FRTA – Ascending Triangle Breakout

FRTA has been trending and now has broken out of a Bullish Ascending Triangle. After the November 8 Bullish breakout FRTA has produced a rising trend. The past 15 days or so the price action has drawn an Ascending Triangle pattern. FRTA has a great deal of profit potential if you look at the $20.00 profit zone and the profit zones along the way

FRTA has been trending and now has broken out of a Bullish Ascending Triangle. After the November 8 Bullish breakout FRTA has produced a rising trend. The past 15 days or so the price action has drawn an Ascending Triangle pattern. FRTA has a great deal of profit potential if you look at the $20.00 profit zone and the profit zones along the way

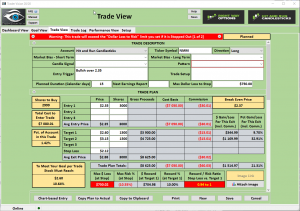

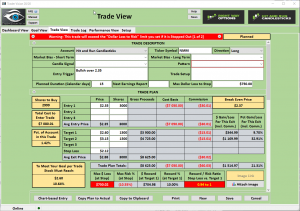

At 9:10 AM ET. We will talk about the technical properties of FRTA with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

► Must Read Trade Update (SGRY)

On December 12, we shared in detail, the chart setup of SGRY in the Trading Room, Yesterday the profits were about 36.92% or $360.00 with 100 shares. Using simple rules and techniques to achieve swing trade profits. A traders lifestyle is worth the work.

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

► Eyes On The Market

Welcome to 2018, what a great day yesterday was. Seems like the market it is playing with a full team! The SPY is still under the control of the T-Line trend (above all 3). Yesterday the SPY closed up $1.01 with a small breakout poised to follow through with a J-Hook continuation pattern.

The DJ-30 closed yesterday with a Doji, bullish chart pattern above the T-Line, come 25K you can do it!

The VXX short-term futures lost all interest yesterday in playing the game!

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Price will lead

2017 was an unbelievable year, but 2018 could be even better. Price will lead the way. I know there a lot of folks out thinking that because the market has run up so much, it necessarily must pullback. That is without a doubt a possibility, but it is also far from a sure thing. Unemployment is at historic lows, and consumer confidence is at historic highs. Manufacturing is growing, and finally, real wages are beginning to increase. The analysis suggests earnings growth may be as good or better this year as the last. Perhaps it would be best not to trade what we think and focus on what we see in the price action. The institutions always have and will always determine the direction of the market. If we can set aside our bias, focus on price and simply follow it rather than trying to predict direction: Then 2018 could indeed exceed our expectations.

2017 was an unbelievable year, but 2018 could be even better. Price will lead the way. I know there a lot of folks out thinking that because the market has run up so much, it necessarily must pullback. That is without a doubt a possibility, but it is also far from a sure thing. Unemployment is at historic lows, and consumer confidence is at historic highs. Manufacturing is growing, and finally, real wages are beginning to increase. The analysis suggests earnings growth may be as good or better this year as the last. Perhaps it would be best not to trade what we think and focus on what we see in the price action. The institutions always have and will always determine the direction of the market. If we can set aside our bias, focus on price and simply follow it rather than trying to predict direction: Then 2018 could indeed exceed our expectations.

On the Calendar

One important report and a slew of bond-related auctions and settlements for this first trading day in 2018. The PMI Manufacturing Index is at 9:45 AM Eastern today. Last month PMI rose 1.2% on increasing orders and employment, but forecasters see the index standing pat at the same 55.0 reading this month.

There are five unconfirmed potential earnings reports today, but they all come after the bell. Remember January begins a new round of earnings so make sure to develop the habit of checking coming reports. The fireworks don’t really begin to ramp up until mid-month, but there is no time like the present to start developing a good habit.

Action Plan

The last trading day of 2017 had a very nice start to the day, but profit takers quickly began to rule the day. The DIA, SPY, and IWM left behind bearish engulfing patterns while the QQQ’s seemed to give up a short-term support. Historically January is a positive month as the bulls find value after a tax selling pullback in December. However, no such pullback occurred this year. Only a choppy consolidation that essentially held the bullish trend. So what happens next? As of right now, I have to recognize the bearish candles left behind on Friday a proceed with caution. At the same time, I want to be careful not to jump to a bearish conclusion by trying to get short. Remember last week was low-volume chop which is not exactly a confidence builder for direction.

