Fourth Consecutive Session

The bear ran roughshod over the bulls for the fourth consecutive session on Friday erasing October’s gains. A hawkish Jerome Powell drove bond yields higher and Middle Eastern war worries drove the market sentiment further damaging index chart technicals. Today, with the 10-year bond topping 5% we have a few notable earnings and a light economic calendar to inspire price movement. The T2122 indicator is in an extremely oversold condition suggesting a relief could begin at any time unless the bearish data continue to pile on. Plan for substantial price volatility, whipsaws, and maybe even a short-squeeze rally sometime this week.

Overnight Asian market closed red across the board as the China CSI fell to 2019 levels. European markets also see red across the board as they monitor rising rates and developments in the Middle East. U.S. futures gave up early gains as the 10-year yield topped 5% but as we move toward the open they have also recovered off session lows in a very volatile premarket trade. Plan for just about anything in this short-term oversold condition.

Economic Calendar

Earnings Calendar

Notable reports for Monday include AGYS, ARE, BRO, CADE, CALX, CLF, CR, MEDP, PKG, SSD, WRB, & WSFS.

News & Technicals’

Chevron, one of the largest oil companies in the world, has announced that it will acquire Hess, a smaller oil company, in a $53 billion deal. The deal will be paid entirely in stock, meaning that Hess shareholders will receive Chevron shares in exchange for their Hess shares. The deal will allow Chevron to expand its presence in Guyana, a South American country that has huge oil reserves. Chevron and Hess are already partners in some oil projects in Guyana, along with Exxon Mobil, another oil giant. The deal will make Chevron and Exxon Mobil the main competitors in two of the most promising oil regions in the world – shale and Guyana. Shale is a type of rock that contains oil and gas and can be extracted using a technique called fracking. Guyana is a new frontier for oil exploration, as it has been discovered to have billions of barrels of oil under its seabed.

Google, the tech giant owned by Alphabet, is facing an antitrust investigation in Japan over its search practices on mobile devices. The Japan Fair Trade Commission (JFTC) announced on Monday that it is looking into whether Google has violated the country’s competition law by making deals with Android smartphone makers to give preference to its apps and services. Google denied any wrongdoing and said that Android is an “open-source platform that has enabled a diversity” of partners and device manufacturers. The JFTC’s probe comes amid growing scrutiny of Google’s dominance in the global digital market.

Philips, a Dutch company that specializes in health technology, has raised its full-year outlook after reporting strong results for the third quarter of 2021. The company said its core profit more than doubled to 457 million euros ($483.3 million), beating analysts’ expectations. The company also saw an 11% increase in comparable sales, reaching 4.5 billion euros. The growth was driven by higher demand for its medical scanners, patient monitoring equipment, and personal health devices, which helped the company cope with the impact of the COVID-19 pandemic. Philips said it expects to deliver a double-digit improvement in adjusted earnings per share and a high single-digit increase in comparable sales for the full year.

The equity markets continued to slide for the fourth consecutive session, erasing the gains made in early October. Investors are nervous about the rising Treasury yields, which reached new highs for this cycle, and the increased geopolitical tensions in the Middle East. Fed Chair Powell delivered a hawkish message saying the inflation is still too high and more rate increases are possible but data dependent. The defensive sectors outperformed, while growth-style investments fell behind. Banks also struggled as Regions Financial warned of further drops in net interest income. Today the bulls and bears will look for inspiration in the earnings reports and of course bond yields that continue to rise this morning. The economic calendar is light for the beginning of this week but market-moving reports are pending at the end of this week.

Trade Wisely,

Doug

No Planned News and Bears On Top

Markets sold off in the morning Friday and then meandered sideways the rest of the day. SPY opened down 0.13%, DIA opened 0.23% lower, and QQQ opened down 0.18%. Then, all three major index ETFs ground sideways for 30 minutes. However, at 10 a.m., DIA sold off sharply for 15 minutes but the SPY and QQQ sold off hard until 11 a.m. and neither reached their low until 11:35 a.m. From there, all three drifted sideways with first a slight bullish trend until 1:20 p.m. and then sideways with a slight bearish trend the rest of the day. This action gave us black-bodied candles with modest upper wicks and very small, if any lower wicks. The SPY is at the breakout of a “Dreaded h” pattern and also crossed down through its 200sma. DIA is still in the downswing of its own Dreaded h and QQQ is sitting at the breakdown of a major support level. This happened with above-average volume in the SPY, average volume in the DIA, and a bit less-than-average volume in the QQQ.

On the day, all 10 sectors were in the red with Technology (-1.75%) out front leading the way lower. Meanwhile, Healthcare (-0.47%) held up better than other sectors. At the same time, the SPY was down 1.23%, the DIA lost 0.88%, and QQQ lost 1.49%. VXX gained 0.61% to close at 26.46 and T2122 dropped even further into the bottom of its oversold territory at 1.37. 10-year bond yields fell slightly to 4.914% while Oil (WTI) fell slightly to close at $89.02 per barrel. So, on Friday we had a very volatile market. There is no way to know for sure what the cause behind the morning volatility or the afternoon selloff was. However, Fed Chair Powell spoke at noon, and it was also midday when the latest stage of the House Republican fiasco began. There was also news out of the Middle East midday as the Israeli Defense Minister had reportedly green-lighted a ground invasion of Gaza and a US Destroyer intercepted drones/missiles launched by the Yemeni Houthi (backed by Iran).

The economic news reported Friday was limited to the September Federal Budget Balance which came in far, far worse than expected at a deficit of $171.0 billion (compared to a forecast of a $78.6 billion deficit and even the August number of an $89.0 billion deficit). Elsewhere, Bloomberg released its monthly survey of economists on Friday. The October survey indicates an increased average estimate for Q3 GDP of 3.5% (up from the 3.0% estimate in September).

In Fed speak news, Cleveland Fed President Mester indicated Friday that the Fed is at or at least very near its peak tightening. Mester said, “Regardless of the decision made at our next meeting, if the economy evolves as anticipated, in my view, we are likely near or at a holding point on the funds rate.” However, she said there is still plenty of room for the Fed to keep tightening by cutting its balance sheet, saying “There’s still more runway there” to lower the size of the Fed’s holdings and this process could play out over the next year and a half to two years.” Mester also made it clear that rate hikes and QT are separate issues, saying “we can have the balance sheet reduction continue independently of federal funds rate moves.”

In Autoworker contract talks and strike news, for the second time in a week, STLA has pulled out of a major auto show. The company cited an effort to reduce costs in the midst of the UAW strike. STLA also announced it would lay off an additional 100 workers due to the strike. Elsewhere, GM announced it increased its proposed wage increases to match the 23% increase offered by F, as well as the additional benefits enhancements. At the same time, UAW President Fain cited progress in his weekly update. He noted that he had received improved offers from GM and STLA. Fain said that a deal is close, but emphasized that the crucial part of any negotiation is the final push before the deal, which he means the need to remain on strike. He announced no new additions to the strike (facilities or workers). However, as usual, Fain threatened wider strikes if even better offers are not delivered by the companies. The strike is now 5-weeks old and some analysts wondered aloud whether Fain was hoping the upcoming earnings reports from GM and F might give those companies a reason to take one more step in order to report a tentative deal along with their earnings. (It would make the earnings call questions easier to address.)

