Bulls Found A Way Out

RYAM – The Bulls finally found a way out by closing over the May 30 high with a huge bullish surged on big volume. With two days of rest, it may be time to add RYAN to the featured trade idea hot list. RYAN is a basic breakout PBO set up. I will explain more about the RYAM chart in the trading room before the market opens

RYAM – The Bulls finally found a way out by closing over the May 30 high with a huge bullish surged on big volume. With two days of rest, it may be time to add RYAN to the featured trade idea hot list. RYAN is a basic breakout PBO set up. I will explain more about the RYAM chart in the trading room before the market opens

Good Trading – Hit and Run Candlesticks

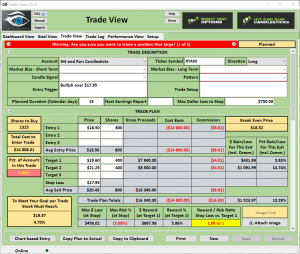

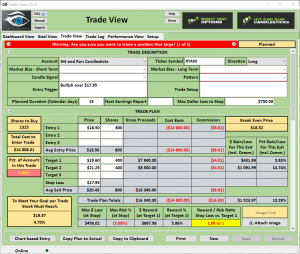

► Members’ Trade Idea Update (AZO)

On August 31 we shared and went over the technical properties of AZO, today the profits would be about 19.54% or $10,345.00, with 100 shares.

If you are interested in learning how to end the week with a profit that could change your life simply start a membership and learn what we have to share. – 30-Day Trial

[button_2 color=”blue” align=”center” href=”https://hitandruncandlesticks.com/hrc-rwo-30-day-offer/” new_window=”Y”]Hit and Run Candlesticks • Right Way Options Trial[/button_2]

► Eyes On The Market

(SPY) The T-Line is higher than the T-Line 20-days ago; the 34-EMA is higher than the 34-EMA 20-days ago, same with the 50-SMA. Price action is above the T-Line and the upper T-Line Band. The simple conclusion here is the trend is intact, and the sellers can’t seem to find a crack.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Back to Work?

With the holiday behind us and the Black Friday shoppers, credit cards still smoldering its time to get back to work. Or is it? Those clever retailers will have much of the online-shoppers testing their credit limits with the so-called Cyber Monday deal. Many folks will be back at work, but you can bet their productivity will be lacking as they chase the next flash sale to hit the internet. Keep in mind that the market will be sensitive to the sales numbers produced today. With many traders likely extending the holiday with vacation time and the millions of Cyber Monday shoppers focused on typing in credit card numbers don’t be surprised to see light volume and choppy price action today.

With the holiday behind us and the Black Friday shoppers, credit cards still smoldering its time to get back to work. Or is it? Those clever retailers will have much of the online-shoppers testing their credit limits with the so-called Cyber Monday deal. Many folks will be back at work, but you can bet their productivity will be lacking as they chase the next flash sale to hit the internet. Keep in mind that the market will be sensitive to the sales numbers produced today. With many traders likely extending the holiday with vacation time and the millions of Cyber Monday shoppers focused on typing in credit card numbers don’t be surprised to see light volume and choppy price action today.

On the Calendar

The Economic Calendar begins the week with a potential market-moving report at 10:00 AM eastern. New Home Sales surged to in September with the largest percentage gain in 28 years and reaching a 10-year high. As a result, the consensus for October new home sales is for a sizable step back to 660K vs. 667K in September. AT 10:30 AM the Dallas Fed MFG. Survey continues to remain strong showing little to no effect from hurricane Harvey. Go Texas! Consensus for November expects a strong print of 24.5. There are several bond auctions today as well as two Fed Speakers this evening at 6:00 and 7:00 PM.

There Earnings Calendar shows just over 30 companies reporting results today. I quickly scanned the list, and I don’t see any big name market-moving reports. However, unknowingly holding a company that’s reporting can certainly move your portfolio. Please make sure to continue checking reporting dates.

Action Plan

As you all know, I went into the Thanksgiving weekend very light in my accounts. Consequently, I will be actively looking for new trades this week. During the evening Futures were headed lower, but around 1 AM they began to rally and currently suggest a modest gap up this morning. On Friday both the SPY and the QQQ’s closed at new record highs while the DIA and IWM choose to consolidate. The QQQ’s have gained market leadership, and as of now, the DIA appears the weakest and not quite able to breakthrough price resistance highs.

On Friday the VIX made a new historic low dipping to 8.56 but quickly seemed to reject that low rallying more than a full point higher. Volume could continue to be light today as may traders likely extended the holiday with some vacation time. With the VIX so low I would also not be surprised to see a bit more volatility. Watch for whipsaws and head fake’s and don’t rule out the possibility of full reversal patterns.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/yv-MoW9TLUc”]Morning Market Prep Video[/button_2]

Bears in a Hurt Locker

The Bulls executed a perfect blitz yesterday, overwhelming the Bears and putting them in a hurt locker. For those of us that stayed with the trend, the rewards were fantastic and a reminder to avoid predicting a top. We had new Record High Closes on all the major indexes as this historic bull run continues. Today after the early morning rush I’m expecting the volume to drop off dramatically for 2-reasons. First, traders will extend the holiday and today will be the big get-away-day. Secondly, we have the FOMC minutes coming out this afternoon, and price action normally gets light and choppy ahead of the release. I won’t totally close the door, but I will say it’s highly unlikely that I will add any new positions today. In fact, I will look for profit taking opportunities to reduce risk ahead of the holiday.

