PNC Crushes, GS Beats, and Empire State Ahead

Friday was another flat and indecisive day in the market. Spy gapped up 0.32%, DIA opened 0.07% higher, and QQQ gapped up 0.26%. At that point, DIA diverged from the other two major index ETFs. DIA sold off the first 90 minutes and then followed the SPY and QQQ, which traded sideways in a tight range. Both QQQ and SPY spent the day bouncing around in the lower end of the opening gap. This action gave us black-bodied Spinning Top candles in all three index ETFs with the DIA having the largest body. DIA retested its T-line (8ema) closing just pennies below it. This all happened on below-average volume in the QQQ and SPY. For its part, DIA had just shy of average volume.

On the day, eight of the 10 sectors were in the green with Energy (+1.09%) out in front leading the way higher on the Yemeni strife. At the same time, Consumer Cyclical (-0.93%) was by far the biggest loser on the board. At the same time, the SPY gained 0.07%, DIA lost 0.33%, and QQQ gained 0.05%. Meanwhile, VXX gained 1.64% to close at 14.84 and T2122 rose but remained firmly in the center of its mid-range at 52.59. 10-year bond yields fell 3.939% and Oil (WTI) gained 1.03% to close at $72.76 per barrel.

The economic news on Friday, December Core PPI came in dead flat and lower than was expected at 0.0% (compared to a forecast of +0.2% and in line with November’s 0.0% value). At the same time, December PPI also came in lower than anticipated at -0.1% (versus a forecast of +0.1% and in line with the November -0.1% reading).

In stock news, before the open Friday, C announced it was cutting 20k jobs over the next two years as part of its massive restructuring effort. At the same time, CNC completed the sale of its Circle Health Group to private firm Pure Health. Later, STLA announced Friday that due to the recent attacks on ships in the Red Sea, the company will temporarily prioritize airfreight to address supply disruptions (at a much higher cost, obviously). At the same time, DAL announced it is shifting toward EADSY (Airbus) A350-1000 aircraft instead of BA jets (which it has used for decades). This included the order for 40 of the A350-1000 planes with the first half to be delivered in 2026. Later, UNP said it expects continued delays in shipments in midwestern states due to heavy snow, severe thunderstorms, and road closures which impact its ability to move crews to trains. Elsewhere, TSCO and TGT were among the retailers saying Friday that they expect product outages of up to 20 days due to the Red Sea attacks, which are causing ships to be rerouted around the horn of Africa. At the same time, WFC, C, and JPM all said they expect industry Net Interest Income (spread between borrowing and lending costs) peaked in Q4 2023. (This is in line with their expectation that rates will fall in 2024.) Later, SUM finalized its $3.2 billion merger with Argos North America. Meanwhile, MSFT edged out AAPL as the company with the largest market cap in the world. (MSFT was at $2.887 trillion as AAPL was “only” $2.875 trillion.) This is the first time since 2021 that AAPL was not the largest capitalized company in the world.

In stock government, legal, and regulatory news, a bipartisan group of 15 US Senators urged the SEC to closely scrutinize the bid of JBSAY to list on the NYSE. The group echoed the concerns of British Parliamentarians from earlier in the week. However, the group’s public letter to the SEC failed to directly call on the SEC to deny the listing, but the letter clearly implied that was their wish. At the same time, the FDA classified the recall of RMD respiratory masks as extremely serious since the use of those products could lead to major injuries or death. (It seems the devices cause magnetic interference with other medical devices and implants.) Later, a US Appeals Court upheld two earlier decisions by a patent tribunal reaffirming the ruling that AAPL stole the intellectual property of MASI related to medial sensor technologies that AAPL then put into their watches. Elsewhere, the FAA said Friday that the agency is planning to perform “closer monitoring” of BA 737 MAX 9 jets when they do reenter service. The agency chief told Reuters it was “pretty clear” the mid-air blowout was a manufacturing problem and not a design defect. As such, BA deserves more scrutiny, including an increase in production line and supplier inspections, which have not been standard in the past. At the same time, MS agreed to pay $249.5 million to the US Dept. of Justice and SEC to end criminal and civil investigations into the company’s handling of large block trades for its customers. Later, the US Supreme Court agreed to hear a challenge by SBUX to lower court decisions that required the company to rehire seven employees it was found to have fired due to their support of unionization. In the afternoon, the FDA announced a major recall by PEP of many Quaker Oats products over the risk of salmonella contamination. At the same time, WH told Reuters it had received a second request for information from the FTC related to a $7.8 billion hostile takeover bid from CHH.

Overnight, Asian markets leaned heavily to the red side. Hong Kong (-2.16%) was way out in front leading Taiwan (-1.14%), and South Korea (-1.12%) as well as the rest of the region lower. Only Shenzhen (+0.31%) and Shanghai (+0.27%) were in the green in that region. In Europe, we see a similar picture taking shape at midday. Only Oslo (+0.22%) is in the green while the CAC (-0.34%), DAX (-0.39%), and FTSE (-0.33%) lead the region lower in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a lower open to start the day. The DIA implies a -0.34% open, the SPY is implying a -0.40% open, and the QQQ implies a -0.46% open at this hour. At the same time, 10-year bond yields have moved back above four percent to 4.014% and Oil (WTI) is up a half of a percent to $73.08 per barrel in early trading.

The major economic news scheduled for Tuesday is limited to NY Fed Empire State Mfg. Index (8:30 a.m.) and Fed Governor Waller speaks (11 a.m.). The major earnings reports scheduled for before the open are limited to GS, MS, and PNC. Then, after the close, IBKR reports.

