Geeze This Market Is Slow

Geeze this market is slow. For the next two days (Thursday/Friday) we will not be offering any trade ideas or trading picks on our blog, the market is just to darn slow and dead. If something changes, we will change. The trading room will be open, and we will discuss possible trades as we see them. There is simply a time to trade and times to sit back and enjoy. We hope this year has been good to you and that your trading and education goals have been met. If you feel like sharing your trading and educational goals, please email us @ https://hitandruncandlesticks.com/contact/ we will do our very best to help, use subject line “GOALS”

Geeze this market is slow. For the next two days (Thursday/Friday) we will not be offering any trade ideas or trading picks on our blog, the market is just to darn slow and dead. If something changes, we will change. The trading room will be open, and we will discuss possible trades as we see them. There is simply a time to trade and times to sit back and enjoy. We hope this year has been good to you and that your trading and education goals have been met. If you feel like sharing your trading and educational goals, please email us @ https://hitandruncandlesticks.com/contact/ we will do our very best to help, use subject line “GOALS”

At 9:10 AM ET. We will talk about the technical properties of charts with target zones, logical entries, and protective stops.

► Eyes On The Market

The overall market has been horrible slow this week, and the next 2-days will likely be the same. We have had a few great discussions in the trading room. As of the close yesterday the bulls are holding there support with only a few minor signs of cracks, nothing I am going to worry about right now. We feel the best way to handle this market right now is to “Do Nothing” enjoy the family and the holiday time. Forcing trades never work out in the end.

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Ascending Triangle Breakout – BAS

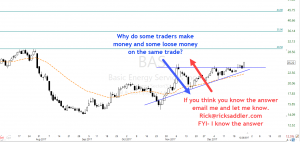

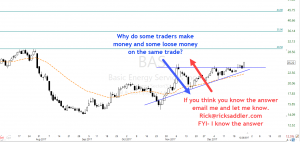

BAS – Broke out of an ascending triangle yesterday after a gap five days ago. With a series of higher lows and capped tops, BAS gapped on 12/20 above the Upper T-Line. The following three days held support, and yesterday more buyers stepped in. There are three important areas, and I will be talking about them in the Pre-market education series. Why do some traders make money and some loose money on the same trade? Something to ponder, ask for the answer if you like.

BAS – Broke out of an ascending triangle yesterday after a gap five days ago. With a series of higher lows and capped tops, BAS gapped on 12/20 above the Upper T-Line. The following three days held support, and yesterday more buyers stepped in. There are three important areas, and I will be talking about them in the Pre-market education series. Why do some traders make money and some loose money on the same trade? Something to ponder, ask for the answer if you like.

At 9:10 AM ET. We will talk about the technical properties of TAHO with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

►Subscribing Members login: for the Trader Vision Trade Plan

► Eyes On The Market

Boring, boring, boring is all I can say about this market. The bulls still hold the chips as of yesterdays close

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Morning Star Flag Breakout – TAHO

TAHO – Is working on a Morning Star Flag Breakout Has flagged above the 50d-SMA after a new low and a Bullish Morning Star kicked off a 10% plus run. We will be using our (RBB) Rounded Bottom Breakout Strategy to trade TAHO. Trade wise and trade with rules.

TAHO – Is working on a Morning Star Flag Breakout Has flagged above the 50d-SMA after a new low and a Bullish Morning Star kicked off a 10% plus run. We will be using our (RBB) Rounded Bottom Breakout Strategy to trade TAHO. Trade wise and trade with rules.

At 9:10 AM ET. We will talk about the technical properties of TAHO with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

►Subscribing Members login: for the Trader Vision Trade Plan

► Eyes On The Market

Giving last week was Holiday slow and this week is likely to be the same we should expect the overall market to see weakness and a short burst of energy. Looking at the SPY, the bulls are still in charge and should remain in charge as long as they can hold above the $264.00 line. I expect the current week to be slow and weak.

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Getaway Day

Combine Friday and the last trading day before Christmas, and you might hear volume sucked out the market. Today is the perfect storm for a Getaway Day for the long weekend. As always there will likely be a flurry of opening activity, but after that, expect very light volume chop. Monday the market is closed, and I would not be at surprised to light volume next Tuesday as traders extend their vacation. If your not planning to take the day off then work on your trading plan for next year. Review your past trades and look for ways to improve. Clean your watchlists and prepare shopping lists for next year. It’s also a very good time to study new techniques or strategies to improve as a trader. I wish you all a Very Merry Christmas!

Combine Friday and the last trading day before Christmas, and you might hear volume sucked out the market. Today is the perfect storm for a Getaway Day for the long weekend. As always there will likely be a flurry of opening activity, but after that, expect very light volume chop. Monday the market is closed, and I would not be at surprised to light volume next Tuesday as traders extend their vacation. If your not planning to take the day off then work on your trading plan for next year. Review your past trades and look for ways to improve. Clean your watchlists and prepare shopping lists for next year. It’s also a very good time to study new techniques or strategies to improve as a trader. I wish you all a Very Merry Christmas!

On the Calendar

The last day of trading before Christmas see an Economic Calendar with several important reports. At 8:30 AM Eastern is the Durable Good Orders which consensus sees increasing by 2%. Even after excluding transportation orders are expected to increase by a solid gain of 0.5% with the core number growing by 0.4%. Also at 8:30 AM is Personal Income and Outlays which income is seen rising 0.4% and consumer spending up 0.5% with the holiday boost. At 10:00 AM is New Home Sales is expecting a decline from October’s 685K vs. Novembers 650K. At 10:00 AM is Consumer Sentiment that is expected to remain very strong with a consensus estimate of 97.0.

On the Earnings Calendar, there are only six companies expected to report today now of which are particularly notable.

Action Plan

The Bulls found a little inspiration yesterday gaping up and pushing higher during the day. Unfortunately, the last hour of the day saw some significant profit taking once again confirming a reason for caution. Currently, the uptrend is still intact, and the VIX showed no rising fear. Futures are currently positive removing the possibility of a government shutdown by passing a CR that’s good through January 19, 2018.

After the morning rush, I expect today’s volume to drop faster than the Times Square New Years Eve ball. Although I will be at my desk, I will not be doing any trading other than maybe taking some profits.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/gAx3piDsmQE”]Morning Market Prep Video[/button_2]

Geeze this market is slow. For the next two days (Thursday/Friday) we will not be offering any trade ideas or trading picks on our blog, the market is just to darn slow and dead. If something changes, we will change. The trading room will be open, and we will discuss possible trades as we see them. There is simply a time to trade and times to sit back and enjoy. We hope this year has been good to you and that your trading and education goals have been met. If you feel like sharing your trading and educational goals, please email us @ https://hitandruncandlesticks.com/contact/ we will do our very best to help, use subject line “GOALS”

Geeze this market is slow. For the next two days (Thursday/Friday) we will not be offering any trade ideas or trading picks on our blog, the market is just to darn slow and dead. If something changes, we will change. The trading room will be open, and we will discuss possible trades as we see them. There is simply a time to trade and times to sit back and enjoy. We hope this year has been good to you and that your trading and education goals have been met. If you feel like sharing your trading and educational goals, please email us @ https://hitandruncandlesticks.com/contact/ we will do our very best to help, use subject line “GOALS”