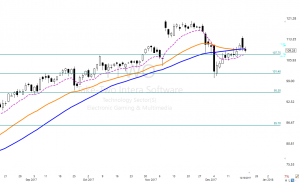

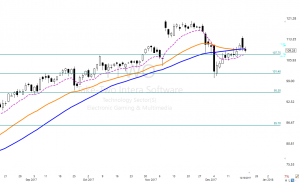

TTWO Blue Ice Failure and Bearish “h” Pattern

TTWO – Because of the Blue Ice Failure and Bearish “h” patterns I have added TTWO to our watchlist for short. Price has been very bullish over the last few months and has now painted a Cradle Top, and now presenting a possible Blue Ice failure with a Bearish “h” Pattern. The full potential of the short can only be reached with bearish follow-through. One plan might be to short below $107.75 with a stop above $113.90

TTWO – Because of the Blue Ice Failure and Bearish “h” patterns I have added TTWO to our watchlist for short. Price has been very bullish over the last few months and has now painted a Cradle Top, and now presenting a possible Blue Ice failure with a Bearish “h” Pattern. The full potential of the short can only be reached with bearish follow-through. One plan might be to short below $107.75 with a stop above $113.90

At 9:10 AM ET. We will talk about the technical properties of TTWO with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

►Recently Closed Trades

TBT 47%

► Eyes On The Market

Although the SPY is still trending above the T-Line and the T-Line is still rising the recent price action in the Candles are looking a little like a scrooge. In the last 2-weeks, we have seen a few signs that the Bah Hum Bug sellers are hanging around. Yesterday’s Candle and recent candle patterns in the SPY, DIA, QQQ, IWM are taking the cheer out of this week. We have made plenty of money, and there is plenty of money to be made. There are times to sit back and watch, and there are times to trade, what time do you think it is?

►Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Short Santa!

Yesterday’s price action left some reason for cautiousness. Three of the four major indexes left behind bearish candle patterns. How dare they Short Santa! The truth is love shorting because of the very quick money made during a panic move. However, for retail traders, we have to be very careful about predicting market tops and jumping to early. Been there, done that and have a lot of battle scars to remind me of the big losses that can occur when trying to predict. Unless you are willing to endure nasty whipsaws and being run over in a short squeeze, don’t short a trending market! If you think the market is failing then stand aside and wait for it to prove. It’s the big boys that will decide a top, not retail traders. Once they make that decision, it will be very obvious, and we will have plenty of time to participate. Try to predict and get eaten by the sharks.

Yesterday’s price action left some reason for cautiousness. Three of the four major indexes left behind bearish candle patterns. How dare they Short Santa! The truth is love shorting because of the very quick money made during a panic move. However, for retail traders, we have to be very careful about predicting market tops and jumping to early. Been there, done that and have a lot of battle scars to remind me of the big losses that can occur when trying to predict. Unless you are willing to endure nasty whipsaws and being run over in a short squeeze, don’t short a trending market! If you think the market is failing then stand aside and wait for it to prove. It’s the big boys that will decide a top, not retail traders. Once they make that decision, it will be very obvious, and we will have plenty of time to participate. Try to predict and get eaten by the sharks.

On the Calendar

The hump day Economic Calendar gets doesn’t get going until 10:00 AM Eastern with Existing Home Sales. Existing sales increased in October 2.1 percent to a 4.870 million rate. Forecasters are expecting, even more, strength. December consensus expects a 5.550 million reading. At 10:30 AM we get the EIA Petroleum Status Report which is not forecast but has shown a trend of rising supplies and concerns about overall demand.

On the Earnings Calendar, we have 20 companies expected to report today. Notable before the bell is GIS and WGO but after the bell keep an eye on BBBY. Don’t get caught by an earnings event. Always check reports against your portfolio!

