Earnings and Jobless Claims Today

Markets gapped up at the open Wednesday, but sold off sharply about 10am and then spent the rest of the day roller-coastering in a tight range the rest of the day. As a result, all 3 major indices printed black-body candles. The QQQ was a sort of Dark Cloud Cover and while the DIA closed at another all-time high close, it printed a Hanging Man candle. On the day, SPY was flat at -0.04%, QQQ was down 0.23%, and DIA gained 0.18%. The VXX gained 1.65% to 16.67 and T2122 also gained further into the overbought territory at 95.83. Bonds fell significantly to 1.124% and Oil (WTI) was flat at $58.35/barrel.

Fed Chair Powell said the US employment situation was bleak, saying the headline jobs number was dramatically understated. He went on to mention the largest drop in workforce participation since 1948. So, he reassured markets that the Fed will remain “patiently accommodative” (because of lessons the Fed learned the hard way in the past) and requested a “society-wide push for full employment (Congress to get Fiscal Stimulus passed again). Despite this calming continuity of message, markets did not have a strong reaction. However, the comments did cause a slump in Treasury yields where an expectation of inflation was muted.

On the earnings front this morning, PEP beat on earnings with a surge in revenue in Q4. As we might expect, AZN posted their highest Q4 sales in many years and beat on earnings as well. TSN beat on earnings, but came in over half a billion light on sales for the quarter. KHC beat on both lines.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 27,897,214 confirmed cases and 483,200 deaths. However, the number of new cases continues the recent trend of falling quickly and is back down to the pre-election level as the average new cases are now 105,798 new cases per day. Still, deaths remain stubbornly high at 2,818 per day. Los Angeles has had to temporarily close all vaccination locations due to a lack of vaccine. This comes as more states are relaxing restrictions, despite the CDC and other health experts warning against relaxing too early.

Globally, the numbers rose to 107,937,567 confirmed cases and the confirmed deaths are now at 2,367,122 deaths. In good news, the world’s average of new cases is down again to 423,410 per day, but mortality remains high at 12,091 new deaths per day. As expected, Germany extended their lockdown to March 7. In the UK, the Gov’t. Science Advisory Group warned that a new “Bristol” variant may well infect people who have have the virus before or been vaccinated. Fortunately, this new variant is not the UK variant that is sweeping the globe, at least yet. Mexico granted emergency use approval for 2 Chinese vaccines. The Eurozone lowered growth forecasts by four-tenths of a percent based on continued drag from COVID restrictions. The still expect positive 3.8% growth in GDP in the next year.

Overnight, Asian markets were mostly green again, but many markets (and economies) are closed now for the Lunar New Year celebration. In Europe, markets are mostly green so far today. The FTSE (+0.05%) and CAC (+0.00%) are flat, but the DAX (+0.49%) is up and is more typical of the rest of the continent. As of 7:30 am, US Futures are pointing toward a flat to modestly higher open. The DIA is implying a +0.24% open, the SPY implying a +0.29% open, and the QQQ implying a +0.41% open at this point.

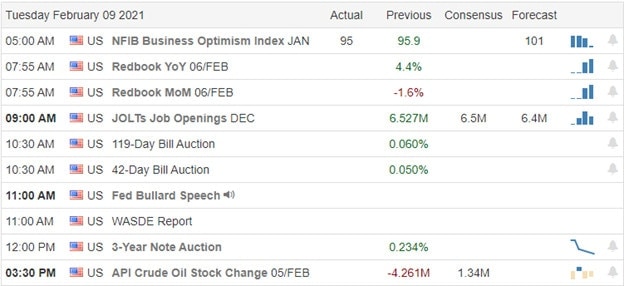

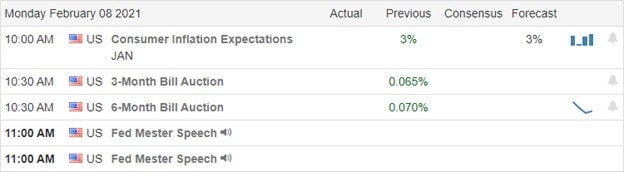

The major economic news for Thursday is limited to Initial Jobless Claims (8:30 am), Fed Monetary Policy Report (11 am), and US Federal Budget (2 pm). Major earnings reports on the day include AB, MT, AZN, BWA, CIGI, UFS, DUK, ENS, FAF, FMCC, GNRC, HII, NSIT, K, KHC, LH, TAP, NUS, PTAK, PBF, PEP, POOL, QSR, R, SON, TPX, THS, TSN, VNT, WSO, and ZBRA. Then after the close CC, DVA, DLR, EXPE, FLO, GDDY, ILMN, MHK, TEX, DIS all report.

As the Impeachment Trial continues to grab headlines and earnings leads the economic news. However, New Jobless Claims may have an impact this morning. Again, markets look a little tired, but the wall of worry is something the bulls love to climb. So, don’t bet on a pullback until you see it happening.

Follow the trend, respect support and resistance levels, and don’t chase the moves you missed. It’s all about achieving trade goals and sticking to your discipline. So, keep locking in your profits when you have them. Stick with your plan, maintain discipline and work your process. Also, remember we have a 3-day weekend coming. So, we may see some profit-taking the next couple days.

Ed

Swing Trade Ideas for your consideration and watchlist: IAG, WYNN, XLE, VLO, AMD, PSX, TSLA, BBBY. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service