T-Line Support

The Price action in MRO presented a type of a Bullish Morning Star yesterday that fond support with the help of the T-Line as has the past 23 days, that’s what we call a T-Line Run. MRO is challenging the December 2016 highs (weekly chart) at the moment. A successful battle would suggest MRO may want to challenge the $25.00 area. To learn more about my trading tools join me in the trading room or consider Private Coaching.

The Price action in MRO presented a type of a Bullish Morning Star yesterday that fond support with the help of the T-Line as has the past 23 days, that’s what we call a T-Line Run. MRO is challenging the December 2016 highs (weekly chart) at the moment. A successful battle would suggest MRO may want to challenge the $25.00 area. To learn more about my trading tools join me in the trading room or consider Private Coaching.

Today At 9:10 AM ET. We will demonstrate live how MRO could be traded using our Simple Proven Swing Trade Tools

► Learn the Power Of Simple Trading Techniques

[button_2 color=”blue” align=”center” href=”https://hitandruncandlesticks.com/hrc-rwo-30-day-offer/” new_window=”Y”]30-Day Trial • HRC • RWO • $14.00 Each • No Auto Bill[/button_2]

On September 13, we shared CRC and how to use the trading tools listed below to profit. Yesterday the swing profits would have been about 184% or $1500.00 with 100 shares. Using our Simple, Proven Swing Trade Tools and techniques to achieve swing trade profits. CRC printed a Bullish Morning Star yesterday with T-Line support.

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning… Learn More

► Eyes On The Market

So the children in DC came to some agreement, for the time being anyway. Yesterday the SPY did what it seems to do best… climb higher. This starting to sound like a broken record, The markets bullish, the bull trend is supporting, tada, yadda, yadda. Every day I watch price and how it acts around the 8-day trend using the T-Line, and its sisters. I must admit the T-Line family has supported price very well of late. So it would stand to reason if the T-Line family fails price we could see a little seeling. My point is – Watch how price and the T-line work together.

The VXX short-term futures slide a little yesterday closing below the T-Line trend but did not close below the January 16 candle. Note the January 16 candle is the candle making the VXX interesting. Keep reading the VXX chart; the story may not be over. Those 2 Dojis lead to a bullish gap day which is now leading to more healthy bottom construction.

►Rick’s Swing Trade ideas

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

History-making bull run.

New records across the board as the market reacts to the government closure coming to an end. The bulls are running so hard it makes you wonder if their hearts could suddenly and without warning explode. One thing for certain, I’m grateful that I can participate in this history-making bull run. The futures have traded all over the place this morning. I can only guess its due to the tsunami warning for the west coast after a big earthquake in Alaska. The price action has been very fast so be careful at the open and for goodness sake don’t chase. There will be a day when the tide will go rushing out, and profit-taking will begin. Avoid complacency and have a plan to protect profits and capital if/when it occurs.

New records across the board as the market reacts to the government closure coming to an end. The bulls are running so hard it makes you wonder if their hearts could suddenly and without warning explode. One thing for certain, I’m grateful that I can participate in this history-making bull run. The futures have traded all over the place this morning. I can only guess its due to the tsunami warning for the west coast after a big earthquake in Alaska. The price action has been very fast so be careful at the open and for goodness sake don’t chase. There will be a day when the tide will go rushing out, and profit-taking will begin. Avoid complacency and have a plan to protect profits and capital if/when it occurs.

On the Calendar

Tuesday is another very light day on the Economic Calendar. The is a Richmond Fed Manufacturing report at 10:00 AM which is very unlikely to move the market. A couple bound auctions and a Fed Speaker after the market close at 6:30 PM.

On the Earnings Calendar, there are 67 companies expected to report earnings. Please make sure you are checking reporting dates of companies you own or those you are thinking of buying. Today we have a showing of some big blue-chip stocks like KMB, VZ, JNJ, and PG. Reporting after the bell is TXN, CREE, and UAL.

Action Plan

Due to a family emergency, I had to quickly lever yesterday missing out on the surge higher. Record highs in all four major indexes occurred as buyers rushed in after the news that the government shutdown was over. If you thought the market looked overextended before the yesterday stretched that rubberband even tighter. NFLX reported blow out earnings after the bell and futures were very bullish all night. However, starting at 6:00 AM Eastern the futures suddenly started moving south and at this moment are continuing to do so. The price action is very fast, so anything is possible by the open.