In stock news, TM extended its temporary partial production shutdown until Monday following a fire at a major supplier in Japan. Elsewhere, SAVE canceled 11% of its flights Friday in order to do inspections for so-called “undocumented parts.” The outage is expected to last at least several days since many of the parts needing inspection are in the center of jet engines. Later, ADIL shares plummeted (closing down 24%) following its announcement of the sale of 1.4 million shares to raise cash. At the same time, BMY said its experimental renal cancer drug has achieved both primary and secondary targets in a Phase III study. In the auto industry, VLKAF (Volkswagen) cut its 2023 profit margin outlook, citing failures in its raw materials hedging. At the same time, a rail union (Brotherhood of Railroad Signalmen) initiated a safety program with NSC (following that railroad’s multiple safety failures this year) and also ratified a sick leave agreement with CSX. After the close, ORCL announced a strategic partnership with NVDA saying it has implemented the NVDA AI stack into its cloud marketplace. (ORCL sells AI processing via the cloud as a service to businesses.) At the same time, OKTA announced it had suffered a security breach via a stolen credential. (OKTA sells cloud software infrastructure intended to provide security authentication…so security breaches are not exactly good for business.) As a result of rumors and leaks of this news, OKTA was down 11.57% Friday (over 9% of the loss came after 2:40 p.m.).

In stock government, legal, and regulatory news, the Fed, FDIC, and Office of the Comptroller of the Currency extended the deadline for comments (from the big banks basically) about why banks should not face stricter capital rules and increased data collection on the banks’ financial stability. The new deadline for comment is Jan. 16. Later, a US District Judge gave final approval of a $75 million settlement reached by DB with various victims of Jeffrey Epstein who had accused the bank of facilitating the late financier’s sex trafficking. Later, Reuters reported that the EU antitrust regulators have resumed their investigation of ABDA (over its $20 billion bid to buy Figma) on Friday. This comes after the agency had halted its investigation while awaiting further data from ADBE. A decision on the deal is due by Feb 5. Later the US Supreme Court ruled in favor of the Biden Administration, throwing out lower court rulings that were intended to limit the administration’s ability to contact social media companies to have misinformation and disinformation moderated by META, GOOGL, AAPL, and Twitter (now X) as well as the non-mainstream platforms.

Overnight, Asian markets were red across the board again. Thailand (-1.66%), Shenzhen (-1.51%), and Shanghai (-1.47%) led the region lower but the move was broad-based. In Europe, we see a similar picture taking shape at midday with only Greece (+0.26%) in the green. The DAX (-0.80%), CAC (-0.21%), and FTSE (-0.54%) are leading the region lower in early afternoon trade. In the US, at 7:30 a.m., Futures are pointing to a move lower to start the week. The DIA implies a -0.54% open, the SPY is implying a -0.50% open, and the QQQ implies a -0.58% open at this hour. At the same time, 10-year bond yields are up again, teasing 5% at 4.999% while Oil (WTI) is down 0.77% to $87.40 per barrel.

There is no major economic news scheduled for Monday. The major earnings reports scheduled for before the open include PHG and SDVKY. Then, after the close, AAN, ARE, BRO, CDNS, CLF, CR, CCK, LOGI, MEDP, PKG, SSD, TFII, TBI, and WRB report.

In economic news later this week, on Tuesday, we get S&P Global Manufacturing PMI, S&P Global Services PMI, S&P Global Composite PMI, and API Weekly Crude Oil Stocks. Then Wednesday, Building Permits, New Home Sales, and EIA Weekly Crude Oil Inventories are reported. We also hear from Fed Chair Powell. On Thursday, we get September Durable Goods Orders, Preliminary Q3 GDP, Preliminary Q3 GDP Price Index, September Goods Trade Balance, Weekly Initial Jobless Claims, Sept. Retail Inventories, Sept. Pending Home Sales, and we hear from Fed member Waller. Finally, on Friday, Sept. PCE Price Index, Sept. Personal Spending, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Expectations, and Michigan 5-year Inflation Expectations are reported.

In terms of earnings reports later this week, on Tuesday, MMM, HOUS, ADM, ARCC, ABG, BCS, CNC, KO, GLW, DHR, DOV, DOW, FI, FELE, GTX, GE, GM, HAL, HCA, HRI, ITW, IVZ, KMB, NEE, NHYDY, NVS, NUE, PCAR, PNR, PII, PHM, DGX, RTX, SHW, SPOT, SYF, TECK, TRU, VZ, XRX, GOOGL, BYD, CNI, CHX, CB, CSGP, ENVA, FFIV, GOOG, HA, MTDR, MSFT, RRC, RHI, RUSHA, SNAP, TDOC, TXN, V, WFRD, and WM report. Then Wednesday, we hear from ALFVY, APH, ATLKY, ADP, AVY, BA, BOKF, CME, CSTM, EVR, FTV, GD, GBX, GPI, HES, HLT, LTH, LAD, MHO, MCO, MSM, EDU, NSC, ODFL, OMF, OPCH, OTIS, OC, PAG, PRG, RDUS, ROP, R, SLGN, TMUS, TMHC, TDY, TMO, TNL, UMC, VRT, WNC, WAB, AEM, ALGN, ALSN, AMP, NLY, AR, ATR, ASGN, AVB, AGR, BKR, BHE, CACI, CP, CLS, CCS, CHE, CHDN, CMPR, CYH, EW, ESI, EQT, EQIX, EG, FLEX, FLS, FBIN, GL, GGG, ICLR, IEX, IBM, INVH, KALU, KLAC, LSTR, MAT, META, MAA, MOH, MYRG, NBR, NXT, ORLY, OII, PPC, PLXS, RJF, ROL, SEIC, NOW, STC, SUI, TER, TNET, TROX, URI, UHS, VMI, VICI, WCN, WFG, WU, and WHR. On Thursday, AOS, MO, AMT, AIT, ARCH, AMBP, BSX, BFH, BMY, BC, BG, CRS, CARR, CX, CNP, CMS, CMCSA, CFR, EXP, EME, FAF, FCNCA, FSV, ULCC, FCN, HOG, HAS, HSY, HTZ, HON, IP, KVUE, KDP, KEX, LH, LAZ, LEA, LII, LIN, LKQ, MDC, MAS, MA, MRK, NYCB, NEM, NOC, ORI, OSK, PATK, BTU, PCG, BPOP, RS, RCL, STX, SAH, LUV, STM, FTI, TXT, TTE, TSCO, TPH, UPS, VLO, VLY, VC, VMC, GWW, WST, WEX, WTW, AB, AMZN, AJG, BIO, SAM, COF, CSL, CC, CMG, CINF, COLM, DECK, DXCM, DLR, EMN, EHC, ENPH, ERIE, FE, F, HIG, HUBG, INTC, JNPR, LHX, LPLA, MTX, NOV, OLN, PFG, RSG, RMD, SKX, SKYW, SSNC, TEX, TXRH, X, VALE, WY, and WKC report. Finally, on Friday, we hear from ABBV, AER, ARLP, AON, ARCB, AN, AVTR, BAH, CBRE, GTLS, CHTR, CVX, CL, DAN, EQNR, XOM, FMX, FTS, GNTX, IMO, LECO, LYB, NWL, NVT, PSX, POR, SAIA, SNY, SWK, TROW, and XEL.

In US Congressional news, I’m sure you heard that Rep. Jordan failed in what was a surprise third vote in his try to become Speaker of the House on Friday. Just as had happened in the second vote, Jorden got less support, losing 4 more GOP votes than he had gotten in the second vote. Speaker Pro Tempore adjourned Congress for a long weekend immediately after the vote. Following adjournment, the GOP Caucus held a secret ballot to confirm their support of Jordan’s candidacy and Jordan got the backing of only 86 of the 221 Republicans. (So, in the space of an hour, Jordan had gone from 194 public votes to 86 private ones.) He was dropped as the GOP Speaker Nominee (and withdrew his candidacy). As of Sunday, there were nine sitting GOP Reps. that had filed officially to throw their hat into the ring for the job. The GOP plans to hear speeches from the nine on Monday and take their next GOP-only vote to choose one on Tuesday. Sadly, as of Sunday night, the Democrats had not shown enough leadership to publicly throw their support behind one of the nine either. Had they done so, they would have made it easier on moderate Republicans to elect a GOP Speaker with bipartisan support. That would have meant the Speaker was much less indebted to extremist minorities on either side. So, we continue down the partisan track, and assuming the GOP can choose their candidate Tuesday morning, the whole House will resume voting for the new Speaker later Tuesday. That will be exactly 24 calendar days and 9 scheduled House working days before another government shutdown ensues.