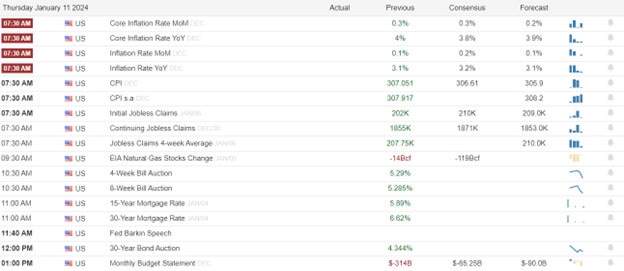

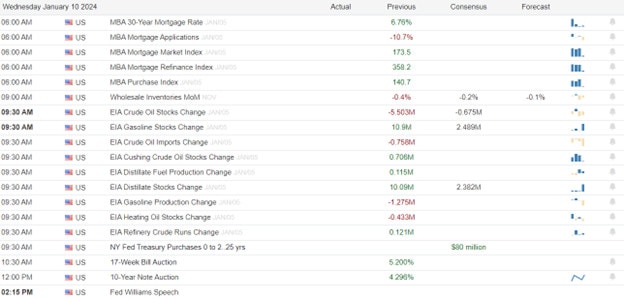

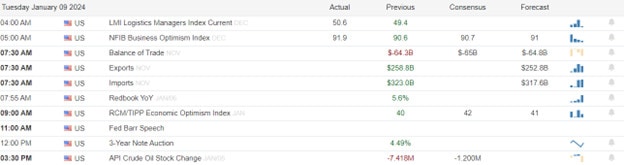

In economic news later this week, on Wednesday we get Dec. Core Retail Sales, Dec. Retail Sales, Dec Imports, Dec. Exports, Dec. Industrial Production, Nov. Business Inventories, Nov. Retail Inventories, Fed Beige Book, API Weekly Crude Oil Stocks, and Fed member Williams speaks. Then Thursday, Dec. Building Permits, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Dec. Housing Starts, Philly Fed Mfg. Index, EIA Weekly Crude Oil Inventories, and Fed Balance Sheet are reported as well as Fed member Bostic speaks. Finally, on Friday, we get Dec. Existing Home Sales, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-Year Inflation Expectations, and Michigan 5-Year Inflation Expectations as well as Fed member Daly speaking.

In terms of earnings reports later this week, on Wednesday, SCHW, CFG, PLD, USB, AA, DFS, FUL, KMI, SNV, and WTFC reports. Then Thursday, we hear from FAST, FHN, KEY, MTB, NTRS, TSM, TFC, JBHT, and PPG. Finally, on Friday, ALLY, CMA, FITB, HBAN, RF, SLB, STT, and TRV report.

In miscellaneous news, on Friday, the Biden Administration put out another bid for 3 million additional barrels of oil to continue refilling the US Strategic Petroleum Reserve. Elsewhere, if you’ve ever doubted whether the saying “it’s not the news, it’s how the market reacts to the news” than Friday was a day for you. JPM reported a record $49.6 billion in profit for 2023 on Friday, a 32% increase over 2022. This caused more than a 2% gap higher and JPM stock was up more than 3.5% in the first five minutes of the day. This was a bear trap as hard selling started at 9:35 a.m. and lasted all the way into the close. On the day, JPM sold off more than 4.12% from the high and ended the day down 0.73% compared to Thursday’s close. For its part, WFC profits rose 9% for Q4, but the market did not like that its costs rose although less than the revenue. WFC was punished with a 2.38% gap lower and ended the day down 3.34%. Part of this big bank angst was due to the forecast by big banks that they truly believe rate cuts are real and will start “soon” cutting into their interest income.

In geopolitical weekend news, Taiwan thumbed its nose at Beijing by electing the “status quo” candidate, which was not Xi’s preferred contender because he is not pro-reunification, William Lai. Almost immediately, President Biden moved to calm the situation by announcing that the US does not support Taiwanese independence and that US policy is still “one China, two systems.” However, the Chinese still did not like the fact that a lesser official, US Sec. of State Blinken, congratulated Lai on his election victory. Meanwhile, in the Red Sea, Saturday the Houthi rebels fired on a US destroyer with rockets and drones. All drones were shot down and no damage was reported. Then on Sunday, the Pentagon reported two Navy Seals had been lost overboard during a ship boarding operation in rough seas off the coast of Yemen. (That seems quite odd given the timing and other happenings in that area, but it was the story disseminated.) At the same time, the US led a second wave of air attacks on the Houthi rebels. In retaliation, on Monday the Houthi hit a US-owned container ship (which was stupid enough to ignore the events in that shipping lane during the last month as well as the US Navy’s explicit warning to all ships to avoid the area for at least three days). No major damage was reported, but a fire was caused in one hold.

So far this morning, GS and PNC reported beats on both the revenue and earnings lines. (PNC destroyed market expectations by reporting $3.16/share in earnings against the consensus forecast of $2.14/share on only modestly higher than expected revenue.) At the same time, MS beat on revenue while missing on earnings. GS cited better-than-expected “asset management profits” during its report.

With that background, markets look to be recovering a bit from a gap lower to start the premarket. All three major index ETFs are showing significant white-bodied candles at this point in the early session. SPY and QQQ both crossed back above their T-line (8ema) and DIA is close to retesting the level that all three gapped below early this morning. So, the Bulls remain in control of the short-term trend in at least the QQQ and SPY (market leaders) although the news out of Yemen had traders very nervous at the beginning of the premarket. In the longer term, we are near all-time highs (potential resistance) in the SPY, QQQ, and DIA. In terms of extension, none of the three major index ETFs are far from their T-line (8ema). At the same time, the T2122 indicator is now sitting in the middle of its mid-range. So, both the Bulls and Bears do have room to run if they can gather the momentum to do it. Continue to keep an eye on the Tech Big Dogs. If they make a move as a group, it is almost impossible for the rest of the market to do anything but follow given their trading volumes.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service