Futures are currently pointing to a bullish open but don’t be surprised if today is another low-volume showing as many traders may have extended their holiday vacation time. I plan to move slowly to as far as adding new positions today, but I certainly will rule out the possibility of new trades. Let’s keep in mind that the FOMC minutes are out tomorrow and the Employment Situation number is Friday morning. Both tend to inspire choppy indecisive price action.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/hO4U3nGv1VQ”]Morning Market Prep Video[/button_2]

NMM Bullish Morning Star Presented

NMM – Last Friday NMM presented us with a Bullish Morning Star with multiple signs of support and the Lower T-Line Band. Note how the Star came off the Lower Band and Fridays price action closed over the Upper T-Line Band. The 4 and five days charts fit the (RBB) strategy profile with two profit zones before the Dotted Deuce and two before the 200-period moving average.

NMM – Last Friday NMM presented us with a Bullish Morning Star with multiple signs of support and the Lower T-Line Band. Note how the Star came off the Lower Band and Fridays price action closed over the Upper T-Line Band. The 4 and five days charts fit the (RBB) strategy profile with two profit zones before the Dotted Deuce and two before the 200-period moving average.

At 9:10 AM ET. We will talk about the technical properties of NMM with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

► Must Read Trade Update (CVRR)

On November 8, we shared, and in detail, the technical properties of CVRR in the Trading Room, Friday the profits were about 27.8% or $360.00. Using simple rules and techniques to achieve swing trade profits. A traders lifestyle is worth the work.

► Eyes On The Market

Last weeks price action wasn’t much to brag about although the buyers were able to keep the sellers away for the most part. The Daily price bar closed as a Bearish Engulf, but we did close on support, so the battle begins. If the sellers can close below $266.30, the mid-December low may be in for a test. A push by the buyers with a close over $268.60 and the Bulls are on there way to challenge the $272.00 area

The VXX short-term futures started a dance last week so they need to be watched a little closer than normal. The past 9-day pattern is a bottoming channel with a Bullish engulf. The pattern needs to follow through so we will keep our eye on it.

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

DJ-30 + 160.77 = 25K

Will the DJ-30 it to 25K this year? The chart is a position to make the run. Over the past few days, the price action has been building a J-Hook continuation pattern, at this point the bull team needs to push over the recent high of $24876.07 and the hope for a gust of wind to carry the industrial bird to the altitude of 25K

Will the DJ-30 it to 25K this year? The chart is a position to make the run. Over the past few days, the price action has been building a J-Hook continuation pattern, at this point the bull team needs to push over the recent high of $24876.07 and the hope for a gust of wind to carry the industrial bird to the altitude of 25K

At 9:10 AM ET. We will talk about the technical properties of charts with target zones, logical entries, and protective stops.

► Eyes On The Market

We saw the market a nice lift going into the close yesterday from the SPY, look at the chart, and you can see how price action has been carving out a reversal bottom near the support of the V-Stop and the Lower T-Line Band. Those are two tools that winners use by the way. IWM and the DIA’s saw bullish interest into the close yesterday while the QQQ’s was just plain lazy. I truly wish the best for the DJ-30 finding the perfect landing spot on 25K

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Focus on Improvement

It’s customary as the year winds down to reflect on the past year. While I’m very grateful for the amazing results that 2017 provided, my focus tends to center on the year ahead. I’m not talking about trying to predict the future as so many traders attempt to do. No matter how 2017 turned out for our future has yet to be written. As a result, I tend to focus on improvement as a trader. As the CEO of my trading business, I must always be on the lookout for ways to improve so my business can grow. Most people don’t like change but change we must it achieve better results. Embrace the change and challenge yourself to improve. Today, right this minute, make the decision to step up. Be willing to do whatever it takes to exercise your right to succeed.

It’s customary as the year winds down to reflect on the past year. While I’m very grateful for the amazing results that 2017 provided, my focus tends to center on the year ahead. I’m not talking about trying to predict the future as so many traders attempt to do. No matter how 2017 turned out for our future has yet to be written. As a result, I tend to focus on improvement as a trader. As the CEO of my trading business, I must always be on the lookout for ways to improve so my business can grow. Most people don’t like change but change we must it achieve better results. Embrace the change and challenge yourself to improve. Today, right this minute, make the decision to step up. Be willing to do whatever it takes to exercise your right to succeed.