In miscellaneous news, the Biden Administration made a formal request for $105 billion of funding for Israel, Ukraine, Taiwan, and US border security. The packaging includes $61 billion for Ukraine ($50 billion of which will actually go to US defense contractors), $14.3 billion for Israel (some of which will also go for US-built missile systems), a bit more than $9 billion for humanitarian aid, $6.4 billion for border operations, $1.2 billion for fighting counterfeit fentanyl entering the country, and $2 billion for Taiwan.

In geopolitical news, two American hostages were released by Hamas on Friday after negotiations made through the UAE. In other Middle East news, a US Destroyer shot down missiles and drones launched by Iran-backed, Yemeni Houthi rebels that were headed toward Israel. Elsewhere, ship tracking data has identified one Russian and one Chinese ship that were in the locations of pipeline and telecom cable that were destroyed recently (running between Finland and Estonia). Sweden said the same two ships were at the location of a telecom cable running between Stockholm and Estonia that was damaged about a day prior to the Finnish damage. Meanwhile, flying under the radar last week, hours after Russia revoked its ban on nuclear testing, the Biden Administration showed its own ability to rattle sabers by conducting a large high-explosive (non-nuclear) test at US nuclear test site. The Dept. of Energy said the test was intended to validate new predictive models for the chemicals and radioisotopes used in the blast. (This will reportedly improve the US ability to detect atomic blasts in other countries.)

In late-breaking news, Japan announced it has launched an antitrust investigation of GOOGL related to mobile phone search monopoly. Third-party opinions on the topic are to be submitted by November 22. Elsewhere, CVX announced early today that it has agreed to buy HES for $53 billion in an all-stock deal. This comes not long after XOM bought PXD as huge consolidation in the US Oil space continues. (Don’t be surprised if the pair of deals draw antitrust scrutiny since the number 1 (XOM) and number 2 (CVX) oil producers gobbling up significant rivals. CVX said that after the deal closes, it intends to increase its share repurchase program by another $2.5 billion (on top of the existing $20 billion buyback plan).

With that background, it looks like the bears continue to have control in the premarket. However, all three of the major index ETFs are up off their lows of the early session. It is also worth noting that DIA and QQQ are printing indecisive premarket candles, with more wick than body and wick on both sides. Still, they are all black-bodied candles. So, the market leans bearish early with all three major index ETFs below their T-line (8ema). With no economic news on tap today and more earnings not really coming until after the close, we might get a true read on relative strength to start the week. Trading should be a little less volatile unless we get geopolitical news of some sort. In terms of extension, all three major index ETFs are starting to get stretched out below the T-line (8ema). The T2122 indicator is now also deep in the bottom of its oversold territory. So, we need a pause or bounce to relieve pressure even if the Bears maintain control. Just remember that the market can stay over-extended a lot longer than we can stay solvent being right too early. So, don’t go betting on “we’re due.”

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Bears Keep Control and No Planned News

Thursday was a volatile day in the morning and the Bear’s market in the afternoon. The SPY “gapped” up 0.16%, the DIA opened dead flat, and the QQQ gapped up 0.43%. From there, all three major index ETFs traded sideways for the first 45 minutes, sold off the next hour, and rallied until 12:25 p.m. Then a short, sharp selloff lasted 15 minutes, reaching new lows for all three major index ETFs. This was followed by an equally sharp rally to the highs of the day by 1:10 p.m. However, that was when the Bears took over and sold the market the rest of the day, closing not far off the lows. This action gave us large-body, black candles with larger upper wicks and smaller lower wicks. All three of those major index ETFs retested and failed their T-line (8ema) from below, while DIA retested and failed its 200sma and QQQ came very close to testing and failing its 50sma. This all happened on heavier-than-average volume in the SPY, DIA, and QQQ index ETFs.

On the day, all 10 sectors were in the red with Consumer Cyclical (-1.46%) out front leading the way lower. Meanwhile, Energy (-0.29%) held up better than other sectors. At the same time, the SPY was down 0.88%, the DIA lost 0.75%, and QQQ lost 0.94%. VXX gained 4.95% to close at 26.30 and T2122 dropped down further into (into the bottom of) its oversold territory at 5.24. 10-year bond yields spiked yet again to 4.994% while Oil (WTI) popped again by 2.42% to close at $90.46 per barrel. So, on Thursday we had a very volatile market. There is no way to know for sure the cause of the morning volatility or the afternoon selloff. However, Fed Chair Powell spoke at noon, it was also midday when Rep. Jordan gave up on having a vote today and decided to back giving more power to appointed Speaker Pro Tempore McHenry (while saying he is still running for the job but would back McHenry for few months). There was also news out of the Middle East midday as the Israeli Defense Minister reportedly green-lighted the expected ground invasion of Gaza and a US Destroyer intercepted drones/missiles launched by the Yemeni Houthis (backed by Iran) toward Israel.

The economic news reported Thursday included Weekly Initial Jobless Claims that came in better than expected at 198k (compared to a forecast of 212k and a previous week’s value of 211k). At the same time, the Philly Fed Mfg. Index came in weaker than anticipated at -9.0 (versus a forecast of -6.4 but better than the September reading of -13.5). For reference, a value above zero means improving conditions, and below zero means deteriorating conditions. Later, September Existing Home Sales (month-on-month) came in better than expected at 3.96 million (compared to a forecast of 3.89 million but down from the August value of 4.04 million). This amounts to a 2.0% decline month-on-month, which is a bit worse than the August decline from July which was -0.7%. Finally, after the close, the Fed Balance Sheet continued to show it slow and steady decline, as it moved from $7.952 trillion to $7.933 trillion.

In Fed speak news, as mentioned, Fed Chair Powell gave a speech to the Economic Club of NY. In the speech, he said pretty much what was anticipated. Powell said inflation remains too high, but progress has been made and the economy remains strong, especially in the labor market (which is also a Fed mandate). However, his primary tone was to expect rates higher for longer…and the process will be long. His notable quotes included “Inflation is still too high, and a few months of good data are only the beginning of what it will take”, “While the path is likely to be bumpy and take some time, my colleagues and I are united in our commitment to bringing inflation down sustainably to 2 percent”, “Incoming data over recent months show ongoing progress toward both of our dual mandate goals —maximum employment and stable prices,” and “Does it feel like policy is too tight right now? I would have to say no.” Then after hours, Dallas Fed President Logan said “We have some time” to see data before deciding on the next rate move. She indicated the Fed can be deliberate and hinted at continuing the rate pause. She noted that tightening monetary conditions (caused by rising bond yields) will help slow economic growth, curbing inflation and giving the FOMC the slack needed to wait.

In Autoworker contract talks and strike news, F laid off another 150 employees at one of its MI plants Thursday, again citing the UAW strike as the reason. Later, UAW workers in AL ratified a deal with MBGAF (Mercedes) supplier ZF and ended their strike with that supplier. Elsewhere, in tangentially related news, Reuters reported Thursday that UNP is seeking to renegotiate contracts with its customers, citing the impact of the UAW strike on costs. However, the primary driver behind the move appears to be inflation impacts, with the UAW strike being a convenient reason to cite for needing renegotiations.

In stock news, on Thursday, TSLA joined GM and F in slowing its expansion of EV production capacity. TSLA CEO Musk said, “People hesitate to buy a new car if there’s uncertainty in the economy.” Later, Reuters reported that Japan’s JFE Steel is in talks to buy a stake in TECK or at least TECK’s metallurgical coal unit. At the same time, NOK announced it plans to cut 14,000 jobs between now and 2026. Elsewhere, DG announced the reinstatement of former CEO Vasos (who had left in 2022). Later, ENPH announced the availability of its EV chargers throughout North America. (The lack of immediate availability has been a drag in charger installations in 2023.) By mid-afternoon, STLA announced a deal to do an asset transfer deal with China’s Dongfeng Motor Group. The deal will increase STLA exports, allowing STLA to further penetrate the Chinese markets. Dongfeng will get STLA land rights and buildings in the swap. After the close, CVS removed many common decongestants (recently found ineffective by studies) from store shelves and discontinued their sale.