Without question the bulls are in control and the market trends are higher. However, the market also appears to very extended which could trigger some profit-taking at any moment so I think it would be wise to exercise a little caution. The current erratic price action in the Dow Futures should be a reminder just how quickly a shift could occur so stay on your toes. Having said that earnings could continue to propel the market higher so avoid prediction and trade the price action making sure not to chase stocks that are already well within their run.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/mbLcytATGe4″]Morning Market Prep Video[/button_2]

Cautiously Optimistic

This weekend a friend asked me for my overall opinion of the market. My answer was Cautiously Optimistic. If you look at the economic markers such as jobs, interest rates, business growth, and wage growth, it’s pretty darn hard to be anything other than optimistic. A quick look at the index charts and all you can see is bullish trends. So why the caution? The short answer is the appearance of extreme complacency. Almost nothing seems to shake this market. Look at the same index charts with a critical eye and its hard not see a bit of complacency. The question on my mind is can earnings support these price levels or has complacency pushed us to high in anticipation? As a result, I’m Cautiously Optimistic as we move into the bulk of earnings reports.

This weekend a friend asked me for my overall opinion of the market. My answer was Cautiously Optimistic. If you look at the economic markers such as jobs, interest rates, business growth, and wage growth, it’s pretty darn hard to be anything other than optimistic. A quick look at the index charts and all you can see is bullish trends. So why the caution? The short answer is the appearance of extreme complacency. Almost nothing seems to shake this market. Look at the same index charts with a critical eye and its hard not see a bit of complacency. The question on my mind is can earnings support these price levels or has complacency pushed us to high in anticipation? As a result, I’m Cautiously Optimistic as we move into the bulk of earnings reports.

On the Calendar

A slow start to the Economic Calendar this week, with no market-moving reports and just a few bond auctions. Perhaps that’s a good thing as the market deals with day-3 of the government shutdown and all drama whipped up by both sides of the aisle.

There are just over 40 companies reporting earnings today with HAL, PETS, & WYNN before the bell. After the bell, Tech will be in focus as NFLX will dominate the earnings news.

Action Plan

Friday’s market saw a Dow index and the Dow Futures oddly decouple. A good portion of the day the Dow index was trying go down while the Dow Futures relentlessly pushed higher. Ultimately the Index closed positively, but the futures were sharply higher. The SPY, QQQ and the IWM all closed at new record highs. Price action overall seemed to rather slow and choppy as we heading into the weekend.

Futures this morning are pointing to a lower open as the market reacts to the government shutdown. Currently, Dow Futures are pointing to a gap down of about 40 points. I’m honestly surprised the reaction isn’t stronger considering the stretched overall condition of the market. With no economic reports to react to the market may be a bit more sensitive to the congressional news as its spun one direction and then another. Earnings reports really begin to ramp up this week. Our first big tech report is after the bell today with NFLX steps up to report results. Don’t be surprised to see higher volatility companies must prove these elevated levels can be justified. There is a lot no the line!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/_8vXdNWBTsI”]Morning Market Prep Video[/button_2]

T-Line Bullish Engulf

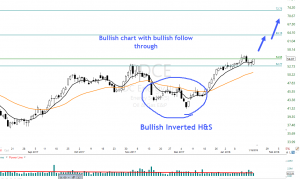

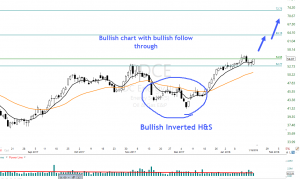

PDCE printed a T-Line Bullish Engulf Friday using the November highs as support. PDCE recently painted a successful Bullish Inverted Head and Shoulders that helped get them to the current position. PDCE is a Bullish chart and will become attractive above $54.95. To learn more about entries join us in the member’s area or consider a trading coach.

PDCE printed a T-Line Bullish Engulf Friday using the November highs as support. PDCE recently painted a successful Bullish Inverted Head and Shoulders that helped get them to the current position. PDCE is a Bullish chart and will become attractive above $54.95. To learn more about entries join us in the member’s area or consider a trading coach.

