US vehicle and the automakers are claiming that over 10 years.) After the close, Reuters reported that the Biden Administration is working on additional sanctions to eliminate loopholes allowing AI chips to make their way to China. NVDA and AMD will be the most impacted by changes that might stop sales to third parties who reship the products to China now.

So far this morning, BAC, BK, GS, JNJ, and LMT all beat on both the revenue and earnings lines. Meanwhile, ERIC missed on revenue while reporting in line with earnings. (PLD and ACI report closer to the opening bell.) It is worth noting that JNJ raised its forward guidance. It is also worth noting that banks continue to show very strong (50%+) quarter-over-quarter earnings growth on the impacts of rising interest rates.

Overnight, Asian markets were green across the board. Japan (+1.20%), South Korea (+0.98%), and Hong Kong (+0.75%) led the region higher. Meanwhile, in Europe, the bourses are mixed but lean to the red side at midday with just five of 15 exchanges in the green. The CAC (-0.26%), DAX (-0.45%), and FTSE (+0.33%) lead the region on volume as usual. In the US, as of 7:30 a.m., Futures are pointing to a modestly lower start to the day. The DIA implies a -0.22% open, the SPY is implying a -0.30% open, and the QQQ implies a -0.36% open at this point. At the same time, 10-year bond yields are up strongly again to 4.769% and Oil (WTI) is up a third of a percent to $86.98 per barrel in early trading.

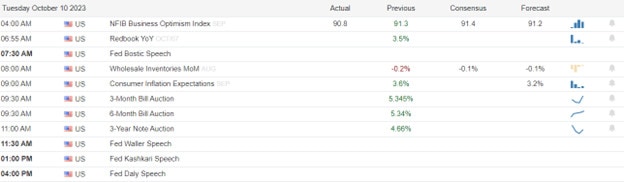

The major economic news scheduled for Tuesday includes September Retail Sales (8:30 a.m.), Sept. Industrial Production (9:15 a.m.), August Business Inventories and August Retail Inventories (10 a.m.), Sept. Federal Budget Balance (2 p.m.), and API Weekly Crude Oil Stocks Report (4:30 p.m.). We also get two Fed speakers (Williams at 8 a.m. and Bowman at 9:20 a.m.). The major earnings reports scheduled for before the open include ACI, BAC, BK, ERIC, GS, JNJ, LMT, and PLD. Then, after the close, IBKR, JBHT, OMC, UAL, and WTFC report.

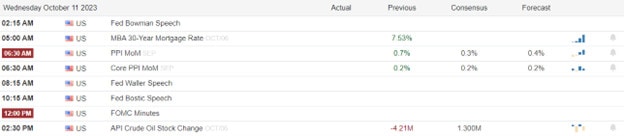

In economic news later this week, on Wednesday, Sept. Building Permits, Sept. Housing Starts, EIA Weekly Crude Oil Inventories, and the Fed Beige Book are reported. We also hear from Fed members Waller (noon), Williams (12:30 p.m.), Bowman (1 p.m.) and Harker (3:15 p.m.). On Thursday, we get Weekly Initial Jobless Claims, Philly Fed Mfg. Index, Sept. Existing Home Sales, and the Fed Balance Sheet. We also hear from Fed Chair Powell (noon), Bostic (4 p.m.), and member Harker 5:30 p.m.). Finally, on Friday, there is no scheduled news. However, again we hear from Fed member Harker (9 a.m.) and Mester (12:15 p.m.).

In terms of earnings reports later this week, on Wednesday, ABT, ALLY, ASML, CFG, ELV, FHN, MTB, MS, NDAQ, NTRS, PG, STT, TRV, USB, WGO, AA, COLB, CCI, DFS, EFX, KMI, LRCX, LVS, LBRT, NFLX, PPG, SAP, STLD, TSLA, and ZION report. On Thursday, ALK, AAL, T, BX, EWBC, FITB, FCX, GPC, KEY, MAN, MMC, NOK, PM, POOL, SNA, SNV, TSM, TFC, UNP, WSO, WBS, CSX, ISRG, KNX, and WAL. Finally, on Friday, AXP, ALV, CMA, EEFT, HBAN, IPG, RF, and SLB report.

In US Congressional news, it appears Rep. Jordan has made progress in reversing some of the “no” votes among Republicans over his candidacy for House Speaker. Two key GOP opponents publicly announced they will vote for him on Monday, bringing down GOP opposition by some unknown number. Jordan can afford to lose eight GOP votes at most…and even then, only if he convinces those eight to vote “present” instead of “no.” The measure will go to the House floor for a vote at noon today. If he fails on the first vote, the most likely scenario is another round-after-round of votes trying to get the extremist candidate over the line and into office. There are two other scenarios being discussed: giving temporary increases in the power to the unelected Speaker Pro Tempore McHenry, and moderate Republicans breaking with the MAGA-wing of the GOP to form a coalition with moderate Democrats in order to elect a compromise Speaker and actually govern. However, those moderate Republicans don’t seem to have the spine to do that, many already caving to MAGA pressure and always fearing retaliation by the vindictive ex-President and his minions.

In miscellaneous news, Reuters reported after hours that dozens of Chinese-listed companies announced plans to buy back shares and/or scrap plans to sell more shares late Monday. This is widely seen as a “government-encouraged” measure to prop up Chinese markets. Elsewhere, it is worth noting that today is the 600th day of the Russian invasion of Ukraine. Finally, the White House announced that President Biden will visit Israel tomorrow after a second visit by Sec. of State Blinken. Sec. of Defense Austin deployed 2,000 medical and logistics troops as of Sunday evening and then another 2,000-man Marine rapid response force to be held close offshore among the flotilla of ships accompanying two aircraft carriers sent to the area “just in case.”

With that background, it looks like the Bears are modestly in control in the premarket despite more strong earnings reports. All three major index ETFs opened the early session flat but have printed small black candles with very little wick so far. However, all three remain above their T-line (8ema) and the QQQ remains just above its 50sma while the DIA remains just above its 200sma. There is economic news today, but the more likely volatility factor would be news from the House Speaker debacle or from the geopolitical front. In terms of extension, none of the three major index ETFs are too far from their T-line (8ema). The T2122 indicator is back in its mid-range. So, again we have plenty of slack to run in either direction.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service