In stock government, legal, and regulatory news, the EPA ordered NSC to do more cleanup in East Palestine OH (site of their Feb. derailment and chemical spill). At the same time, AMZN asked a US District Court to dismiss the FTC lawsuit, claiming the FTC was using poorly defined concepts and terms to punish the company. (The terms mentioned were “manipulative” or “deceptive.”) Later, WBA settled a class action suit brought by investors in now-bankrupt RAD for $192 million. (The investors claimed WBA had misled them about WBA’s interest in buying RAD back in 2017.) Meanwhile, PFE won unconditional approval for its acquisition of SGEN from EU antitrust regulators. In the early afternoon, MO filed suit against 34 vape manufacturers, seeking an injunction as it claimed they violated state and federal laws to “illegally compete” with MO’s NJOY vape unit. At the same time, Bloomberg reported that the FDIC and Fed are considering rules to curb the system leverage by regulating how banks can trade with hedge funds. Currently, hedge funds are allowed to employ significant leverage by betting on the spread between Bond futures and the cash market price of the same vehicle with banks. The FDIC and Fed can only regulate the banks but this new rule on banks would be a means of curbing systemic risks posed by hedge funds by denying them the bank trading partners. Elsewhere, on Thursday the CFPB proposed new rules that would make it easier for consumers to transfer their data between financial service providers. The “open banking draft” rule is intended to supercharge competition in the financial services sector by giving customers the ability to easily walk away from bad service. The rules should be finalized in 2024. (The EU, UK, and others already have such rules.)

After the close, AMTB, ASB, OZK, CSX, KNX, and WAL all reported beats to both the revenue and earnings lines. Meanwhile, ISRG missed on revenue while beating on earnings. It is worth noting that the regional banks continued their massive revenue growth quarter-on-quarter (ASB +49.2%, OZK +67.8%, WAL +44.3% just to name three.)

Overnight, Asian markets were red across the board. South Korea (-1.69%) Thailand (-1.66%), and New Zealand (-1.27%) led the region lower. In Europe, we see the same thing taking shape at midday. The DAX (-1.24%), CAC (-1.16%), and FTSE (-0.82%) are leading the region lower in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a modestly red start to the day (relative to the rest of the globe). The DIA implies a -0.22% open, the SPY is implying a -0.21% open, and the QQQ implies a -0.28% open at this hour. Meanwhile, 10-year bond yields are “down” to 4.933% and Oil (WTI) is up modestly to $90.60 per barrel in early trading.

There is no major economic news scheduled for Friday. However, again we hear from Fed member Harker (9 a.m.) and Mester (12:15 p.m.). The major earnings reports scheduled for before the open include AXP, ALV, CMA, EEFT, HBAN, IPG, RF, and SLB.

So far this morning, CMA, EEFT, HBAN, and TLSNY all reported beats to both the revenue and earnings lines. Meanwhile, AXP and SLB have missed on revenue while beating on earnings. On the other side, ALV, IPG, and RF beat on revenue while missing on the earnings line. It is worth noting that the banks continue to post significant quarter-on-quarter revenue growth. For example, CMA (+36.0%), HBAN (+35.2%), and RF (+19.7%).

In US Congressional news, Rep. Jordan failed to garner any more support for his bid to become Speaker of the House on Thursday. So, voting was again postponed (canceled for the day). Jordan’s GOP opponents leaked to the press that they’ve been planning their opposition and intend to slowly decrease his vote total, by increasing the number who vote for someone else, on each successive vote. (This sounds like a pretty odd approach that would mean some who are in opposition actually vote for Jordan in early rounds of votes. Nonetheless, it was leaked to multiple news outlets.) After another fiery closed-door shouting/swearing match amongst the GOP caucus, opponents refused to even talk with Jordan. As a result, Jordan said he will now back giving appointed Speaker Pro Tempore “increased interim powers” for the rest of 2023…but will continue running for the job in hopes of ceasing the post in January. (Jordan believes the two-plus months would allow him to pressure and sway his GOP opponents. However, other GOP Reps. say the time will make no difference, the bullying/pressure will increase opposition, and the move would only prolong the GOP agony by reigniting the fight in January.) Meanwhile, the extreme right-wing group of the GOP that brought down former speaker McCarthy despises the idea of empowering McHenry anyway, because he was chosen by and is a very close ally of McCarthy.

In miscellaneous news, while fear of inflation makes the headlines, there are places where disinflation is taking place. For example, a bumper corn crop has caused global corn stockpiles to grow with the USDA expecting that after the US harvest, US storage of corn will have increased 55% from a year earlier. As a result, all the companies that use corn inputs are seeing major decreases in cost. CALM (largest egg producer in the US) says that their input cost per dozen eggs has fallen almost 11% in the 3-months ending on Sept 2 and corn supplies won’t peak for 2-3 months. Elsewhere, the Biden Administration announced two separate offers to buy oil to refill the strategic petroleum reserve totaling 6 million barrels. The offers would be filled in December and January. Meanwhile, NOAA released a forecast saying low water levels in the Mississippi River will persist through at least January, despite an improved drought forecast. The hope of relief from the drought in the Mississippi River Valley comes from the El Nino weather pattern forecast for this winter.

In mortgage news, Bloomberg reported Thursday that the average home price in the US is now just over $412,000. Assuming a 20% downpayment ($82,400), and a 7.2% interest rate, an American family would need to make more than $112k per year and spend no more than 30% of their income on housing. There are only two problems with that math. The US average 30-year, fixed-rate, 20% down rate is now 8.5% and the US average annual salary is $70k. In other words, the average American family cannot afford to buy a home…not even close. In related news, long-term US bond yields (which are loosely tied to mortgage rates) are spiking along with other bond yields. The US 10-year bond briefly traded at a 16-year high Thursday of above 5%.

With that background, it looks like the market is still undecided at this point in the premarket. All three index ETFs gapped modestly lower to start the early session. However, they have been putting in indecisive moves since that open with DIA giving us a small black-body candle, QQQ giving us a small white-bodied candle, and SPY giving us a small Doji. So, the market leans bearish but does not seem to have made up its mind yet. All three major index ETFs are back below their T-line (8ema). With no economic news on tap today and Fed Chair Powell having spoken Thursday, it is not likely the Fed speakers will rock the boat much either today. We could get a little volatility from anything the House does. However, the main news risk would seem to be geopolitics and Middle Eastern war and/or terror news. In terms of extension, none of the three major index ETFs are too far from their T-line (8ema). The T2122 indicator is now back down well into its oversold territory. So, we still have some slack to the downside, but more slack to the upside if one of the two sides can gather momentum. Just remember that the market can stay over-extended a lot longer than you can stay solvent being right too early. Also, remember that its Friday, Payday, and time to prepare your account for the weekend news cycle.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Member e-Learning 10-19-23 – John

Jobless Claims and Powell Speaks Today

The market gapped lower on Wednesday, opening down 0.41% in the SPY, down just 0.10% in the DIA, but down 0.73% in the QQQ. From there, the first 45 minutes saw a sideways chop in all three major index ETFs. However, then the Bears took over and sold the market off (in a jagged fashion) for the rest of the day. Only a slight bounce in the last 10-15 minutes kept all three index ETFs from closing on their lows. This action gave us black-bodied candles in all three. The QQQ printed a larger-bodied, black Spinning Top candle that crossed back down through its T-line (8ema) and 50sma. The DIA printed a large-body, black candle that crossed back below its T-line and 200sma. Meanwhile, the SPY printed a large-body, black candle with a bit more wick on each end than the DIA. SPY also crossed back below its 8ema. This happened on just slightly above-average volume in all three.

