Tradable Tops/Bottoms

In a last-minute surge of bullishness, the Dow close 4 points over 28000 as new records in three of the four major indexes created history. The poor small-cap Russell continues to lag way behind, under-loved, and struggling with resistance. Positive news on the Phase 1 trade deal negotiations has the market once again gaping higher as the bulls continue to show no fear of heights. With Fed signaling a rate-cutting pause and earnings season, winding down the market may become more sensitive to trade developments and news out the impeachment hearings. Remember, big round numbers such as 28,000 will likely see a test as support in the not to distant future, so remain flexible and focused on price action.

Overnight Asian markets closed green across the board despite the increasingly violent protests in Hong Kong choosing to focus on US/China trade hopes. European markets are mostly flat and mostly lower this morning, taking a much more cautious approach to trade news. However, US Futures are tossing caution to the wind looking to extend Friday’s record-breaking rally with a Dow gap up open of more than 75 points. The possibility of a pop and drop exists, so consider your risk carefully if you chase the open.

On the Monday Earnings Calendar, we just over 50 companies reporting results. Of the companies reporting, MANU is the only one that I see as particularly notable.

The big move Friday looks to have additional inspiration this morning after a report of a productive meeting on the Phase 1 trade deal. With the majority of earnings reports now behind us, we still have about 200 companies reporting this week. The majority of the notable reports will be in the retail sector, with HD kicking it off tomorrow morning. As Impeachment hearings enter their second-week traders will have to keep on eye on the news for possible market-moving reports spun-out of by the political drama.

On Friday, the Dow closed above 28,000 for the first time while the DIA lagged slightly behind at 279.84. Big round numbers can sometimes be a stumbling block for the market, but the SP-500 cut through 3100 like warm butter and the Nasdaq lept right though 8500 like it wasn’t even there. That in mind, be careful chasing the morning opening gap. Testing these big round numbers as support is not out of the question in the near future, so as always remain focused on price action for clues. With earnings winding down and the rate-cutting, Fed pausing inspiration may turn to the Phase 1 trade deal hopes and making the market very news sensitive.

Trade Wisely,

Doug

The bulls ran roughshod Friday from a gap higher (on a Larry Kudlow report of a phase-one deal with China being nearly complete) to a push most of the day. During the late afternoon, President Trump announced Executive Orders forcing transparency in drug expenses. With bulls only wanting to hear good news, this was read as very bullish by insurers, hospitals and even drug makers (no downside was going to be recognized for anyone). So, at the end of the day the SPY, DIA, and QQQ had all achieved new all-time high closes.

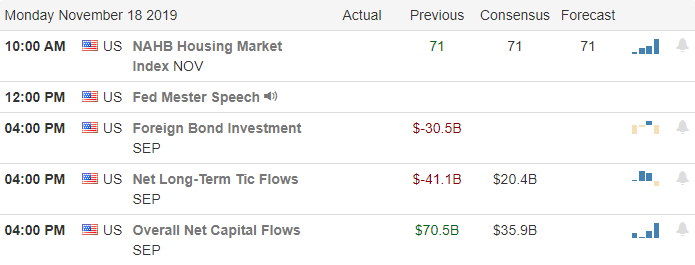

Monday has no major economic news. There will also be another break in Impeachment Hearings. In addition, there are also no major earnings reports. However, there were more violent clashes in Hong Kong with Police forcing entry into a University and being met by Molotov Cocktails and homemade arrows.

Overnight, Asian markets were mixed. In Europe, markets are also mixed with the FTSE and a couple of smaller burses in the green, while the DAX, CAC and most others are in the red at this point. As of 7:30 am, U.S. futures are pointing toward a gap higher of between 0.1% (SPY) and 0.3% (QQQ).

With no major news planned for the day, it is quite possible that the lull gives bulls the chance to push even higher. However, unexpected news from the Impeachment or Trade War with China front can always throw things one way or the there. Either way, the bulls have really only wanted to hear good news for months now. So, don’t get caught over-reacting to a temporary shock. Follow the trend, wait for an entry signal and above all, obey your rules! Be cautious and continue to take profits and move stops. Remember that a Trader’s job is to consistently make gains…not to hit the occasional home run.

Ed

Swing Trade Ideas for your consideration. Long – BHC, CXO, IPG, CDW, CAH, PM, K, PNR, PCAR, DOV, GE, AMP, CTXS, UTX, WFC, MS. Short – MOS, OHI, CINF, CHD, MCD, CTAS. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

In this E-Learning class we discuss how to uncover the fingerprints of institutional activity and use to your profitable advantage.

Another day and more new record highs as the bullish trend show no signs of stopping their push higher just yet. Though yesterday’s rally was not broad-based key stocks, continue to find the support needed to drive the indexes higher even with troublesome developments in the US/China Phase 1 negotiations. News that the USMCA trade deal may be finalized soon helped to lift spirits ahead of the busy morning of economic reports and the resumption of the impeachment hearings in the House.