The Bulls executed a perfect blitz yesterday, overwhelming the Bears and putting them in a hurt locker. For those of us that stayed with the trend, the rewards were fantastic and a reminder to avoid predicting a top. We had new Record High Closes on all the major indexes as this historic bull run continues. Today after the early morning rush I’m expecting the volume to drop off dramatically for 2-reasons. First, traders will extend the holiday and today will be the big get-away-day. Secondly, we have the FOMC minutes coming out this afternoon, and price action normally gets light and choppy ahead of the release. I won’t totally close the door, but I will say it’s highly unlikely that I will add any new positions today. In fact, I will look for profit taking opportunities to reduce risk ahead of the holiday.

On the Calendar

The Wednesday Economic Calendar is a busy one with several potential market-moving reports. 8:30 AM Eastern, Durable Good Orders – Consensus expects a 0.4% increase in durable good orders, take out transportation the number rises to 0.5%. The core capital goods are expected to increase by a very healthy 0.5%. Also at 8:30 is the weekly jobless claims that forecasters see rising from 240K to 249K largely due to Puerto Rico hurricane victims. Consumer Sentiment comes out at 10:00 AM and is seen remaining historically high at 98.1. 10:30 AM brings the EIA oil status report which has been showing supply increases as demand declines. Finally at 2:00 PM, the FOMC Minutes, rounds out the day.

We only have just over 30 companies reporting today but keep an eye on DE as it reports before the bell and could easily move the Dow index.

Action Plan

New records for all of the 4-major indexes as the Bulls squeezed early short traders into covering trades. I must admit I was tempted to put on some short trades last week, but after a close look at the charts I stuck to my rules and stayed with the trend. As a result, Right Way Options members took several very nice profits yesterday. As of right now, the Futures are suggesting more bullishness at the open with Dow gaping higher about 30 points. Of course, all the economic news and earnings reports could extend or erode the morning sentiment.

As per the plan, I have taken profits this week thus lowering my risk as we head into the holiday. Honestly, there is not a thing wrong with the charts. The trend is still very much intact but anything is possible, and I want to enjoy the holiday knowing a large portion of my capital is safely tucked in. Of course, I will continue to hold a few positions, and long-term holdings will not change.

Trade Wisely and Happy Thanksgiving!

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/NT8XfG1X4Lo”]Morning Market Prep Video[/button_2]

Members Cover Their Membership Cost

Working to help our subscribing members cover their membership cost – (Keep reading we will get to that) The day before and the day after a holiday most of us have already checked out, Wall Street certainly has, of course, the FED minutes are released today. So on days like today why add more risk? Next week will get be here before you know it. I am sure we can all find something to do to relax or set up your goals for next year.

Working to help our subscribing members cover their membership cost – (Keep reading we will get to that) The day before and the day after a holiday most of us have already checked out, Wall Street certainly has, of course, the FED minutes are released today. So on days like today why add more risk? Next week will get be here before you know it. I am sure we can all find something to do to relax or set up your goals for next year.

What I will be doing today– I have mentioned the last couple weeks that we have a way for our subscribing members to eliminate or at least 85% of your membership fee. LOL…nope, it’s not a secret candle formation we dug up buried for the last 400 years. I will be working on this project today, and we should have it ready for you before Christmass.

Happy Thanksgiving from our family to yours

► Members’ Trade Idea Update (SQ)

It just keeps on going… On August 4 we shared and went over the technical properties of SQ, at yesterdays close the profits would be about 86% or $2230.00, with 100 shares invested.

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/hrc-rwo-30-day-offer/” new_window=”Y”]30-Day Trial • HRC • RWO • Or Both[/button_2]

► Eyes On The Market

SPY broke out yesterday, and so did everything else. The trend in SPY, DIA, IWM, QQQ remain bullish, and the transports (ETF) IYT is trying to make a comeback. It still needs work, but it is trying. Buying charts that are trending and consolidating have been profitable, as you may know.

Happy Thanksgiving

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

RYAM – The Bulls finally found a way out by closing over the May 30 high with a huge bullish surged on big volume. With two days of rest, it may be time to add RYAN to the featured trade idea hot list. RYAN is a basic breakout PBO set up. I will explain more about the RYAM chart in the trading room before the market opens

RYAM – The Bulls finally found a way out by closing over the May 30 high with a huge bullish surged on big volume. With two days of rest, it may be time to add RYAN to the featured trade idea hot list. RYAN is a basic breakout PBO set up. I will explain more about the RYAM chart in the trading room before the market opens