On the day, nine of the 10 sectors were in the red with Basic Materials (-2.71%) and Industrials (-2.62%) out front leading the way lower. Meanwhile, Energy (+0.45%) held up much better than the other sectors (by 0.75%). At the same time, the SPY was down 1.33%, the DIA lost 0.99%, and QQQ lost 1.31%. VXX gained 6.41% to close at 25.06 and T2122 dropped down into the middle of its oversold territory at 10.61. 10-year bond yields spiked again to 4.911% while Oil (WTI) popped again to close at $88.16 per barrel. So, Wednesday was the Bear’s day from premarket into the close.

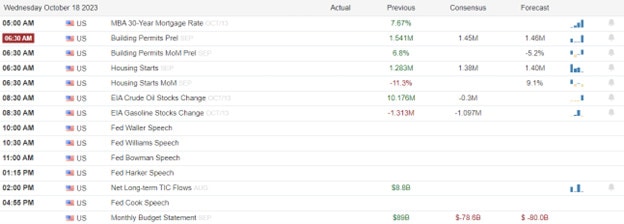

The economic news reported Wednesday included Preliminary September Building Permits which came in better than expected at 1.473 million (compared to a forecast of 1.455 million but less than the August number of 1.541 million). This amounted to a Preliminary decline of 4.4% month-on-month (versus a 6.8% month-on-month increase between July and August). At the same time, September Housing Starts came in light at 1.358 million (compared to a forecast of 1.380 million but well above the 1.269 million in August). That amounted to a 7.0% increase month-on-month in September versus a 12.5% decline between July and August. Later, EIA Weekly Crude Oil Inventories showed a much larger than expected drawdown of 4.491-million-barrels (versus a predicted draw of 0.300-million-barrels and drastically different than the prior week’s inventory build of 10.176-million-barrels. Finally, at the close, the TIC Net Long-Term Transactions for August came in worse than expected at +$63.5 billion (versus a forecast of +$76.8 billion but dramatically higher than the July reading of +$9.5 billion…which itself was revised up from the original reporting).

In Fed news, Fed Governor Waller promoted the idea of a cautious approach to any further Fed Funds rate changes in a speech made at a conference in London. Waller said, “I believe we can wait, watch, and see how the economy evolves before making definitive moves on the path of the policy rate.” He went on to outline two scenarios (an economic slowdown that brings down inflation and a sustained strong economy requiring more hikes), but said which will happen remains very unclear. Later, NY Fed President Williams reaffirmed the FOMC mantra that rates will need to be kept higher for longer to tame inflation. At a Queens College speech, Willams reiterated that progress has been made in bringing down inflation and said he will advocate rate cuts once inflation pressures ease. “Right now, we need to keep this restrictive stance of policy in place for some time to get inflation down.” These two positions were reinforced by the Fed Beige Book released Wednesday, which showed little change in economic activity in the 45 days ending October 6. In other words, despite the anecdotes of some, the hard data continues to show a strong economy.

In Autoworker contract talks and strike news, F announced a management shakeup appointing the head of its combustion vehicle unit as the new COO. The head of its Ford Blue (gas and hybrid) unit will take over as head of the combustion vehicle unit.

In stock news, on Tuesday, HSBC announced it will ban texting from work phones to hopefully head off future investigations for “off book” communications between traders. At the same time, BA pledged its support to key supplier SPR, in order to overcome the production problems that have plagued SPR (and therefore BA) for a year. BA did this by providing an agreement under which it will give SPR financial assistance by adjusting SPR prices upward by $190 million. By mid-morning, AMZN announced it had brought an automated warehouse in Houston, including a humanoid robot worker. aimed at reducing labor costs, improving inventory accuracy, and increasing order-filling speed. By early afternoon, members of a Swedish metal worker’s union called for strikes against TSLA in all (seven) of its service centers across that country. (Around 90% of TSLA employees in Sweden are covered by a collective bargaining agreement.) The strike was called over salary and pension concerns. Elsewhere, BNS announced it will terminate 2,700 employees globally (3% of its workforce). After the close, PCYG announced it would move its listing from NASDAQ to NYSE and chance to the ticker TRAK “around Nov. 2.” Also after the close, the CEO of COST (Jelinek) announced he will step down in April 2024. Shortly after this announcement, COST named the current Operations Chief as the new CEO when Jelinek retires. At the same time, NFLX announced price increases and that the service had added 9 million new users globally.

In stock government, legal, and regulatory news, the SEC proposed a ban on volume-based transaction pricing. The measure would target brokerages who are routing orders based on volume contracts with middlemen. In the major anti-trust case now underway, GOOGL began presenting its defense Wednesday. It called one of its own VPs to testify about the efforts the company has put into improving its (now terrible due to ad and pay-for-placement) search tool since 2004. Later, Mexico announced that two Chinese TSLA suppliers will invest $1 billion in the Northern Mexican state where TSLA is building a new factory. Between the two suppliers, Mexico is also expecting to create 14,000 jobs. After the close, F and the NHTSA announced the carmaker was recalling 35,000 2021-2022 Mustang Mach-E cars because main battery connectors may overheat resulting in a loss of control while the car is moving. Also after the close, a US Appeals Court revived a shareholder case against META for violating user privacy and concealing the misuse of user data in 2017-2018.

After the close, COLB, FNB, LRCX, LVS, LBRT, NFLX, SAP, and ZION all reported beats on both the revenue and earnings lines. Meanwhile, CCI and PPG both missed on revenue while beating on earnings. On the other side, AA, DFS, and STLD all beat on revenue while missing on earnings. Unfortunately, EFX, KMI, and TSLA missed on both the top and bottom lines. It is worth noting that CCI raised its forward guidance while EFX and NFLX lowered guidance.

Overnight, Asian markets were nearly red across the board. Only Taiwan (+0.07%) managed to hang onto green territory. Meanwhile, Hong Kong (-2.46%), Japan (-1.91%), and South Korea (-1.90%) led the region sharply lower. In Europe, we see a similar picture taking shape at midday. Only Greece (+0.11%) is in the green as the CAC (-0.59%), DAX (-0.22%), and FTSE (-0.88%) lead the region lower in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a mixed open on either side of flat. The DIA implies a -0.12% open, the SPY is implying a -0.14% open, and the QQQ implies a +0.04% open at this hour. At the same time, 10-year bond yields are spiking again to 4.971% and Oil (WTI) is down more than one percent to $87.37 per barrel in early trading.

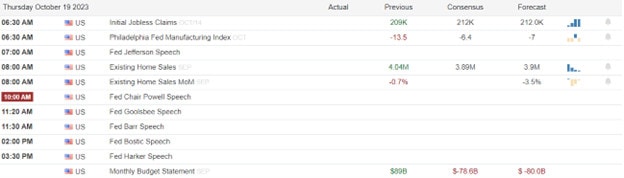

The major economic news scheduled for Thursday includes Weekly Initial Jobless Claims and Philly Fed Mfg. Index (both at 8:30 a.m.), Sept. Existing Home Sales (10 a.m.), and the Fed Balance Sheet (4:30 p.m.). We also hear from Fed Chair Powell (noon), Bostic (4 p.m.), and member Harker 5:30 p.m.). The major earnings reports scheduled for before the open ALK, AAL, T, BX, EWBC, FITB, FCX, GPC, KEY, MAN, MMC, NOK, PM, POOL, SNA, SNV, TSM, TFC, UNP, WSO, and WBS. Then, after the close, CSX, ISRG, KNX, and WAL report.

In economic news later this week, on Friday, there is no scheduled news. However, again we hear from Fed member Harker (9 a.m.) and Mester (12:15 p.m.).