Action Plan

After a gap up open, the bulls decided to take a siesta and allow the bears to have a little snack. The DIA, SPY, and IWM left behind bearish engulfing candles, and the QQQ joined in to slide south as well. Although caution is warranted, the futures have been signaling all night that a follow through move down will be challenged by the bulls. Perhaps it’s due to the Tax Reform bill passing the Senate or the good earnings reports from FDX and MU. However at this point but the bulls don’t seem ready to give up just yet.

If the futures continue to show strength into the open those who got short early could get trampled under by stampeding bulls. I’m not sure there is enough short interest to trigger a full on short squeeze, but you never know. Equally possible is that the gap up open could be meet with some very hungry bears. Stay on toes and focus on price action clues. Remember Congress will have to act quickly on a budget to prevent the government from running out of money midnight Saturday. The spin doctoring in the new could easily toss the market around so don’t dip into that eggnog just yet. It’s also important to note that with the holiday weekend fast approaching volumes could quickly decline so plan accordingly.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/64zWsaC0wDQ”]Morning Market Prep Video[/button_2]

SYNT Produced a Bullish Belt Hold

SYNT – Last week SYNT produced a Bullish Belt Hold, and the sellers have stepped away. The bulls close SYNT yesterday above the November high, and the chart looks ready to take on the next resistant levels and target zones.

SYNT – Last week SYNT produced a Bullish Belt Hold, and the sellers have stepped away. The bulls close SYNT yesterday above the November high, and the chart looks ready to take on the next resistant levels and target zones.

At 9:10 AM ET. We will talk about the technical properties of SYNT with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

►Subscribing Members login: for the Trader Vision Trade Plan

► Eyes On The Market

The SPY closed above its morning gap with a wick longer than it’s body, this indicates the buyers and seller are in a battle, and the seller was able to push price down from it’s high. If the buyers give up the sellers will create a low below $267.98. Overall the buyers are leading the trend.

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Dow 25,000?

The bulls appear to have limitless energy to drive the market higher. Is Dow 25,000 in the cards? With Congress likely passing the Tax Reform bill today and the VIX indicating No Fear it certainly seems possible. Exciting, yes, but let’s not get too overconfident or complacent. Let’s remember we are still facing a government closure this weekend unless Congress can get their act together and pass a budget. A failure to do so would likely send shock waves through the market so stay focused on price and have a plan if the tide starts to go out. It would also be wise as you plan the rest of the week that volumes may quickly begin to decline as traders take off for Christmas. A trade may look perfect, but without volume, it can’t move and do you want to be holding a lot of open positions over the holiday. Something to ponder as you look ahead and assess the risk.

The bulls appear to have limitless energy to drive the market higher. Is Dow 25,000 in the cards? With Congress likely passing the Tax Reform bill today and the VIX indicating No Fear it certainly seems possible. Exciting, yes, but let’s not get too overconfident or complacent. Let’s remember we are still facing a government closure this weekend unless Congress can get their act together and pass a budget. A failure to do so would likely send shock waves through the market so stay focused on price and have a plan if the tide starts to go out. It would also be wise as you plan the rest of the week that volumes may quickly begin to decline as traders take off for Christmas. A trade may look perfect, but without volume, it can’t move and do you want to be holding a lot of open positions over the holiday. Something to ponder as you look ahead and assess the risk.

On the Calendar

Tuesdays Economic Calendar kicks off at 8:30 AM Eastern with the Housing Starts Report. October saw a sharp acceleration with starts up 13.7% with permits up 7.4%. Forecasters expect November to moderate with starts coming in at 1.240 million annualized vs. 1.290. Permits pullback slightly to 1.270 million annualized vs. 1.316 in October. After that, we have a couple of reports unlikely to move the market, a bond auction, and a Fed speaker at 1:10 PM.

On the Earnings Calendar, we have just over 30 companies reporting today. After the bell, a couple of earnings report to take note of is RHT and MU. Continue to reinforce the good habit of checking earnings dates on the stocks you own or are thinking about buying.

