META Spooks Market and Mixed Earnings

Markets diverged at the open Wednesday. SPY opened 0.18% higher, DIA opened down just 0.04%, and QQQ gapped up 0.71%. However, at that point all three major index ETFs sold off modestly with DIA reaching its low of day at 11:50 a.m., QQQ reaching that low level by 12:35 p.m., and SPY doing so at 12:50 p.m. From there, the SPY and QQQ meandered back-and-forth between the open and lows the rest of the day. DIA did something similar, but rallied to a new high of the day at 2 p.m. This action gave us black-bodied, indecisive, Spinning Top candles in all three major index ETFs. QQQ crossed above its T-line (8ema), so all three closed above their T-lines after a retest from above during the day. This all happened on below-average volume in all three, with well-below-average volume on the SPY.

On the day, six of the 10 sectors were in the red with Industrials (-0.72%) out in front leading markets lower. At the same time, Consumer Defensive (+0.49%) and Utilities (+0.42%) held up better than the other sectors. Meanwhile, SPY lost 0.04%, DIA lost 0.15%, and QQQ gained 0.34%. VXX fell another 1.02% to close at 13.57 and T2122 climbed again dropped back to the center of its mid-range at 51.16. 10-year bond yields rose to 4.646% and Oil (WTI) was down 0.56% to close at $82.89 per barrel. So, Wednesday was an indecisive day. It could be seen as rest after a couple decent days of gained or maybe as the relief rally petering out. bullish day with DIA breaking up out of its consolidation while SPY and DIA turned higher. However, the downtrend has only been broken in the DIA with the two broader index ETFs still below that falling line. None of the three has put in a higher low yet. So, for now this must be considered a relief rally at the moment.

The major economic news scheduled for Wednesday included March Core Durable Goods Orders came in lower than expected at +0.2% month-on-month (compared to a forecast of +0.3% but still up from February’s +0.1%). At the same time, March Durable Goods Orders were stronger than predicted at +2.6% month-on-month (versus a +2.5% forecast and well above the February +0.7% value). Later, Weekly EIA Crude Oil Inventories were far lower than anticipated, drawing down 6.368 million barrels (compared to a +1.600 million forecast and well down from the prior week’s +2.735 million barrels).

After the close, ALGN, NLY, AR, ASGN, CACI, CCS, CLS, CMG, CHDN, CYH, EHC, F, ICLR, KALU, LRCX, LSTR, MTH, MEOH, META, MOH, ORLY, PLXS, ROL, SLM, SEIC, NOW, STC, TER, TX, TYL, URI, UHS, WCN, WU, and WHR all reported beats on both the revenue and earnings lines. Meanwhile, AGI, BMRN, CHX, DBOEY, IBM, SNBR, and WM missed on revenue while beating on earnings. On the other side, CHE, CP, NBR, and RJF all beat on revenue while missing on earnings. Unfortunately, GGG, FAF, KNX, and OII missed on both the top and bottom lines.

In stock news, on NVDA announced it had agreed on a deal to acquire Run:ai a cloud workload management software provider. (Finances were not released, but reports said the deal was around $700 million.) At the same time, HUM withdrew its forward guidance, citing disappointing Medicare reimbursement rates (but not mentioning its hack that shut down operations at it CHNG unit). Later, BAC shareholders rejected a proposal to split the CEO and Chairman roles. At the same time, LUV flight attendants ratified their new union contract, with 81% voting to approve. The contract gives them an immediate 22% raise and 3% annual raises until May 2028. Later, the Wall Street Journal reported that WHR will cut 1,000 jobs globally (out of 59,000 employed). No timetable was provided. At the same time, Reuters reported that BX is buying the” Tropical Smoothie Café” restaurant chain in a deal that sources say will be for about $2 billion. Tropical Smoothie currently has 1,400 cafes. Later, SPWR announced it was cutting 1,000 jobs in coming weeks, mostly from its direct sales channel, as part of a restructuring. After the close, Bloomberg reported that BHP is considering a buyout bid for AAUKF. (AAUKF has a $36.71 billion market cap.) Also after the close, F disclosed that is lost $1.3 billion on its electric vehicles, which is $132,000 for each of the 10,000 electric vehicles it sold in Q1. (That 10,000 was down 20% from the number it sold in Q1 2023.)

