Relief Moves Ahead and Oil Moves Up

Markets gapped up a percent Friday on a major beat by the Feb. Nonfarm Payrolls (379k vs 182k est.) while unemployment dipped to 6.2%. However, that gap was met with an immediate 2% selloff as fears of inflation resurfaced. Then about 11:30am, the bulls stepped in to defend the lows as bond yields lessened a touch from their highs. This led to a rally that lasted the rest of the day. This left all 3 major indices with long-wicked White-bodied Hammer type candles. On the day, the SPY gained 1.84%, the DIA gained 1.83%, and the QQQ gained 1.51%. The VXX fell 7% to 15.12 and T2122 rose back up to just outside the overbought territory at 77.18. 10-year bond yields spiked again to 1.577% and Oil (WTI) rose almost 4% to $66.28.

The Democratic relief bill hit a few snags on Friday. First, the President had to agree to a reduction from $400/week extended unemployment to $300/week. Then a WV Senator held the bill hostage for several hours related to various unemployment aspects. In the end, the Senate passed the bill Saturday in a 50-49 party-lines vote (one Republican was absent). The bill is now expected to be passed (as amended by the Senate) in the House on Tuesday before being signed by President Biden. The bill gives $1,400 direct checks to those making less than $80,000, extends unemployment at $300/week through September 6 and makes the first $10,200 of unemployment tax free for households making less than $150,000. Even with Senate passage, futures are pointing lower. So, apparently Mr. Market has already baked-in the stimulus and has moved on to other concerns.

After the close Friday, the SEC charged T and 3 of its executives with selectively sharing non-public information about the company’s investments to certain stock analysts. In return, those analysts lowered their earnings estimates to just below the level the company then reported. In other words, the SEC is claiming that T bought an “earnings beat” by giving insider data to certain specific analysts. In other market news, Pot stocks slumped for the second straight week last week. This comes as the partisan nature of Washington is being seen by industry analysts as making it much harder to get national legalization (which many had expected from a Biden administration). And in commodity news, OPEC+ members unexpectedly agreed to keep output restrictions in place. This triggered another rally in oil which now has the price of oil above the balanced-budget required price of three large producing countries. This includes Saudi Arabia, Bahrain, and Oman, with UAE and Kuwait only about $3/barrel from their own break-even prices. This was before Brent topped $70/barrel over the weekend on the OPEC+ restriction extension news.

Related to the virus, US infections are starting to plateau at a level above the fall level after a month and a half of steep and steady decline in new cases. The totals have risen to 29,696,250 confirmed cases and deaths have now passed half a million at 537,838 deaths. As mentioned, the number of new cases fell again to an average of 59,777 new cases per day. Deaths, which have always lagged, also fell again to 1,725 per day. In good news, the US has now hit the milestone of doing over 2 million vaccinations per day. However, Health officials again warned over the weekend that it is too soon to ease social distancing and especially mask mandates.

Globally, the numbers rose to 117,509,784 confirmed cases and the confirmed deaths are now at 2,606,789 deaths. The trends have been good, but we saw a significant uptick today. The world’s average new cases have up-ticked again by 10,000 over the weekend to 399,523 per day. Mortality, which lags continued to tick down slowly, now at 8,715 new deaths per day. Among the places seeing a surge is Brazil, which reports it highest daily increase in new cases in over 2 months.

Overnight, Asian markets were mixed, but mostly red Monday. Shenzhen (-3.24%), Shanghai (-2.30%), and Hong Kong (-1.92%) led the move lower as China bore more most of the brunt of rising oil prices. However, Singapore (+1.90%) gained on that news. In Europe, stocks are green across the board so far today. The DAX (+1.38%) and CAC (+0.88%) are typical of the continent, but the FTSE (+0.21%) lags. As of 7:30 am, US Futures are mixed but generally down. The QQQ is implying a -1.32% open, the SPY implying a -0.49% open, but the DIA remains flat, implying a -0.01% open.

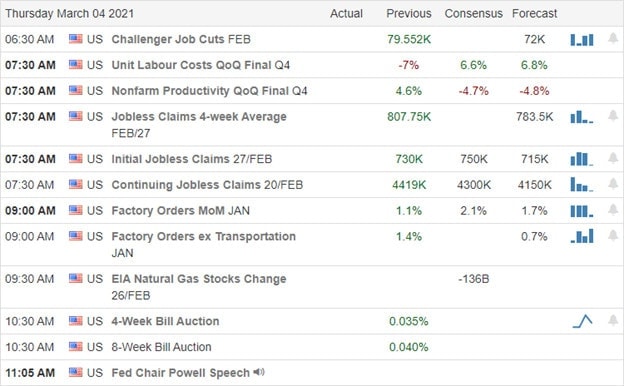

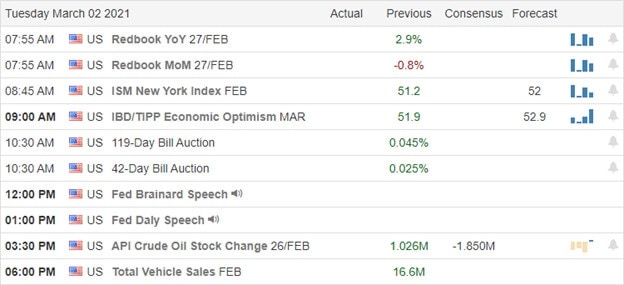

There is no major economic news on Monday. There are also no major earnings reports before the open. However, after the close, CASY and WISH report.

Inflation fears continue to grip Wall Street. Even clearing another major hurdle toward the $1.9 trillion stimulus bill has not helped the weekend mood. It looks as though Friday’s strong day is being answered by the bears pushing back today. The trend remains to the downside, but remember the bulls have recently defended a level not far below. So, volatility is to be expected.

As always, don’t try to predict, just follow the market. It’s the big money that makes the market move and we just need to tag along for the swings. Follow the trend, respect support and resistance, and don’t chase those moves that you miss. Another trade will come along any minute. Keep booking your trade goals when you can and stick with your discipline.

Ed

Swing Trade Ideas for your consideration and watchlist: DFS, DIS, F. XRT, MO, PFE, WMT, LUMN, NLSN, IVZ, MA. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service