Today At 9:10 AM ET. We will demonstrate live how PDCE could be traded using our Simple Proven Swing Trade Tools

► Learn the Power Of Simple Trading Techniques

On January 10, we shared SRNE and how to use the trading tools listed below to profit from SRNE. Yesterday the swing profits would have been about 23% or $350.00 with 300 shares. Using our Simple, Proven Swing Trade Tools and techniques to achieve swing trade profits.

[button_2 color=”blue” align=”center” href=”https://hitandruncandlesticks.com/events/” new_window=”Y”]Events Calendar • Hit and Run Candlesticks • Right Way Options • Trader Vision • A Look Ahead • TradeHAwk[/button_2]

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning

► Eyes On The Market

Despite the government shut down in the wind, the SPY ETF closed at a record level Friday. As the shut down became real, the futures didn’t seem too concern. It’s now Monday morning, the government is shut down, and the futures are down a little but not bad. When the bulls are strong, they are strong! The trend is still bullish and intact. However, would not be surprised to see chop until the 3rd graders in Washinton grow up.

The VXX short-term futures closed Friday still inside the January 16th candle and above the T-Line. The bulls/buyers have been working with the last 12 bars to construct a bottom. Not fully constructed and still venerable a bottom still being constructed.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Shocking!

A day without new record new record highs? Shocking! It would seem the Bears are starting to test the strength of the advancing Bulls with little attacks here and there. The results of this minor skirmishes have thus far proved the Bull is strong and unwilling to yield even a little. Does that mean we should toss caution to the wind and chase into this rally? Absolutely not. Chasing with the fear of missing out cost me a lot of money over the years as I was learning my craft. If you are going to buy look for stocks that are finding buyers at or near price support levels. Futures are bullish this morning, and trends are still solidly pointing up so stay with the trend but choose your risk wisely.

A day without new record new record highs? Shocking! It would seem the Bears are starting to test the strength of the advancing Bulls with little attacks here and there. The results of this minor skirmishes have thus far proved the Bull is strong and unwilling to yield even a little. Does that mean we should toss caution to the wind and chase into this rally? Absolutely not. Chasing with the fear of missing out cost me a lot of money over the years as I was learning my craft. If you are going to buy look for stocks that are finding buyers at or near price support levels. Futures are bullish this morning, and trends are still solidly pointing up so stay with the trend but choose your risk wisely.

On the Calendar

The Friday Economic Calendar is a light one for a change. At 10:00 AM Eastern we get the latest reading on Consumer Sentiment which consensus it expecting an increase to 97.0 vs. Decembers 95.9. Other than that Fed speaking tour continues with one at 8:45 AM, then 1:00 and 1:30 PM.

The Earnings Calendar is also light today with only 17 companies reporting earnings today. Most notable are those reporting before the bell such as RF, CFg, FHN, KSU, and SLB. Keep in mind that earnings reports ramp up heavily next week. Make sure you are checking dates on positions you hold and those your thinking of buying.

Action Plan

Although there were a couple of intra-day bears attacks, the bulls managed to hold the battle line with relative ease. During the evening there was an attempt to move the futures lower, but once again the bulls were not interested in giving up any ground. Also during the evening, the US House passed a tempory spending bill. Now it’s up to the Senate to prevent the government from shutting down at midnight tonight. I don’t know about you, but this drama is getting old.

Despite the political drama and the intermittent bear attacks the futures market is putting on a confident face. As I write this, the Dow futures are pointing to a gap up open, and the NASDAQ could set new records at the open. Go Bulls! Stay with the trend but keep in mind that gap up opens can be very whippy so avoid chasing. As always I will be focused on profit taking more than adding new risk as we head into the weekend. However, I will be looking for trades, and anything is possible.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/zS0jcryHXMc”]Morning Market Prep Video[/button_2]

The Price action in MRO presented a type of a Bullish Morning Star yesterday that fond support with the help of the T-Line as has the past 23 days, that’s what we call a T-Line Run. MRO is challenging the December 2016 highs (weekly chart) at the moment. A successful battle would suggest MRO may want to challenge the $25.00 area. To learn more about my trading tools join me in the trading room or consider Private Coaching.

The Price action in MRO presented a type of a Bullish Morning Star yesterday that fond support with the help of the T-Line as has the past 23 days, that’s what we call a T-Line Run. MRO is challenging the December 2016 highs (weekly chart) at the moment. A successful battle would suggest MRO may want to challenge the $25.00 area. To learn more about my trading tools join me in the trading room or consider Private Coaching.