Action Plan

New closing record highs across the board on the major indexes yesterday. If I heard it correctly, the Dow has amassed 85 new records so far this year. What an amazing year! While the markets continue marching higher, the VIX is once again testing historical lows. Fear of a market correction at least for now is not at all on the mind of traders and investors. The Tax Reform bill is likely to pass today, and then Congress has to deal with the pending government closure coming this weekend. We could see some volatility due to the D.C. news cycle as a result so stay on your toes. Complacency is dangerous!

As of now, the futures are pointing to a small gap up open. At the open, the Dow will likely be less than 150 points from a 25000 print. Can the bulls get it done this week? We have some bigger earnings reports after the bell today that could certainly help if they report well. As for me I will continue to trade long positions with the overall trend and will continue to look for new trading opportunities. However, I will also need to keep in mind that volumes could quickly begin to diminish as Christmas draws near. Plan accordingly.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/zmU8rKm7vu4″]Morning Market Prep Video[/button_2]

Big Resistance

Friday’s free trade in PSEC is working out nicely. Those that took the trade should have a nice little profit as it bounces off of support. Today I’m looking a counter-trend trade running into Big Resistance.

Friday’s free trade in PSEC is working out nicely. Those that took the trade should have a nice little profit as it bounces off of support. Today I’m looking a counter-trend trade running into Big Resistance.

T is on a very nice bull run but has run headlong into a big price resistance level. I am not looking for a big selloff, I’m only looking for T to stay below 39 for a short-term pullback in reaction to the resistance. Consider buying the 22 DEC 39 Puts to take advantage of a small swing lower.

Recently Closed Trades

CSCO 17% • BAC 31% • CREE 48% • WMT 245% • NFLX -40% • STX 42% • 2nd CSCO Trade 30%

Today’s Market Prep Note

Yesterday we saw some selling on worries the Tax Reform bill would not get finished up. This morning sentiment quickly changes as news of a vote and passage could happen as early as today. I hate politically driven markets because as retail traders our edge simply disappears into the spinning black hole of the news cycle. Futures are not pointing to a significant gap up that will put a lot of pressure on those that got short early. Let’s keep in mind that a Dow 25,000 print is not that far away so don’t expect the bulls to give up easily. Perhaps the passage of tax reform is all the fodder needed to encourage the bulls to push higher. I think the road ahead could be a bit bumpier than we have seen this week. Plan carefully and remember to take profits.

Become a Member Today!

30 Day Trial Monthly Semi-Annual Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Doug Campbell is not a licensed financial adviser, nor does he offer trade recommendations or advice to anyone except for the trading desk of Right Way Options Inc.

Christmas Gift

With the promise of Tax Reform passing Congress today the futures are wildly bullish. The President, of course, will quickly sign the new bill into law bringing a huge Christmas Gift to the market. After the morning gap up the Dow will be in striking distance of a 25,000 print. I would be surprised it the 25K hats, and t-shirts are ready printed and just waiting under the trading desks. Earnings this week from, FedEx, Micron, RedHat, General Mills, Carmax, ConAgra, Nike, and Cintas could be just enough rocket fuel to propel the market higher. Anyone caught short will experience significant pain this morning and will likely get squeezed out this morning. Expect higher volatility and prepare for quick price action.

With the promise of Tax Reform passing Congress today the futures are wildly bullish. The President, of course, will quickly sign the new bill into law bringing a huge Christmas Gift to the market. After the morning gap up the Dow will be in striking distance of a 25,000 print. I would be surprised it the 25K hats, and t-shirts are ready printed and just waiting under the trading desks. Earnings this week from, FedEx, Micron, RedHat, General Mills, Carmax, ConAgra, Nike, and Cintas could be just enough rocket fuel to propel the market higher. Anyone caught short will experience significant pain this morning and will likely get squeezed out this morning. Expect higher volatility and prepare for quick price action.

