T-Line Low Supports Pullback

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.

At 9:10 AM ET. We will demonstrate how IMMU was chosen using our Simple Proven Swing Trade Strategies

Simple Proven Swing Trade Tools

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning

► Learn From The Chart (WTW)

On December 26, we shared, in detail, the technical chart properties of WTW in our members Trading Room and why we thought this chart was ready for a run. Yesterday the profits would have been about 13.50% or $685.00 with 100 shares. Using our simple, proven Swing Trade tools and techniques to achieve swing trade profits.

► Eyes On The Market (Caution Caution Caution)

Six days up is more than this horse can take. The SPY has moved higher the past six days a little faster than it can handle and is now in need of a rest. As I mentioned in last nights e-Learning webinar, the market is primed for a profit taking and the morning futures are pointing this out. The main trend is still up, and as of yet, support has not been broken. I suspect we see the sellers challenge the $271.70 area and then we can get a better idea of what price action is up to.

The VXX short-term futures printed a Bullish Egulf yesterday, and today it will likely test the T-Line Band High. A close over the T-Line Band High would indicate that fear is heating up and that would be a first step in creating a bullish bottom in the VXX chart.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

The Bulls Keep Charging

The bulls keep charging upward trampling any bears that happened to step into their path. I like some everyone else see the indexes as extend and common sense would suggest a rest of pullback should occur soon. It took me a long time learn that when the bulls are this feisty that try to apply common sense left me standing on the sidelines and missing out on an extraordinary bull run. I can only assume that money is pouring into funds and 401K plans because of the fear of missing out. There are now analysis’s which have built a case for Dow 30,000. If you think that can’t happen, just go back and study the late 90’s tech bull run.

The bulls keep charging upward trampling any bears that happened to step into their path. I like some everyone else see the indexes as extend and common sense would suggest a rest of pullback should occur soon. It took me a long time learn that when the bulls are this feisty that try to apply common sense left me standing on the sidelines and missing out on an extraordinary bull run. I can only assume that money is pouring into funds and 401K plans because of the fear of missing out. There are now analysis’s which have built a case for Dow 30,000. If you think that can’t happen, just go back and study the late 90’s tech bull run.

Please understand that I am not predicting that will occur I’m only pointing out it has in the past, and the possibility exists. Common Sense may not apply. Stay with the trend but guard against complacency by having a plan to protect profits and capital if the bears return. Remember reversals can be swift and brutal but a prepared trader and avoid the pitfalls of emotional trading.

On the Calendar

Tuesday’s Economic Calendar begins with a Fed Speaker at 10:00 AM followed directly by the Jolts report. Consensus for November on job openings is expected to grow to 6.038 million. With the country at seen at full employment, supports the concern that the lack of qualified workers is now limiting company growth. After that, we only have a couple of bond auctions to close the economic calendar day.

On the Earnings Calendar, we have 13 companies reporting results. Notable before the bell is AZZ and SCHN and after the close is WDFC and SNX.

Action Plan

After a slightly weak beginning to the trading day, the bulls once again showed their tenacity by pushing higher. The DIA closed down a whopping 0.05% while the SPY, QQQ, and IWM pushed upward to set new record closing highs. Go Bulls! Currently, the Dow futures are pointing to a slightly higher open this morning. Oil futures are also pushing higher this morning as winter demand continues to grow with the persistent cold temperatures around the country continue.

I fell like I’m beginning to sound like a broken record, but the bulls are still in control so I will say with the trend. However, with the market looking as if its extended at least in the short-term we should closely monitor price action and have a plan ready if profit-taking begins. The bears haven’t eaten in a very long time so given a chance expect them to bite at any time.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/Kf6QAxsTQzo”]Morning Market Prep Video[/button_2]

Rounded Bottom Breakout POOTB Strategy

FTK has been in a downtrend that seems to have hit bottom on November 8, 2017. A Bullish piercing candle started the bullish price action that has lead to constructing a Bullish Bottom. Price broke out above the 50-SMA creating an RBB strategy, and the recent price action is now creating a Pop Out of The Box strategy as well. To learn more about the “RBB” and the “POOTB” visit us in the trading room.

FTK has been in a downtrend that seems to have hit bottom on November 8, 2017. A Bullish piercing candle started the bullish price action that has lead to constructing a Bullish Bottom. Price broke out above the 50-SMA creating an RBB strategy, and the recent price action is now creating a Pop Out of The Box strategy as well. To learn more about the “RBB” and the “POOTB” visit us in the trading room.

At 9:10 AM ET. We will demonstrate how FTK was chosen using our Simple Proven Swing Trade Strategies

►Simple Proven Swing Trade Tools

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

► Learn From The Chart (ALDR)

On December 26, we shared, in detail, the technical chart properties of ALDR in our members Trading Room and why we thought this chart was ready for a run. Yesterday the profits would have been about 30.47% or $350.00 with 100 shares. Using our simple, proven Swing Trade tools and techniques to achieve swing trade profits.

