Monday Starts Modestly Green

Markets opened modestly lower Friday. SPY opened down 0.16%, DIA opened down 0.09%, and QQQ opened down 0.34%. From there, all three of the major index ETFs meandered back-and-forth around the opening gap until 12:30 p.m. Then the market saw a sharp rally for a little over an hour, followed by a weaker selloff for an hour, with all three then drifting modestly bullishly the rest of the day. This action gave us small gap-down, white-bodied candles, with wicks at both ends in SPY, DIA, and QQQ. DIA was a prototypical Spinning Top candle. All three crossed back above their T-line (8ema), although DIA only did so by a dime. This happened on average volume in DIA and QQQ as well as less-than-average volume on the SPY.

On the day, nine of the 10 sectors were green with Technology (+0.57%) and Financial Services (+0.56%) out front leading the others higher. Meanwhile, Industrials (-0.10%) was the only sector in the red (barely). At the same time, SPY gained 0.44%, DIA gained 0.16%, and QQQ gained 0.52%. VXX plummeted 12.12% to close at 55.78 and T2122 fell but remained in its mid-range at 38.79. On the bond front, 10-year bond yields fell to 3.94% and Oil (WTI) popped another 1.04% to close at $76.98 per barrel. So, Friday was a meandering day with less energy that the other days in the week. As a result, the magnitude of the whipsaws Friday was muted.

This action ended a tumultuous week that started with a huge gap lower and featured heavy volatility, especially early in the week. That said, the week ended as “much ado about nothing” as stocks rallied back from the huge INTC-inspired gap lower Monday. SPY ended the week up 0.02% after trading in nearly a 5% range during that time. DIA did end the week 0.50% lower after having been down more than 3% at one point. And QQQ was the show-stealer, closing the week up 0.37% after having been down 5.59% at one point and trading in almost a 7% range for the 5-days.

There was no major economic news scheduled for Friday. In addition, there were no earnings reports after the close Friday.

In Fed speak news, on Saturday, Fed Governor Bowman softened her normal very hawkish tone. She noted “welcome” evidence of inflation reduction and seemed to indicate rate cuts will be needed if inflation stays on a downward trajectory. Bowman said, “Should the incoming data continue to show that inflation is moving sustainably toward our 2% goal, it will become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive on economic activity and employment.” The prepared remarks were delivered to a Kansas City Banking Assn.

In stock news, on Friday, STLA announced it is planning to lay off 2,450 US workers later this year as it plans to end production of the “Ram 1500 Classic” truck. (Layoffs may begin as soon as October 8.) Later, SBUX gained on a Wall Street Journal report that activist fund Starboard Value had taken a significant position in the company. At the same time, BA announced it had been awarded a $2.56 billion contract from the USAF for the development of two rapid prototypes of airborne warning and control aircraft. Later, after the close, C announced it has initiated a process to sell its Trust Services business unit. (No details were provided.) On Saturday. Reuters reported that CSCO will cut thousands of more jobs in a second round of layoffs this year. (CSCO laid off 4,000 employees in February.) Also on Saturday, TSLA stopped taking orders for the cheapest version of its Cybertruck ($61k) and not only has the $100k version available for sale.

In stock legal and governmental news, on Friday, the NHTSA announced it had opened an investigation into 330k HYMTF (Hyundai) vehicles over potentially faulty seatbelts. At the same time, the SEC announced it had reached settlements with the CEO of IDEX and two of the company’s former executives related to securities fraud and misleading financial reporting. Later, JPM asked a federal judge in Manhattan to dismiss its case against Russian VTB Bank, which was seeking to recover $439.5 million in accounts frozen after Russia’s invasion of Ukraine. JPM said it was being coerced to request the dismissal by a Russian injunction on JPM and fear of what retaliatory action would take place if the suit was not dropped. At the same time, META won an appeal by RFK Jr.’s anti-vax group which had been alleging censorship due to META’s policy against the spread of misinformation.