In terms of earnings reports later this week, on Friday, AXP, ALV, CMA, EEFT, HBAN, IPG, RF, and SLB report.

So far this morning, T, FITB, KEY, MAN, MMC, POOL, SNA, TSM, TCBI, TFC, WSO, and WBS all reported beats to both the revenue and earnings lines. Meanwhile, AAL, GPC, and PM missed on revenue while beating on earnings. On the other side, BKU beat on revenue while missing on earnings. Unfortunately, ALK, BX, and NOK missed on both the top and bottom lines. It is worth noting that ALK and MAN both lowered their forward guidance.

In US Congressional news, after a day of bullying tactics (including harassing and then trying to intimidate the wife of a GOP opponent) by right-wing media and Rep. Jordan supporters, Jordan failed in his second vote to be made Speaker of the House. Jordan lost 3 GOP votes and gained 1 between the first and second votes. Again, the House adjourned after the single vote when it was clear Jordan would not get the votes to win on Wednesday. At this point, there is more movement toward expanding the powers of unelected Speaker Pro Tempore McHenry as a stop-gap. However, there are also some more moderate Republicans who say they won’t support that measure unless it is Jordan himself putting the bill forward (they want their pound of flesh related to the way Scalise was torpedoed). Finally, another group is now pushing for MI Rep. Bergman (Retired Marine General) to be voted in as Speaker. Late Wednesday, Bergman made the announcement he would run for the GOP nomination, but would only take the job through the end of this Congress (January 2025). Jordan announced he plans to stay in the race. For their part, most of the GOP side of the aisle is trying to blame all their problems on the Democrats for not magnanimously crossing the aisle to save McCarthy from MAGA and then not doing the same to elect Scalise as Speaker. Another round of voting is planned for Thursday, but the time was not scheduled.

In miscellaneous news, with the spike in Treasury yields, 30-year, fixed-rate, home loans (after 20% down) hit 8% this morning. That’s the highest level since the year 2000. Although there has not been enough time for the market to adjust, demand for loans is expected to plummet in response. Elsewhere, after a call between President Biden, Sec. of State Blinken, and Egyptian President el-Sissi, the US and Egypt have agreed to open a humanitarian corridor into Gaza from the Egyptian side. In other Gaza news, Battle Damage Assessment (BDA) tends to indicate that the hospital (parking lot) explosion on Tuesday was caused by a misfire of a Hamas missile. (The area is burnt, indicating a lot of fuel burned off in/after the explosion. Israeli air strikes would not contain a lot of fuel. There was also only a small hole caused by kinetic energy from a falling missile, not a huge crater and collapsed building that would be caused by a bomb explosion. These indicate it was likely a freshly fired missile from very nearby that malfunctioned and crashed/burned in the hospital parking lot.)

With that background, it looks like we gapped a bit lower in the premarket but since then the Bulls have rallied a bit, giving us white-bodied candles. However, the early session candles are small and indecisive (considerable wick). So, the market does not seem to have made up its mind yet. All three major index ETFs are back below their T-line (8ema). QQQ is also below its 50sma and while the DIA is just below its 200sma in the early session. Economic news today is not likely to rock the boat during premarket and Fed Chair Powell’s speech at noon will also likely cause volatility. Lastly, more drama/news out of Congress could have a say in markets. In terms of extension, none of the three major index ETFs are too far from their T-line (8ema). The T2122 indicator is now back down in the middle of oversold territory. So, we have some slack to the downside, but more slack to the upside if one of the two can gather momentum. Also, remember that the market can stay over-extended a lot longer than you can stay solvent being right too early.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Bond Yields

Increasing geopolitical concerns engaged the bears on Wednesday as bond yields and rising interest rates reversed Tuesday’s gains. Mortgage rates topped 8% for the first time since 1995 and unfortunately, the yields continue to rise this morning as we wait on Jerome Powell’s comments at mid-day. Bulls or bears will have plenty of earnings results and economic data to inspire price volatility with an afternoon filled with bond auctions and Fed speakers to keep traders guessing. Anything is possible folks so plan your risk carefully.

Asian markets closed sharply lower overnight with Japan reporting a surprise trade surplus and the Bank of Korea holding rates steady. European markets trade red across the board this morning as the Middle East war hampers sentiment and increases winter energy prices. Ahead of earnings and possible market-moving economic reports, U.S. futures point to mixed but overall flat open but that could change substantially as the data rolls out.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ALK, AAL, T, BMI, BX, CSX, FITB, FCX, GPC, ISRG, KEY, KNX, LNN, MAN, PM, POOL, SNA, TFC, UNP, WDFC, WBS & WNS.

News & Technicals’

Netflix, the streaming platform, reported better-than-expected results for the third quarter, sending its shares up nearly 14% in premarket trading on Wednesday. The company added 8.8 million subscribers in the quarter, the highest number since the peak of the pandemic. The company attributed its strong performance to its diverse and original content, as well as its expansion in international markets. Netflix also said that it expects to add 8.5 million subscribers in the fourth quarter, surpassing the market expectations. Netflix’s results showed that it remains the dominant player in the streaming industry, despite the increasing competition from other platforms.

Tesla, the electric car maker, reported lower-than-expected earnings for the third quarter, as its operating margin declined sharply from a year ago. The company earned 66 cents per share on an adjusted basis, missing the analysts’ estimate of 73 cents per share. The company’s operating margin, which measures how much profit it makes from each dollar of revenue, was 7.6%, down from 17.2% in the same quarter last year. The company said that the lower margin was due to higher costs and lower prices for its vehicles. Tesla CEO Elon Musk said on the earnings call that the company was facing challenges in the global economy and that it was working on making its cars more affordable for more customers. Tesla also said that it delivered a record number of vehicles in the quarter and that it expects to achieve its full-year delivery target of 750,000 vehicles.

TSMC, the world’s leading chipmaker, reported a third-quarter profit of NT$211 billion on Thursday, beating the analysts’ expectations. However, the profit was the lowest since the first quarter of 2019, as the demand for consumer electronics remained weak after the pandemic. The Taiwanese company produces the most advanced processors for various devices, but the post-pandemic recovery has been uneven and slow for the consumer electronics sector. TSMC said that it expects the demand to improve in the fourth quarter, as it ramps up its production capacity and launches new products. TSMC also said that it is confident in its long-term growth prospects, as it invests in new technologies and markets.

The bears attacked the indexes on Wednesday, as bond yields and interest rates surged higher as geopolitical issues weighed on investor’s minds. The energy sector was the only one that did well, as oil prices rose due to supply concerns. The defensive sectors, such as consumer staples, utilities, and health care, also performed better than the cyclical sectors, such as small caps, which suffered more. That said, better-than-expected earnings results from NFLX may help improve investor spirits in the QQQ. Unfortunately, TSLA’s overnight decline and the bond yields continuing to rise may well mute that bullish bright spot. Today traders will have to deal with Jobless Claims, Philly Fed MFG, Existing Home Sales, Natural Gas, and a slew of Fed speakers that include Jerome Powell at noon Eastern time. We also have a busy day of earnings to add to the volatile price action this morning so plan your risk carefully.

Trade Wisely,

Doug

Permits, Starts, Fed Talk, and Speaker Votes

Tuesday saw a fair amount of whipsaw in the Market. The SPY gapped down 0.72%, DIA gapped down 0.46%, and QQQ gapped down 0.99%. However, the Bulls stepped in to rally all three major index ETFs until 12:30 p.m. when all three had recrossed the opening gap and reached the high of the day. Then the Bears took over to sell off the market and recapture a good portion of what the Bulls had taken back during the morning rally by 2 p.m. The rest of the day saw an hour and 45 minutes of sideways grind and then a rally into the close the last 15 minutes for all three major index ETFs. This action gave us white-bodied candles in all three. The QQQ printed a Spinning Top candle that retested and closed back up above its T-line (8ema) and 50sma. The SPY and DIA both printed white candles with significant upper wicks that stayed up above their T-lines and the DIA stayed above its 200sma. Again, this all happened on above-average volume in the DIA and below-average volume in both the SPY and QQQ.