Asian market closed their week mixed amidst trade tensions and Hong Kong protests. European markets are mostly bullish this morning renewed trade deal hopes and the US futures point to another gap up and new record highs at the open. With a light day of earnings attention will shift to the possible market-moving economic reports and the political drama unfolding on Capitol Hill.

On the Friday Earnings Calendar, we get a break from with only six companies reporting today, but we still have a couple of notable reports with JNP and JD, which both report before the bell.

The bulls achieved more record highs on Thursday, although the rally was not broad-based, with the T2122 indicator moving slightly lower in the process. Nonetheless, the bulls remain in control, and the technicals of the index charts remain very bullish. The House will resume impeachment hearings today, so beware of possible events that could quickly move the market with more than enough political rhetoric to choke both bulls and bears.

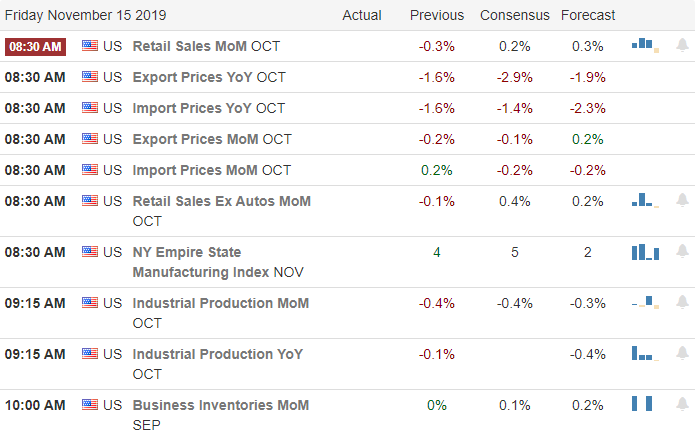

With the 4th quarter earnings season winding down, we have a very light day on the earnings calendar this Friday. However, we have a big morning on Economic Calendar with several potential market-moving reports that could inspire some price action volatility. Most notable is the Retail sales number at 8:30 AM ET, and the Industrial Production follows quickly after at 9:15 AM. Futures got a lift this morning on a story that suggests Congress is nearing the completion of the USMCA trade deal with Mexico and Canada. After the morning rush, don’t be surprised if the congressional hearings divert attention, and we have a period of light choppy price action as the political drama unfolds.

Trade Wisely,

Doug

Markets got a respite Thursday, with no new trade-related news, Fed Chair Powell saying nothing new and no news on the Impeachment front. As a result of the lull, markets rested all day. However, as has been the modus operandi recently, the bulls stepped in at day end to ensure that we printed a new all-time high close in the SPY and DIA.

Thursday news included a pre-market beat and raise by WMT, which was met by tremendous fading of the gap-up all day long. KHC also got a downgrade by GS and suffered a massive sell-off all day. It is also worth noting that T2122 shows the 4wk High/Low Ratio remains only mid-range. This means these recent index highs have been achieved with fewer participating companies. This is a risk factor for bulls.

After-hours, NVDA reported a 20-cent beat on higher than expected sales. This should provide a Friday tailwind to the Tech Sector. 13F filings released after the close also showed that BRKB (Warren Buffet) had reduced holdings in AAPL, WFC, PSX and SIRI, while at the same time adding positions in OXY and RH. (This was for the quarter ended in June.) While the US Administration has no credibility left on the matter, Larry Kudlow did again tell Bloomberg that a “phase one deal” is in the final stages of negotiation between the US and China.

Friday economic news includes Retail Sales and Import/Export Prices (both at 8:30 am), Industrial Production (9:15 am) and Business Inventories (10 am). However, Impeachment Hearings also resume again Friday. The only major earnings report on the day will be JD, before the bell.

Overnight, Asian markets were all in the green. In Europe, markets are mixed, but mostly red with the FTSE, CAC, and several others underwater so far. As of 7:30 am, U.S. futures are all pointing to gap higher of between a quarter percent and 0.40%.

Impeachment hearings resume Friday. It is also quite possible we see more twists in the Trade War saga. However, the bulls have remained stubborn in recent months. So, don’t over-react to what may turn out to be very temporary whiplashes. Follow the trend, wait for an entry signal and above all, obey your rules! Be cautious and continue to take profits and move stops. Remember that a Trader’s job is to consistently make gains…not to hit the occasional home run.

Ed

Sorry, but no Trade ideas for Friday. Remember that Friday is pay day. Take some profit off the table and protect yourself in front of a long weekend news cycle (when we cannot react). Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

The House of Mouse (DIS) surprised the market yesterday, reporting it had gained 10 million new subscribers on the first day of service, pushing the stock up more than 7% on the day and taking the Dow to record highs in the process. FOMC Chairman Jerome Powell testified yesterday they will back off on rate cuts adopting a wait and see approach siting a strong economy led by solid jobs growth. Mr. Powell speaks today with the House Budget Committee giving us a one day reprieve from the impeachment hearings.

