Members E-Learning 11-11-17

Tax Reform

Tax Reform

With the Tax Reform bill looking as if it will pass, markets thumbed their nose at North Korea. Who would have guessed that money trumps a threat of nuclear attack? With all this going one would have expected the VIX the have gone wild. Oddly enough the VIX barely moved the entire day! Futures markets want the party to continue this morning with Dow pointing to a gap up around 70 points. Anyone caught holding short positions yesterday got completely run over by stampeding bulls. A very good reminder that shoring an up-trending market is an unwise business decision. Stay with the trend but avoid the temptation to chase and consider taking profits into strength.

With the Tax Reform bill looking as if it will pass, markets thumbed their nose at North Korea. Who would have guessed that money trumps a threat of nuclear attack? With all this going one would have expected the VIX the have gone wild. Oddly enough the VIX barely moved the entire day! Futures markets want the party to continue this morning with Dow pointing to a gap up around 70 points. Anyone caught holding short positions yesterday got completely run over by stampeding bulls. A very good reminder that shoring an up-trending market is an unwise business decision. Stay with the trend but avoid the temptation to chase and consider taking profits into strength.

On the Calendar

The Economic Calendar starts off with the very important GDP report at 8:30 AM eastern. The 2nd estimate for the 3rd-quarter GDP is expected to come in higher at 3.3 vs. the 3.0 on the first reading. Oddly enough consumer spending is expected have nearly paused, up from 2.4% to only 2.5%. The overall GDP Pirce index is expected to remain unchanged at 2.2%. Janet Yellen speaks at 10:00 AM while the Pending Home Sales Index reports. Consensus expects a sharp rise of 1.0% in October pending home sales. At 10:30 AM is the EIA Petroleum Status report which they don’t estimate forward, but a recent pipeline problem may have decreased stockpiles. There is another Fed speaker at 1:50 PM followed by the Beige Book at 2:00.

On the Earnings Calendar, I see 49 companies reporting results today. TIF is one of the companies reports before the bell while LZB, HOME, JACK, and WDAY are among those reporting after the bell.

Action Plan

All four major indexes ignored the threat of a North Korean nuclear attack setting new record highs across the board. Amazing and just a little spooky is the fact that the VIX barely moved yesterday in response to such a strong rally. Very odd. Even the IWM pitched in yesterday showing nice energy as it reacted higher from price support. Logic would suggest after such a big move the market would take a rest, but currently, futures are pointing to a gap up of nearly 70 points! The surge in bullishness seems to be the direct result of the Tax Reform bill looking as if it will pass.

Thank goodness we stuck to our rules and continued to trade with the trend because we were nicely rewarded yesterday. Continue to trade long but please avoid chasing as this kind of wild bullishness can suddenly find profit takers. Remember the rule, take profits into strength!

Trade Wisley,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/A10SlH1nmhY”]Morning Market Prep Video[/button_2]

Exploded With Price Action

Exploded With Price Action

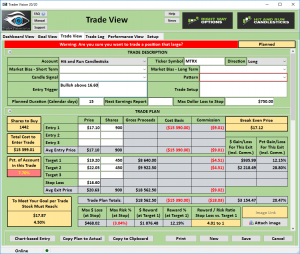

MTRX – Challenged the September 27 high with an inside Pop Out O the Box pattern then exploded with price action. After a few days of consolidation and support, the current price action may now be ready for the next leg. Yesterday’s candle opened even with the previous days close and closed above the previous days open. The T-Lines and the 34-EMA have been trending very well. We love to see the candles stack.

MTRX – Challenged the September 27 high with an inside Pop Out O the Box pattern then exploded with price action. After a few days of consolidation and support, the current price action may now be ready for the next leg. Yesterday’s candle opened even with the previous days close and closed above the previous days open. The T-Lines and the 34-EMA have been trending very well. We love to see the candles stack.

Good Trading – Hit and Run Candlesticks

► Members’ Trade Idea Update (CAKE)

On October 18 we shared and covered in detail the technical properties of CAKE, today the profits would be about 9% or $396.00, with 100 shares. CAKE broke through the Dotted Duece yesterday in a Rounded Bottom Breakout pattern/strategy.

[button_2 color=”light-green” align=”center” href=”https://hitandruncandlesticks.com/hrc-rwo-30-day-offer/” new_window=”Y”]Trading Stocks For Extra Income? Or for A Living? CLICK ME[/button_2]

► Eyes On The Market

(SPY) No stinking missile is gonna mess with this market! The SPY • S&P500 closed at another new high. The SPY broke out from a Pop Out Of the Box patterns as it held above the T-Lines. Every day we have given me opportunities to trade great looking charts, it’s how we manage them that matters. As long as the bull keeps serving up perfectly cooked steaks, we’ll keep eating well.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Learn how and what we trade: The T-Line • T-Line Bands • Support • Resistance • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Fifth Bar At The Support Level

Fifth Bar At The Support Level

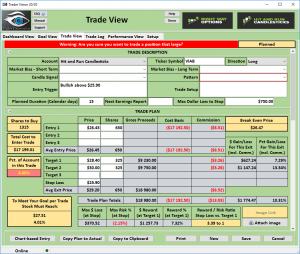

VIAB – Yesterday was the fifth bar at the $25.16 (ish) support level. After strong a run up the consolidation is taking place with a flag forming. This chart pattern is also what we call a [PBO] Pull Back Opportunity. Price rises, and then minor profit takes place when the buyers start to step in this a PBO. Be aware of recent price action, support, and resistance, and profit opportunities.