On the day, eight of the 10 sectors were in the green with Basic Materials (+1.08%) and Consumer Cyclical (+1.00%) out front leading the way higher. Meanwhile, Utilities (-0.15%) lagged behind the other sectors. At the same time, the SPY was flat, the DIA gained 0.03%, and QQQ lost 0.33%. VXX gained 2.79% to close at 23.55 and T2122 climbed back up to the bottom of the overbought territory at 81.61. 10-year bond yields spiked to 4.836% while Oil (WTI) popped back up to close at $87.73 per barrel. So, it was a volatile day but at least it came on only a couple of moves. We gapped down, rallied all morning, and reversed to give back much of the morning rebound. At that point, Mr. Market was basically worn out. So, we drifted sideways in the late afternoon only to rally the last 15 minutes.

The economic news reported Tuesday included September Retail Sales month-on-month, which came in stronger than expected at +0.7% (compared to a forecast of +0.3% but less than the August reading of +0.8%). This included Sept. Core Retail Sales that were also stronger than expected at +0.6% (versus a forecast of +0.2% but with a declining rate of increase since August’s value was +0.9%). Later, Sept. Industrial Production month-on-month was also stronger than anticipated at +0.3% (compared to a forecast of +0.1% and the August reading of +/-0.0%). On a year-on-year basis, September Industrial Production came in unchanged at +0.08% versus the August value of +0.08%. Still later, August Business Inventories month-on-month grew more than expected at +0.4% (compared to a forecast of +0.3% and the July value of +0.1%). At the same time, August Retail Inventories were lower than predicted at +0.5% (versus a forecast of +0.6% but still higher than the July reading of +/- 0.0%). Finally, API Weekly Cruce Oil Stocks reported a greater-than-expected drawdown of 4.383-million-barrel (compared to a forecasted 1.267-million-barrel drawdown and far different from the prior week’s 12.940-million-barrel inventory build).

In Fed speak news, Richmond Fed President Barkin indicated he is in the “wait and see” camp but is leaning dovish on Tuesday. Barkin told a Real Estate Conference, “I see an economy that is much further along the path to demand normalization than much of the data would tell you.” even as “the path for inflation isn’t clear yet.” He went on to say, “I am still looking to be convinced, both that demand is settling and that any weakness is feeding through to inflation.” Later while being questioned by reporters, Barkin said “Longer-term rates have moved up, that’s certainly tightened financial conditions…” After the close, Minneapolis Fed President Kashkari gave hawks some reason for hope when Reuters reported he told a University of Minnesota event that inflation has taken much longer than expected to come down and “it is still too high.”

In Autoworker contract talks and strike news, STLA canceled a scheduled presentation at technology show CES in January, blaming the cancellation on the UAW strike. At the same time, GM announced that it is pushing back the scheduled start of production at its Orion EV truck plan by a year. While speculated by analysts, the company did not mention the strike as a cause.

In stock news, on Tuesday, WH rejected a $7.8 billion ($49.50/share plus 0.324 shares of CHH) takeover offer from CHH. This came after a six-month negotiation process. Later, LCID shares plummeted after they reported Q3 productions and deliveries with minimal increases despite steep discounting. At the same time, after announcing earnings, JNJ said it has embarked on a 2-year restructuring plan for its orthopedics (medical devices) business unit. Elsewhere, HSBC announced it has taken further steps to tighten internal communications rules amidst strong scrutiny of the industry for prohibited “off books” communications between traders. Later, GOOGL and QCOM announced a joint project to develop a RISC-V Snapdragon Chipset to increase the functionality of Wear OS watches. (This comes after the recent announcement of GOOGL’s latest Pixel Watch 2 using the QCOM Snapdragon processor.) At the same time, Reuters reported that TSN workers and activists continue their protests outside of the meat company’s headquarters in AR. The protests are over the company using child labor (through contractors) to clean their slaughterhouses and packing plants. After the close, Reuters reported that CHK had approached SWN about a potential acquisition in the $12 billion deal value range. At the same time, Reuters also reported that MSFT is near to bringing on AMZN as a customer for its Office365 via cloud tools (1 million seat licenses) in what insiders said would be more than a $1 billion deal annually for MSFT.

In stock government, legal, and regulatory news, the AVGO merger with VMW was hurt by rumblings from Chinese regulators. The rumor is that this $61 billion deal is a bargaining chip in the US-China technology sanctions fight. Later, NKTX shares skyrocketed Tuesday after the FDA approved the company’s genetically engineered therapy for lupus nephritis. (NKTX closed up more than 112%.) Elsewhere, the NHTSA announced they have initiated an investigation into GM’s self-driving division (Cruise) related to pedestrian risks posed by their robotaxis. At the same time, the Fed announced it will not enforce Dodd-Frank Category 2 requirements by the end of 2024. The rules would have required additional capital requirements for banks of over $700 billion in assets. BAC was the strongest big bank on the news after having acquired MUFG, which was not compliant with the rules. Meanwhile, the NHTSA announced TSLA is recalling 55,000 2021-2023 Model X, which are failing to detect low brake fluid. After the close, META and FTC lawyers argued against one another in a case over the FTC’s toughened privacy rules. Also after the close, NVDA filed a notice that new technology export restrictions from the US will impact its results by preventing the sale of its high-profit AI products and top-end gaming video cards (which can be used for low-end AI) into China. The restrictions will also impact AMD and to a lesser extent INTC but neither of them has filed SEC earnings impact statements yet.

After the close, HWC, IBKR, OMC, UAL, and WTFC all reported beats on both the revenue and earnings lines. However, JBHT missed on both the top and bottom lines. It is worth noting that UAL also lowered its forward guidance. It is also worth noting that IBKR had 87% revenue growth (quarter on quarter), while PNFP and WTFC both had greater than 54% quarter-on-quarter revenue growth.

Overnight, Asian markets were mixed but leaned toward the red side. Shenzhen (-1.24%), Taiwan (-1.21%), and Singapore (-1.11%) led the region lower. Meanwhile, in Europe, we see a similar picture taking shape midday. The CAC (-0.61%), DAX (-0.64%), and FTSE (-0.72%) are leading the region lower in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a down start to the day. The DIA implies a -0.28% open, the SPY is implying a -0.44% open, and the QQQ implies a -0.56% open at this hour. At the same time, 10-year bond yields are down a bit to 4.815% and Oil (WTI) has spiked 2.7% to $89.00 per barrel in early trading.

The major economic news scheduled for September Building Permits and Sept. Housing Starts (both at 8:30 a.m.), EIA Weekly Crude Oil Inventories (10:30 a.m.), and the Fed Beige Book (2 p.m.). We also hear from Fed members Waller (noon), Williams (12:30 p.m.), Bowman (1 p.m.) and Harker (3:15 p.m.). The major earnings reports scheduled for before the open ABT, ALLY, ASML, CFG, ELV, FHN, MTB, MS, NDAQ, NTRS, PG, STT, TRV, USB, and WGO. Then, after the close, AA, COLB, CCI, DFS, EFX, KMI, LRCX, LVS, LBRT, NFLX, PPG, SAP, STLD, TSLA, and ZION report.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Philly Fed Mfg. Index, Sept. Existing Home Sales, and the Fed Balance Sheet. We also hear from Fed Chair Powell (noon), Bostic (4 p.m.), and member Harker 5:30 p.m.). Finally, on Friday, there is no scheduled news. However, again we hear from Fed member Harker (9 a.m.) and Mester (12:15 p.m.).