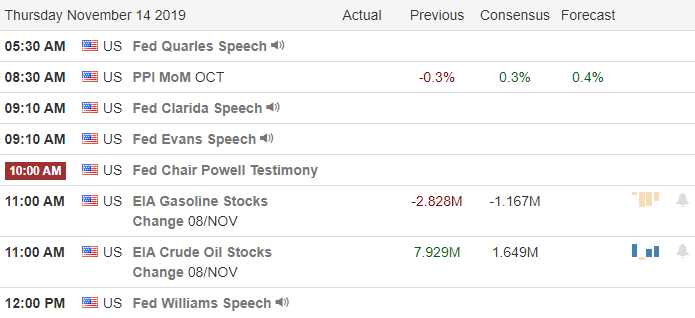

Asian markets closed the day mixed and mostly lower on trade war tensions as they demand more tariff cuts. European indexes are trading flat to mostly lower this morning in reaction to the apparent stalemate in US/China trade talks. US Futures currently suggest a flat open but have improved after WMT reported an earnings beat this morning. Jobless Claims and PPI numbers are out 8:30 AM Eastern as well as a big round of earnings reports, so stay focused on price action for clues.

On the Thursday Earnings Calendar, we have just over 275 companies reporting quarterly results. Notable reports include WMT, NVDA, AMAT, BAM, CGC, DDS, FTCH, HP, IGT, SCVL, SINA, VIAB, WB, WIX, & WSM.

The Dow powered to new record highs after DIS reported their new streaming service gained 10 million subscribers on its very first day of service. However, this morning, futures are pointing slightly bearish with China not wanting to commit to a level of farm purchases and demanding removal of tariffs. The Congressional impeachment hearing had a huge viewership but seemed to have very little if any impact on the market. We have break in that regard today, but the hearings resume on Friday.

Mr. Powell testified yesterday that after 3-rate cuts, the FOMC is comfortable taking a wait and see approach with future rate cuts unlikely in the near future. The chairman will continue his testimony before the House Budget Committee at 10 AM Eastern today. We have a big day earnings with the retail giant WMT reporting before the bell and NVDA as the most notable after the bell. CSCO disappointed the market yesterday afternoon and is indicated to open substantially lower this morning.

Trade Wisely,

Doug

Markets gapped down a bit Wednesday on trade fears prompted by President Trump’s Tuesday speech and threats of new tariffs. However, the bulls stepped in as usual and drove the indices quickly back to flat. Fed Chair Powell made no waves with his Congressional testimony and there were no major twists in the Impeachment hearings. So, markets treaded water most of the mid-day before the SPY, DIA and QQQ all closed at new all-time record highs again.

Among the news driving markets Wednesday was DIS reporting very good subscriber sales for their new streaming service and NKE saying it will no longer sell directly to AMZN. On the trade front, China reported that it will not be buying $50bil in US grain (as President Trump has repeatedly touted) and don’t want to set a specific amount on what they will buy. Moreover, they also repeated that tariff reductions are needed for the so-called “Phase One” of a deal. This may have just been another tit-for-tat reply to the President’s tariff threats from Tuesday. Regardless, this news stream is likely to continue as a Deal our President says was done appears to be anything but done.

At the end of the day, the EU reported that it “expected” President Trump to postpone tariffs on European Autos (as was done in May). However, there was no word of another postponement out of the White House. (Wed. was the deadline to postpone them.) Then after hours, CSCO and NTWP both reported beats.

Thursday economic news includes PPI and Weekly Jobless Claims (both at 8:30 am). Fed Chair Powell also testifies before Congress again at 10 am, but Impeachment Hearings will likely grab the spotlight. The only major earnings Thursday will be WMT and VIAB before the bell and AMAT and NVDA after the close. (WMT already reported a beat this morning.)

Overnight, Asian markets were all in the red. In Europe, markets are mixed with the FTSE, DAX, and most others in the red, but the CAC and a couple others in the green. As of 7:30 am, U.S. futures are all just on the red side of flat.

The Impeachment hearings are likely to drive markets Thursday. (Fed Chair Powell is very unlikely to say anything to the Senate that he did not say to Congress on Wed.) However, more twists on the China Trade War front may also occur. Regardless of what shocks that may come, remember that the bulls have been extremely resilient in recent months. So, don’t over-react to temporary whiplash. Try to follow the trend. Be cautious and continue to take profits and move stops.

Ed

Swing-Trade Trade ideas for your consideration. Long – KHC, ALLE, ARNC, IFF, CVX, CDW, K, MAS, KLAC, SWKS, PNR, SYY, FBHS, AMP, UTX. Short – TGT, STZ, CINF, JCI, F, MOS. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service