VIAB – Yesterday was the fifth bar at the $25.16 (ish) support level. After strong a run up the consolidation is taking place with a flag forming. This chart pattern is also what we call a [PBO] Pull Back Opportunity. Price rises, and then minor profit takes place when the buyers start to step in this a PBO. Be aware of recent price action, support, and resistance, and profit opportunities.

30-Days in the Trading Room could be a game changer for you.

Good Trading – Hit and Run Candlesticks

► Members’ Trade Idea Update (ZYNE)

On October 3 we shared and went over the technical properties of ZYNE, today the profits would be about 56% or $492.00, with 100 shares.

Learn how and what we trade: The T-Line • T-Line Bands • Support • Resistance • Buy Box • Volatility Stops • Price

[button_2 color=”blue” align=”center” href=”https://ob124.infusionsoft.com/app/orderForms/Gold-Monthly-Membership-85″ new_window=”Y”]We never stop teaching • Learn at your pace • Cancel anytime[/button_2]

Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops.

► Eyes On The Market

(SPY) The battle between the buyers and sellers was pretty much even yesterday, The candle action of yesterday was the [Doji Indecision thing]. Price above the T-Line and the High T-Line says the sellers did not have enough juice yesterday. As of yesterday below $258.40 would suggest the sellers are mounting an attack on the buyers. IWM felt the seller’s bit yesterday, below $147.90 would give the sellers a little juice.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

The American Consumer

The American Consumer

The American consumer is alive and well according to the sales numbers during the Thanksgiving holiday. Black Friday sales reached new record highs, and now the Cyber Monday sale topped all-time highs coming in a 6.56 billion. The market lacked volume because everyone must have been online looking for deals. As those credit cards begin to cool down the Tax bill in Congress is seriously heating up. Even the President himself is working the Hill trying to secure enough votes to pass this major reform bill. Expect the market to be sensitive to the news on the bill’s progress. Big an very fast price action moves could be possible as the potential votes are won or lost. Let’s hope the Presidents Twitter feed remains quite on the subject! Plan accordingly.

The American consumer is alive and well according to the sales numbers during the Thanksgiving holiday. Black Friday sales reached new record highs, and now the Cyber Monday sale topped all-time highs coming in a 6.56 billion. The market lacked volume because everyone must have been online looking for deals. As those credit cards begin to cool down the Tax bill in Congress is seriously heating up. Even the President himself is working the Hill trying to secure enough votes to pass this major reform bill. Expect the market to be sensitive to the news on the bill’s progress. Big an very fast price action moves could be possible as the potential votes are won or lost. Let’s hope the Presidents Twitter feed remains quite on the subject! Plan accordingly.

On the Calendar

We kick off the day on the Economic Calendar with the 8:30 AM Industrial Production report. October is expected to widen the deficit from 64.8 billion to 64.1 September. There will also be an advanced report used for GDP inputs. At 9:00 AM is the Case-Shiller home prices number which consensus expects a 0.4% increase in September. At 10:00 AM we get the Consumer Confidence Report which last month was at a 17-year high but is expected to pull back slightly to 124.5. We have Fed Speakers at 9:15 and at 10:00 AM as well as several other nonmarket-moving reports.

On the Earnings Calendar, we show 46 companies reporting today with the biggest group coming after the bell. ADSK, MOMO, AABA, and MRVL are some worth noting.

Action Plan

Yesterday the market just seemed to wander around lacking volume an purpose. Pretty much as expected with extended vacations and Cyber Monday shopping. Unfortunately, the lackluster day left behind questionable daily candle patterns hinting of slight bearishness not nearly enough to shift the bullish trend. This morning Futures are pointing to a gap up open on the back of a new record with more than 6.5 billion in Cyber Monday sales. A very good week to be in the shipping business!

I will continue to look for new trade entries, but I will not chase or force trades. Trading for the sake of having something to do is unwise. I get the sense the market is waiting around to see if Congress follows-through on their Combo Tax Bill – Kill Obamacare plan. A failure to pass could move the market sharply lower so expect the market to be very sensitive new reports. Very fast reversals as this congressional battle progress and the Washington spin machine whips up the drama.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/KWM5JP8HuG8″]Morning Market Prep Video[/button_2]