On the Calendar

Monday’s Economic Calendar is a light one with only the Housing Market Index report at 10:00 AM Eastern. Home builders have been reporting gains in confidence as new home sales have been rising in recent months. Forecaster sees the December index holding at steady matching the 70 reading in November. After that, all we have is a bill announcement and a couple of bill auctions.

On the Earnings Calendar, we only have 11 companies stepping up to report results today. Most notable today are CCRC and LEN which both report before the bell.

Action Plan

Friday’s market highlight reel would have to focus on the sudden strong move in the tech sector. The QQQ’s reached out to a new record high close and regained market leadership. The SPY and the IWM both had good days but ran into some profit-taking the last hour of trading ahead of the weekend. Trends continue up, and the Bulls remain solidly in control.

With a weekend of wrangling, it seems Congress is finally ready to vote on the Tax Reform bill. According to reports they now have the votes so they can comfortably pass the bill. As a result, Futures are flying high with the Dow futures pointing to more than a 100 point gap up at the open. Big gap up opens at market highs are dangerous to chase due to the possibility of a so-called blow-off top. They are also often subject to violent whipsaws so don’t get caught up in the drama and chase. At the open, the Dow will only be about 200 points from a 25,000 handle. With some big earnings coming out this week, I there is a very real possibility the energy will be there to drive it up to that level before the end of the week. I also think we could see an extra dose of volatility so plan carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/9VTrf9PbSAU”]Morning Market Prep Video[/button_2]

Bottoming Pattern

Yesterday Lottery Ticket was a dismal failure as FIT made a full reversal and then gaped down. How rude. Today I’m looking at a nice bottoming pattern with an nice entry signal with upside potential.

Yesterday Lottery Ticket was a dismal failure as FIT made a full reversal and then gaped down. How rude. Today I’m looking at a nice bottoming pattern with an nice entry signal with upside potential.

PSEC has just recently broken a nasty downtrend and is holding support. The nice candle today suggest buyers are trying to move it higher. As an added bonus the chart is showing a possible Inverted Head and shoulders pattern and a Rounded Bottom Breakout. If your interested take a look at the 19 JAN 6 Calls. A close below the last swing low would be a good reason to exit the trade.

Recently Closed Trades

CSCO 17% • BAC 31% • CREE 48% • WMT 245% • NFLX -40% • STX 42% • 2nd CSCO Trade 30%

Today’s Market Prep Note

Yesterday we saw some selling on worries the Tax Reform bill would not get finished up. This morning sentiment quickly changes as news of a vote and passage could happen as early as today. I hate politically driven markets because as retail traders our edge simply disappears into the spinning black hole of the news cycle. Futures are not pointing to a significant gap up that will put a lot of pressure on those that got short early. Let’s keep in mind that a Dow 25,000 print is not that far away so don’t expect the bulls to give up easily. Perhaps the passage of tax reform is all the fodder needed to encourage the bulls to push higher. I think the road ahead could be a bit bumpier than we have seen this week. Plan carefully and remember to take profits.

Become a Member Today!

30 Day Trial Monthly Semi-Annual Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Doug Campbell is not a licensed financial adviser, nor does he offer trade recommendations or advice to anyone except for the trading desk of Right Way Options Inc.

TTWO – Because of the Blue Ice Failure and Bearish “h” patterns I have added TTWO to our watchlist for short. Price has been very bullish over the last few months and has now painted a Cradle Top, and now presenting a possible Blue Ice failure with a Bearish “h” Pattern. The full potential of the short can only be reached with bearish follow-through. One plan might be to short below $107.75 with a stop above $113.90

TTWO – Because of the Blue Ice Failure and Bearish “h” patterns I have added TTWO to our watchlist for short. Price has been very bullish over the last few months and has now painted a Cradle Top, and now presenting a possible Blue Ice failure with a Bearish “h” Pattern. The full potential of the short can only be reached with bearish follow-through. One plan might be to short below $107.75 with a stop above $113.90