Overnight, Asian markets were mixed but leaned toward the green with eight of the 12 exchanges in positive territory. Taiwan (+1.42%) and South Korea (+1.15%) led the gainers while Singapore (-0.81%) paced the losses. In Europe, with the sold exception of Belgium (-0.18%) we see green across the board at midday. The CAC (+0.05%), DAX (+0.28%), and FTSE (+0.59%) lead the region higher in early afternoon trade. In the US, as of 7:45 a.m., Futures are pointing toward a modestly green start to the day. The DIA implies a +0.13% open, the SPY is implying a +0.20% open, and the QQQ implies a +0.22% open at this hour. At the same time, 10-Year bond yields are back up to 3.955% and Oil (WTI) is up another 1.09% to $77.68 per barrel in early trading.

There is no major economic news scheduled for Monday includes NY Fed 1-Year Consumer Inflation Expectations (11 a.m.), the WASDE Ag report (noon), and Fed Budget Balance (2 p.m.). The major earnings reports scheduled for before the open include GOLD, CEPU, FTRE, and BEKE. Then, after the close AGRO, PACS, AND SLF report.

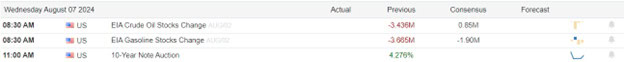

In economic news later this week, on Tuesday we get July Core PPI, July PPI, and API Weekly Crude Oil Stocks report. In addition, Fed member Bostic speaks. Then Wednesday, July Core CPI, July CPI, and EIA Weekly Crude Oil Inventories report. On Thursday, we get Weekly Initials Jobless Claims, Weekly Continuing Jobless Claims, July Core Retail Sales, July Export Price Index, July Import Price Index, NY Empire State Mfg. Index, Philly Fed Mfg. Index, Philly Fed Mfg. Employment Index, July Retail Sales, July Industrial Production, Jun Business Inventories, June Retail Inventories, TIC Net Long-Term Transactions, and the Fed Balance Sheet. We also hear from Fed member Harker. Finally, on Friday, July Building Permits, July Housing Starts, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-Year Inflation Expectations, and Michigan 5-Year Inflation Expectations are reported.

In terms of earnings reports later this week, on Tuesday, we hear from HD, JHX, MLCO, ONON, SE, TME, CIG, FNV, and NU. Then Wednesday, ARCO, EAT, CAE, CAH, DOLE, ESLT, ICL, PFGC, UBS, CSCO, and STNE report. On Thursday, we hear from BABA, AIT, DE, GRAB, JD, NICE, SPTN, TPR, WMT, AMCR, AMAT, COHR, GLOB, and HRB. Finally, on Friday, FLO reports.

So far this morning, GOLD and BEKE reported beats on both the revenue and earnings lines. However, FTRE missed on both the top and bottom lines.

In miscellaneous news, on Friday, the CFTC said that short bets on 5-Year Treasury Bond Futures were now the largest on record. The report stain almost 1.7 million contracts of short bets were in place as of the week ending Aug. 6. (Two-Year and 10-Year Bond Future short bets also increased during the week, but were not at record levels.) Elsewhere, the state of MI reported a human case of Swine Flu on Friday. (The source of exposure is still under investigation and no word on patient outcome was given.) Meanwhile, Sunday was the 900th day of Russia’s invasion of Ukraine (if you do not count the 2014 invasion that stole Crimea and parts of Eastern Ukraine) and the 6th day of the Ukrainian invasion of the Kursk oblast of Russia.

With that background, it looks as if markets are tepidly bullish again early today. All three major index ETFs made a modest gap higher to start the premarket. Since then, SPY and DIA have printed white-body, small-wick candles while QQQ had printed a black-body, mostly-wick candle. All three are back above their T-line (8ema) and the short-term trend remains bullish. However, the mid-term trend is bearish. Still, while the bullish trend line is broken, the longer-term charts remain bullish. In terms of extension, all three major index ETFs are now back to being close to their T-line (8ema). At the same time, the T2122 indicator is back into the mid-range. So, the market has some room to run if either side can find momentum. With regard to those 10 big dog tickers, eight of the 10 are in the green led by the biggest dog, NVDA (+0.79%), which also leads by far on the dollar-volume traded as usual, and AMZN (+0.78%). The second-largest dollar volume trader is TSLA (-0.30%), which is also the biggest loser in premarket.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service