On the Calendar

The Friday Economic Calendar is devoid of any market moving reports today. There are two note settlements and an oil rig count report but other than that a quiet day.

On the Earnings Calendar, there are only eight companies expected to report as we wind down the trading year.

Action Plan

After the morning flurry of activity, the market as expected slipped into choppy price action. It was surprising to see some bulls wake up in the last 30 minutes of trading to close the DIA, SPY, and IWM higher on the day. The QQQ’s, on the other hand, decided just to rest. Dow futures are pointing to a bullish open that may come close to making a record high print at the open.

Overall the trends continue to remain bullish with no signs of any meaning selling or market fear. Nevertheless, I plan to avoid adding risk just ahead of a long holiday weekend. As a result, my focus is on profit taking and capital protection today. There are a lot of very good looking charts on my shopping list for next year. Expect volume to decline a quickly today as many traders will be headed out for New Years celebrations.

2017 has certainly been an exciting record-breaking year filled with amazing profits for which I am very grateful. I want to wish you all a safe and Happy New Year.

Trade wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/8rFyeMqZo8Q”]Morning Market Prep Video[/button_2]

Never Say Never

As this amazing year winds down, it seems more and more logical that light volume chop is likely to continue. But never say never with the Bulls having such a big target of 25,000 just above. The odds of that occurring are quickly diminishing, but you never want to rule out the power of a big round number. Futures are pointing to a bullish open, but volume is anemic and likely to decline quickly after the morning flurry of activity. If you continue to hold market risk, stay focused on price and guard against complacency. Although it may appear unlikely, this record-breaking year could still have a trick or two up its sleeve.

As this amazing year winds down, it seems more and more logical that light volume chop is likely to continue. But never say never with the Bulls having such a big target of 25,000 just above. The odds of that occurring are quickly diminishing, but you never want to rule out the power of a big round number. Futures are pointing to a bullish open, but volume is anemic and likely to decline quickly after the morning flurry of activity. If you continue to hold market risk, stay focused on price and guard against complacency. Although it may appear unlikely, this record-breaking year could still have a trick or two up its sleeve.

On the Calendar

Thursday’s Economic Calendar gets going at 8:30 AM Eastern with International Trade in Goods & Jobless Claims. The goods deficit is expected to slightly narrow to $67.7 billion in November vs. October’s reading of $68.1. Jobless Claims forecasters see a decline 240K vs. last week 245k print as demand for labor remains very strong. At 11:00 AM is the EIA Petroleum Status Report which if not forecast but the trend has been showing a slight drawdown in supplies helping to bolster the energy sector. After that, there are several reports unlikely to move the market as well as several Bill Announcements.

There are nine companies expected to report today, mostly considered penny stocks and very unlikely to have any market effect.

Action Plan

Although I have been under the weather, I have continued to keep very close tabs on the market. So far this week light volume and choppy price action have reigned supreme. The question is will that continue as trading this year rapidly winds down. Logic would say yes but with Dow 25,000 only 225 points away a bullish push is not out of the question. After all underestimating the Bulls this year would have been a mistake of a lifetime. Having said that I think its still very wise to be very cautious in such light volume market conditions.

Rather than adding risk ahead of another long weekend, I will be more focused on building shopping lists for next year, taking profits and protecting capital.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/92AmxWLWn74″]Morning Market Prep Video[/button_2]

FRTA has been trending and now has broken out of a Bullish Ascending Triangle. After the November 8 Bullish breakout FRTA has produced a rising trend. The past 15 days or so the price action has drawn an Ascending Triangle pattern. FRTA has a great deal of profit potential if you look at the $20.00 profit zone and the profit zones along the way

FRTA has been trending and now has broken out of a Bullish Ascending Triangle. After the November 8 Bullish breakout FRTA has produced a rising trend. The past 15 days or so the price action has drawn an Ascending Triangle pattern. FRTA has a great deal of profit potential if you look at the $20.00 profit zone and the profit zones along the way