► Eyes On The Market

The S&-500 closed at another new high yesterday candlesticks stacking higher and higher. I was asked yesterday if the market is getting oversold? I replied “yes,” and I think all investors think the same thing. One person said oversold to what? True oversold compared to what? Then I said maybe the best way to look at this market is to follow the trend, the trend is not predictive it is what it is, and when the price falls out of the trend, you will know. Oversold/overbought indicators promo is guessing and predictions. Price action in or out of the trend is crystal clear.

The VXX short-term futures follow the trend, not much to talk about until price action can close above the “Lower T-Line Band”

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

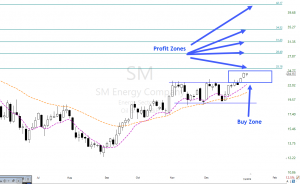

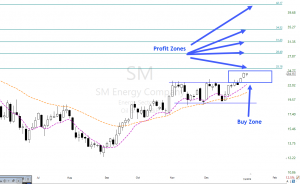

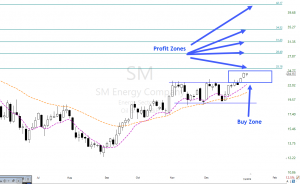

Weekly Doji Continuation Pattern

The weekly Doji continuation pattern on SM has recently broken out of a bullish rectangle pattern – On the daily chart, The T-Line is rising after a breakout of resistance with price resting with two dojis and support. The breakout pattern suggests the buyers think has not reached its potential. A major profit zone that you might consider is the $42.00 area with several mini profit zones on the way.

The weekly Doji continuation pattern on SM has recently broken out of a bullish rectangle pattern – On the daily chart, The T-Line is rising after a breakout of resistance with price resting with two dojis and support. The breakout pattern suggests the buyers think has not reached its potential. A major profit zone that you might consider is the $42.00 area with several mini profit zones on the way.

At 9:10 AM ET. We will talk about the technical properties of SM with target zones, a couple of logical entries and a protective stop.

► Must Read Trade Update (OSTK)

On January, we shared, in detail, the technical chart properties of OSTK in the Trading Room and why we thought this chart was ready for a run. Friday the profits would have been about 17.90% or $1280.00. Using our simple tools and techniques to achieve swing trade profits.

► Simple Proven Swing Trade Tools

T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

[button_2 color=”green” align=”center” href=”https://hitandruncandlesticks.com/private-personal-coaching-right-from-the-pros/” new_window=”Y”]A Trading Coach Can Lift The Fog[/button_2]

► Eyes On The Market

Friday marked another four days positive run for the S&P-500, and it’s ETF the SPY. This 4-day run may need a little rest and pullback. Price has moved pretty far from the T-Line, and it has been my experience that when this happens price stalls out to allow the T-Line to catch up. Resting pullback can be very shallow or even test the previous day’s support. Below $272.95, we could see $272.60 and below $272.60 and below $272.60 we could see $271.80, so on, so on, so on.

The VXX short-term futures may be trying to get off the ground, above $26.90 and we may have to take the VXX a little serious.

Rick’s Swing Trade ideas –

Symbols from TC2000

CME

NVDA

DO

FOSL

AGN

TECK

RIG

BURL

NOG

HIBB

CHRS

ATRS

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Weekly Doji Continuation Pattern

The weekly Doji continuation pattern on SM has recently broken out of a bullish rectangle pattern – On the daily chart, The T-Line is rising after a breakout of resistance with price resting with two dojis and support. The breakout pattern suggests the buyers think has not reached its potential. A major profit zone that you might consider is the $42.00 area with several mini profit zones on the way.

The weekly Doji continuation pattern on SM has recently broken out of a bullish rectangle pattern – On the daily chart, The T-Line is rising after a breakout of resistance with price resting with two dojis and support. The breakout pattern suggests the buyers think has not reached its potential. A major profit zone that you might consider is the $42.00 area with several mini profit zones on the way.

At 9:10 AM ET. We will talk about the technical properties of SM with target zones, a couple of logical entries and a protective stop.

► Must Read Trade Update (OSTK)

On January, we shared, in detail, the technical chart properties of OSTK in the Trading Room and why we thought this chart was ready for a run. Friday the profits would have been about 17.90% or $1280.00. Using our simple tools and techniques to achieve swing trade profits.

► Simple Proven Swing Trade Tools

T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

[button_2 color=”green” align=”center” href=”https://ob124.infusionsoft.com/app/orderForms/Membership—Hit-and-Run-Candlesticks—Quarterly” new_window=”Y”]HRC 3-Month Membership • Cancel Anytime.[/button_2]

► Eyes On The Market

Friday marked another four days positive run for the S&P-500, and it’s ETF the SPY. This 4-day run may need a little rest and pullback. Price has moved pretty far from the T-Line, and it has been my experience that when this happens price stalls out to allow the T-Line to catch up. Resting pullback can be very shallow or even test the previous day’s support. Below $272.95, we could see $272.60 and below $272.60 and below $272.60 we could see $271.80, so on, so on, so on.

The VXX short-term futures may be trying to get off the ground, above $26.90 and we may have to take the VXX a little serious.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Feed the Beast?