In stock legal and governmental news, on Wednesday, the US Dept. of Transportation announced finalized rules requiring upfront disclosure of airline fees and immediate refunds for canceled flights, delayed (more than 12 hours) baggage delivery, and inoperative services. Later, the US Dept. of Justice announced it will decide in May whether BA violated the agreement (consent decree) the company made to avoid prosecution over the 2018 and 2019 737 MAX crashes. This came as family members of the crash victim families met with DOJ officials Wednesday to urge prosecution after the FAA and DOT investigations into the mid-air loss of a door plug revealed broad and deep quality issues at BA stemming back to the time of that agreement. At the same time, Bloomberg reported that the FDIC is in talks with buyers to sell FRBK which was seized in 2023. Later, the USAF chose two unlisted finalists (General Atomics and Anduril) to compete for its unmanned combat aircraft design, production, and testing. (This means that BA, LMT, and NOC were eliminated and if they wish to push toward somehow overturning the decision, they would have to foot their own bills for all efforts past today on the project.) A final choice and production decision is scheduled for 2026. At the same time, a US appeals court revived a lawsuit against Whole Foods (AMZN) which alleges the company illegally fired an employee for refusing to remove her “Black Lives Matter” facemask during covid restrictions. The suit alleges she was fired over racism. The court ruled 3-0 that the company had “arguably deviated” from its internal disciplinary process in firing the worker. After the close, a TSLA shareholder who successfully sued to have CEO Musk’s $56 billion pay package thrown out filed a motion with the Delaware court who made that ruling, asking that the court prevent TSLA from dodging the ruling by moving its headquarters to TX.

Overnight, Asian markets were evenly mixed but leaned to the downside on strength of moves. Japan (-2.16%), South Korea (-1.76%), and Taiwan (-1.36%) led the region lower. In Europe, markets are more firmly red at midday with only four of 15 bourses showing gains at the half-way point. The CAC (-0.93%), DAX (-0.75%), and FTSE (+0.62%) lead the region on volume, as always, in early afternoon trade. Meanwhile, in the US, as of 7:30 a.m., Futures are pointing toward a gap down to start the day. DIA implies a -0.58% open, the SPY is implying a -0.68% open, and QQQ implies a -1.04% open at this hour. At the same time, 10-year bond yields are at 4.65% and Oil (WTI) is just on the green side of flat at $82.92 per barrel in early trading.

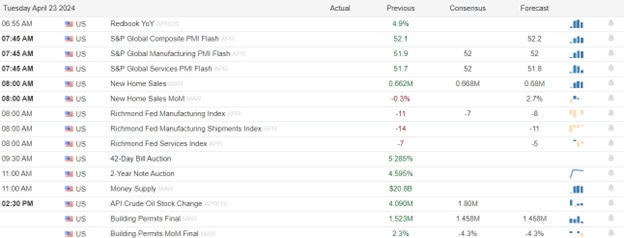

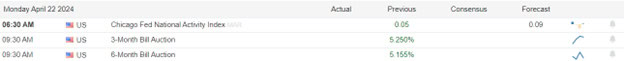

The major economic news scheduled for Thursday include Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q1 GDP, Q1 GDP Price Index, March Goods Trade Balance, and March Retail Inventories (all at 8:30 a.m.), March Pending Home Sales (10 a.m.), and the Fed Balance Sheet (4:30 p.m.). The major earnings reports scheduled for before the open include AOS, ADT, ALFVY, ALLE, MO, AAL, HOUS, AIT, ARCH, AMBP, ABG, AZN, BFH, BMY, BC, CARR, CAT, CBZ, CX, CHKP, CMS, CMCSA, CFR, DAR, DOV, DOW, DTE, EQNR, FCNCA, FCFS, FCN, GTX, GEV, HOG, HP, HTZ, HES, HON, IP, KDP, KEX, LH, LAZ, LECO, HZO, MRK, NDAQ, NEM, NOC, ORI, OSK, PCG, PHIN, POOL, RS, RCL, SPGI, SNY, SAH, LUV, SRCL, STM, FTI, TECK, TXT, TSCO, TRU, TPH, UNP, VLO, VC, GWW, WST, WEX, WTW, and XEL. Then, after the close, AEM, AB, ALSN, GOOGL, ATR, AJG, TEAM, AVB, BYD, COF, CSL, CINF, COLM, DXCM, EMN, EW, EGO, ERIE, FE, GILD, GOOG, TV, HIG, HUBG, INTC, JNPR, KLAC, LHX, MSFT, MTX, MHK, NOV, DOC, PFG, RMD, RHI, ROKU, SKX, SKYW, SNAP, SSNC, TMUS, TDOC, TS, TEX, TFII, TBBB, TPC, WDC, WY, and WKC report.