In terms of earnings reports later this week, on Thursday, ALK, AAL, T, BX, EWBC, FITB, FCX, GPC, KEY, MAN, MMC, NOK, PM, POOL, SNA, SNV, TSM, TFC, UNP, WSO, WBS, CSX, ISRG, KNX, and WAL. Finally, on Friday, AXP, ALV, CMA, EEFT, HBAN, IPG, RF, and SLB report.

So far this morning, ABT, ALLY, ASML, CBSH, ELV, FHN, MTB, MS, NDAQ, PG, and USB all reported beat on both the revenue and earnings lines. Meanwhile, CFG, NTRS, and TRV reported beats on revenue while missing on earnings. On the other side, WGO missed on revenue while beating on earnings. However, SCL and WIT missed on both the top and bottom lines. It is worth noting that ABT and ELV raised their forward guidance while CFG and USB lowered guidance.

In US Congressional news, right-wing Re. Jordan failed to get anywhere near enough votes to become Speaker Tuesday, coming in a distant second even though his party has the majority. 20 GOP members voted against him and one abstained, giving him 200 votes after bullying other moderates to fall in line. After that vote, a second vote was canceled until today when it became clear he would not gain the votes on Tuesday. Multiple media reports say one “no” vote has said they will vote for Jordan on the next ballot, but others that were “yes” votes said they are leaning toward voting “no” now. Elsewhere, Reuters reported that Israel is asking for $10 billion in cash aid immediately to pay for its retaliation against Hamas and also payments to its citizens impacted by the terror attacks. However, Bloomberg reports the Administration is now considering a funding request of $100 billion covering Israel, Ukraine, and Taiwan. (This comes just days after the request was expected to be North of $2 billion and to be fair, I guess 100 is greater than 2.) Given the race to proclaim and demonstrate support for Israel, these packages are likely to get broad bipartisan support. GOP Senate Majority Leader McConnell said he expects an assistance bill for Israel, Ukraine, and Taiwan as well as doing “something serious” about the US-Mexican border. However, he did not commit to any amount when pressed by Reuters. Of course, no package can even be voted on until the GOP finds their next Speaker of the House.

In miscellaneous news, President Biden is in Israel today and his trip to Jordan to meet with Palestinian and Arab leaders was canceled after a Gaza hospital was blown up Tuesday, reportedly killing at least 500. (It’s a bit difficult to de-escalate or talk about the future of Palestinians without talking to any Palestinians or their supporters.) Upon landing, Biden echoed the Israeli line that the hospital bombing “appears” to be the fault of a failed missile launch by Hamas. Elsewhere, in China, one of the country’s largest developers faces bankruptcy as Country Garden failed to make a payment on its debt and the grace period expired today.

With that background, it looks like the Bears are firmly in control in the premarket despite more strong earnings reports. All three major index ETFs opened the early session down and have printed black-bodied candles (with DIA being the only one of the three looking indecisive). However, only the QQQ has crossed back below their T-line (8ema). QQQ is also crossing down its 50sma in the early session while the DIA remains just above its 200sma. The economic news today is not likely to more markets much, but news out of the House, Fed speakers, or President Biden’s trip to Israel could cause some volatility. In terms of extension, none of the three major index ETFs are too far from their T-line (8ema). The T2122 indicator is now back just inside the low end of the overbought territory. So, again we have slack to run in either direction, but the probabilities are slightly in the Bears favor.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Volatile Tuesday

After gapping lower in reaction to hotter-than-expected Retail Sales numbers the bulls rushed back in producing a very whippy and volatile Tuesday as bond yields surged higher with worries about inflation. After surging higher to test resistance levels index prices softened leaving behind more questions than answers with the declining market breadth. Today we have a very busy day of earnings and economic reports to inspire the bulls or bears. However, the war in the Middle East and the increasing tensions add a level of caution and uncertainty to the morning as oil prices surge higher.

Asian market closed the day mixed with modest gains and losses despite the better-than-expected economic figures out of China. European markets trade red across the board this morning as they monitor Middle East tensions and worry about inflation as energy prices rise. U.S. futures suggest a slightly bearish open due to the war tensions, but anything is possible by the open of the day with earnings and economic reports before the bell. Expect another day of challenging price action.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ABT, AA, ALLY, ASML, CFG, CCI, DFS, EFX, FNB, FHN, KMI, LRCX, LVS, MTB, MS, NDAQ, NFLX, NTRS, PPG, PG, REXR, SLG, STT, STLD, TSLA, TRV, USB, WGO, ZION.

News & Technicals’

China’s economy grew faster than expected in the third quarter of this year, according to the latest data from China’s National Bureau of Statistics. The data showed that China’s gross domestic product (GDP) increased by 4.9% year-on-year in the July to September period, beating the 4.4% growth forecast by economists. China’s retail sales also exceeded expectations, rising by 4.3% year-on-year in September. China’s urban unemployment rate dropped to 4.7% in September, the lowest level since November 2019. The data indicated that China’s economic recovery from the Covid-19 pandemic was gaining momentum, as domestic consumption and industrial production improved. China was the only major economy to report positive growth in 2020 and is expected to maintain its growth momentum in the fourth quarter of this year.

Roblox, the online gaming platform and game creation system, has announced a change in its work policy that will require its employees to relocate to the office. Roblox CEO David Baszucki said in a memo on Tuesday that the company will adopt a hybrid work model, where employees will have to work from the office on Tuesdays, Wednesdays, and Thursdays, starting from January 2024. Employees who choose not to relocate to the office can opt for a severance package and leave the company. The new policy is a reversal from the previous one, which allowed employees to “primarily work remotely” since May 2022. Baszucki said that the change was necessary to foster collaboration, innovation, and culture at Roblox.

United Airlines, one of the largest U.S. airlines, has warned that its profits will be affected by higher fuel costs and the conflict in the Middle East. The airline said that the price of jet fuel has increased by 50% since the beginning of the year and that the war between Israel and Hamas has reduced the demand for travel to the region. United Airlines and other airlines with large international networks have enjoyed a boost in overseas travel this summer, as more countries reopened their borders and eased travel restrictions. The summer season is usually the most profitable period for airlines, as they generate most of their revenue in the second and third quarters. However, United Airlines said that the rising fuel costs and geopolitical uncertainty will offset some of the gains from the recovery in international travel.

Index prices produced a whippy and volatile Tuesday after gapping lower after the retail sales report came in hotter than expected driving bond yields higher yet finishing the day nearly unchanged. The industrial production also surprised to the upside, growing by 0.3% month-over-month in September, while the forecast was for a 0.1% drop. However, the market was also affected by the weak housing market index, which fell to 40 in October, the lowest level since January. The index showed that the higher interest rates have hurt the demand for housing, and the 2-year bond surging back above 5% yesterday added more pressure. Today, investors face a big day in earnings events as the 4th quarter season heats up with NFLX, and TSLA numbers pending. We also have Mortgage Apps, Housing Starts, Petroleum Status, and several Fed speakers throughout the day. With renewed concerns in the Middle East this morning oil prices are surging adding inflation worries to the mix of uncertainties the market faces.

Trade Wisely,

Doug

Weirdly Bullish Day

With no major economic news to influence the DIA enjoyed a weirdly bullish day as market breadth declined. The SPY and QQQ recovered much of Friday’s selloff while continuing to struggle with overhead resistance as those pesky bond yields moved higher. Today bulls and bears will have plenty of data to find inspiration with Retail Sales and industrial Production numbers, with several potential market-moving earnings that include BAC and GS. Be prepared for volatile prices with consensus estimates suggesting a decline in the retail figures.

Overnight Asian markets enjoyed a strong bullish session as China and Australia broke a three-day losing streak. However, European markets trade mixed and mostly lower this morning taking a cautious approach to earnings and economic data with Middle East tensions keeping investors on edge. U.S. futures indicate a slightly bearish open ahead of busy morning earnings and economic numbers that may provide clues to the strength of the consumer.

Economic Calendar

Earnings Calendar