Last week the bulls ran like their tails were on fire and their hind ends were catching. I saw a headline where Cramer said the market is in “Beast Mode.” Okay, but I think the real question on the mind of most traders, is should they continue to feed the beast? There is no question that the market seems extended and any reasonable thinking trader suspects a pullback could start at any time. However, price action currently has no hint of stopping just yet. We all know that predicting is unproductive as it could put you on the wrong side of the market or have you missing out on the best bull run of the year. My suggestion is to say with the trend taking profits along the way and focus on price action for clues of a change. Take only low-risk entries when adding risk and avoid chasing of any kind. The trend is our friend, stay with it until it ends.

Last week the bulls ran like their tails were on fire and their hind ends were catching. I saw a headline where Cramer said the market is in “Beast Mode.” Okay, but I think the real question on the mind of most traders, is should they continue to feed the beast? There is no question that the market seems extended and any reasonable thinking trader suspects a pullback could start at any time. However, price action currently has no hint of stopping just yet. We all know that predicting is unproductive as it could put you on the wrong side of the market or have you missing out on the best bull run of the year. My suggestion is to say with the trend taking profits along the way and focus on price action for clues of a change. Take only low-risk entries when adding risk and avoid chasing of any kind. The trend is our friend, stay with it until it ends.

On the Calendar

Monday’s Economic Calendar seems focused on kicking off an FOMC speaking tour. The is one before the market opens, one at 12:40 and another at 1:35. We have a couple of small reports that are likely to go unnoticed by that market as well as two bond auctions to round out the day.

There are 11 companies on the Earnings Calendar expected to report day. Although there are a couple of bigger companies, I would not expect any of them to be market moving. Keep in mind earnings season officially kicks off on Friday with reports from Blackrock, PNC, JPM, and WFC.

Action Plan

The futures markets opened yesterday positively and have managed to maintain that sentiment all night. New record high closes across all four of the major indexes as the bears seem to have gone into hibernation. The Consumer Electronics Show kicked off last night with the CEO of NVDA as the keynote. NVDA shares are indicated higher this morning and could make an all-time high. The INTC CEO speaks this evening with most thinking they will extinguish the recent chip rumors.

Tech could be a driving force for the first part of this week due to the new coming out of CES, but it will quickly shift to the beginning of earnings season that officially kicks off on Friday. As always I will continue to trade with the trend and focused on price action. Having moved up so strongly last week, it would not be out of the question to see the market rest so watch closely for price action clues. Also, remember gap up opens to new market highs can produce whipsaws and reversals so don’t chase.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/SoIYkVlKEbo”]Morning Market Prep Video[/button_2]

Bulls, bulls everywhere.

Look forward, and you see bulls. Look right and left and you see bulls. Bull, bulls everywhere and the only bears in sight lye trampled under the hooves of stampeding bulls. Markets around the world are also moving higher caught up in the excitement. The VIX is registering no fear as the futures once again point to another gap up open. Even though everything seems to be coming up roses, I will do what I always do ahead of the weekend. Go to the bank by some taking profits. Let the good times roll but never forget to take profits along the way!

Look forward, and you see bulls. Look right and left and you see bulls. Bull, bulls everywhere and the only bears in sight lye trampled under the hooves of stampeding bulls. Markets around the world are also moving higher caught up in the excitement. The VIX is registering no fear as the futures once again point to another gap up open. Even though everything seems to be coming up roses, I will do what I always do ahead of the weekend. Go to the bank by some taking profits. Let the good times roll but never forget to take profits along the way!

On the Calendar

The first Friday of 2018 has several important reports on the Economic Calendar. Before the market opens, we get the biggest of these reports with the Employment Situation & International Trade at 8:30 AM Eastern. Consensus for nonfarm payrolls is 191K and an unemployment rate unchanged at 4.1%. Hourly earnings are expected to rise 0.3% with the average workweek hours bumping up slightly as well. The International Trade deficit is expected to widen once again from October’s 48.7 billion to 50.0 billion. 10:00 AM brings the Factory Orders report which is seen rising 1.1% fueled mostly by aircraft orders. Also at 10:00 is the non-manufacturing index which consensus expects a slight increase to 57.6 vs. 57.4 last month. After that, we have three Fed Speakers at 10:15 AM, 12:30 PM and 1:00 PM.

We have 11 companies on the Earnings Calendar today. Notable before the bell is STZ, HURC, and GBX.

Action Plan

Another day and another round of new record highs. This time all 4-indexes pitched in with new closing all-time-high prints with the Dow slicing right through the 25,000 milestone. Stampeding bulls for as far this eye can see. Even the President chimed in by saying, I guess 30,000 is the new target! As you might guessed the current futures action are suggesting the celebration will continue with a gap up of more than 70 points.

Now before you decide the market is never going down again and throw caution to the wind remember gap up opens to new market highs can also be blow off tops. Don’t get me wrong I am in no way suggesting that will happen I’m only reminding that the possibility exists. Also, gap up opens at market highs often have a tendency to create whipsaw price action. The market is very bullish so stay with the trend just don’t get complacent.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/UA_CqimALZY”]Morning Market Prep Video[/button_2]

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.