In economic news later this week, Friday, March Core PCE Price Index, March PCE Price Index, March Personal Spending, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-Year Inflation Expectations, and Michigan 5-Year Inflation Expectations are reported.

In terms of earnings reports later this week, on Friday, ABBV, AON, ALV, AN, AVTR, BALL, CNC, CHTR, CVX, CL, XOM, FMX, GNTX, HCA, IMO, LYB, NWL, PSX, POR, ROP, SAIA, and TROW report.

So far this morning, ADT, MO, AIT, ARCH, AZN, CHLP, CMCSA, DOV, DOW, EQNR, FCNCA, HOG, HON, KDP, KEX, LH, LAZ, MRK, NEM, NOC, ORI, OSK, RNECY, RCL, SPGI, SNY, SWDBY, FTI, TRU, TPH, and WST all reported beats on both the revenue and earnings lines. Meanwhile, AOS, ALLE, AMBP, CARR, CAT, CMS, DAR, FCFS, GTX, PCG, SAH, SRCL, VLO, and XEL all missed on the revenue line while beating on earnings. On the other side, ASX, BFH, BMY, IP, NDAQ, VLY, and WEX beat on revenue while missing on earnings. Unfortunately, AAL, ABG, BC, CBZ, DTE, HZO, POOL, RS, LUV, STM, TECK, TXT, and VC all missed on both the top and bottom lines. Notable was BMY, which better have a good story to tell since they had higher than expected revenue but still missed earnings estimates by $6 per share. It is also with nothing that AIT, RS, RCL, WST, and WEX all raised their guidance. However, HZO lowered forward guidance.

In miscellaneous news, on Thursday, the CEO of DJT (former Congressman Nunes) complained publicly, urging his former House GOP friends to launch an investigation of short-sellers as “market manipulators.” While the House has no regulatory power, I suppose it could pass a law banning short sales. As usual, the threat of being attacked by MAGA types and the hassle of being subpoenaed and testifying is meant to bully short-sellers into not shorting DJT stock in particular. (We all know some people feel they need to be treated by different rules.) However, large short-sellers like Citadel called those demands “losers trying to blame someone else for their falling stock price.” Elsewhere, CT lawmakers advanced the state’s first-in-the-nation “paid sick leave” law. The 2011 law was revised to overcome legal challenges and it will require employers (down to a single-employee in size) to provide paid sick leave (one hour for every 30 hours worked) by 2027. While the passage was not technically party line, it was close to being so, with Democrats supporting the law. Meanwhile, GOP members in both CT houses decried the law as an unfounded mandate on business that will be abused by employees who will “take a day off to go to the beach.” Finally, the US Chamber of Commerce (and other business groups) sued the FTC over the rules passed Tuesday which ban most types of non-compete clauses in employment contracts. As expected, the suit was filed in the Eastern district of TX, where all the Federal judges are extremely conservative.

With that background, it looks as if the bears have control of the market early as all three major index ETFs gapped lower to start the premarket. However, they have reacted a bit differently since then. DIA is giving us a decent sized black candle since that gap-down premarket open. However, SPY is very flat with no body on its candle and QQQ is giving a modest white body candle after the gap-down start to the early session. SPY and QQQ are back below their T-line (8ema) while DIA is retesting that level as I write. So, the short-term trend is uncertain to bearish. Meanwhile, the mid-term remains bearish but under pressure from Bulls. The longer-term market remains Bullish but trend has been broken and is clearly under pressure. In terms of extension, none of the major index ETFs is too far extended from their T-line and the T2122 indicator is back in the center of its mid-range. So, both sides have plenty of room to run if they can gain the momentum to do so. In terms of those 10 big dog tickers, six of the 10 are in the red with META (-14.63%) leading markets lower on bad forward guidance after an earnings beat. However, it is worth noting that the two biggest dogs, NVDA (+0.78%) and TSLA (+0.31%) are both on the green side and although META has traded more dollar volume in premarket, it will not trade more than those two over the day. With that all said, continue to be careful. We’ve see a lot of those widowmaker reversales lately.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service