Traders Digest Fed as Bulls Try to Rally

Markets gapped four to six-tenths of a percent higher Wednesday as fears over the Chinese Evergrande debt crisis faded. The bulls followed though all morning and then volatility set in during the afternoon after the Fed announcement and press conference. This left us with gap-up indecisive Spinning Top candles in all 3 major indices. On the day, SPY closed up 0.98%, DIA gained 0.99%, and QQQ gained 0.93%. The VXX fell over 6% to 27.06 and T2122 rose a bit but remains in the mid-range at 68.70. 10-year bond yields fell to 1.307% and Oil (WTI) gained 2% to $71.95/barrel.

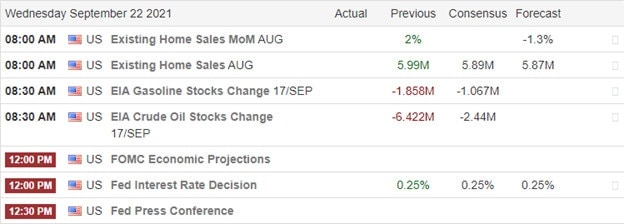

The FOMC held rates near zero as expected Wednesday afternoon. Fed Chair Powell also said that the tapering of asset buying will come soon, which most analysts expect to mean the taper will start in November following an October announcement. During questions, Powell implied the taper (any purchases) would come to an end in mid-2022. The Fed now forecasts 5.9% GDP growth for the year (down from a 7% forecast in June) and 3.8% in 2022 (versus the June 3.3% estimate). They expect inflation of 3.7% for the year (versus 3% previous estimate) and 2.3% for 2022 (compared to the June estimate of 2.1%). Powell also told reporters that the Fed is considering “whether to issue” their own cryptocurrency (and perhaps in a more telling follow-up answer “in what form that may be”).

After the close, FB announced its Chief Technology Officer is stepping down. In other evening news, Auto Industry consulting firm AlixPartners has raised its forecast of lost vehicle sales due to the global chip shortage. The firm now estimates 7.7 million units of lost production for 2021 (up from 3.9 million in their May forecast), which would amount to $210 billion in lost revenue for the industry. This will primarily be felt by US giants GM, F, and FCAU (Fiat, Chrysler, Dodge, and Jeep), because the Japanese auto industry had a normal practice of holding a year’s worth of supply inventory in their supply chain. Now that the inventory has been used up, Japanese auto firms are hurting as well, but they postponed their pain far longer than US automakers.

The FDC is set to vote on PFE booster shots for “older and at-risk patients” today. In the meantime, Covid-19 surpassed the 1918 Spanish Flu as the deadliest pandemic in US history on Monday. As of yesterday, the US has seen 43.4 million total cases and 699,748 total deaths in the country. Meanwhile, the averages 130,121 new cases and 1,678 new deaths per day across America. In related news, yesterday the President announced the US will buy another 500 million doses of the PFE vaccine to donate to poorer nations, raising the total US donation commitment to 1.1 billion doses.

Overnight, Asian markets were mostly higher as China pumped $17 billion of liquidity into their banking system and told local governments to “prepare for a storm and be ready to step-in (if needed) at the last minute” to prevent spill-over events from the Evergrande defaults. Japan (-0.67%) and South Korea (-0.41%) were the only red in the region today. India (+1.57%), Hong Kong (+1.19%), and Australia (+1.00%) were the leaders to the upside. In Europe, markets are green across the board at mid-day. The FTSE (+0.05%) is the laggard after British PM Johnson failed to get the trade deal he had been promising prior to and shortly after Brexit. However, the DAX (+0.76%) and CAC (+0.85%) are typical of the region, even though some of the smaller exchanges are up almost 1.5% in early afternoon trading. As of 7:30 am, US Futures are pointing toward another gap higher. The DIA is implying a +0.47% open, the SPY implying a +0.52% open, and the QQQ implying a +0.54% open. 10-year bond yields are flat with Oil down three-quarters of a percent even as the Dollar is down sharply in early trading.

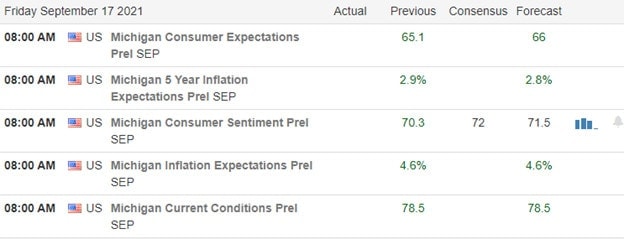

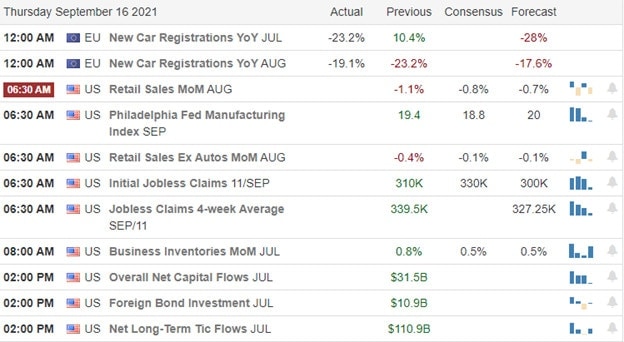

The major economic news scheduled for release on Thursday is limited to Weekly Jobless Claims (8:30 am), Mfg. PMI and Services PMI (both at 9:45 am). The major earnings scheduled for the day include CAN, DRI, and RAD before the open. Then after the close, AIR, COST, NKE, and TCOM report.

As markets digest (second-guess) the Fed results and afternoon reaction and fear over the Chinese debt default from Evergrande fades, US stocks are looking to rally at the open again. The question is whether the overhead resistance created on the recent pullback will hold or if the bulls will have their way. Either way, volatility remains elevated, the short-term trend remains bearish, and the next news story will be the success or failure of both the US Debt Ceiling raise and passing a budget to allow continuing government operations after September. It now appears any bipartisan efforts have failed, which leaves open the question of whether Democrats can come together enough to ram-through one-party solutions to those problems.

Remember, the trend is your friend until it ends. Right now, that trend remains bearish with a lot of volatility. So, manage your existing trades before you chase any new ones. Focus on the process and on managing the things you can control. Don’t worry about the things you can’t control. Discipline and good trading rules are what separates trading success from failure over the long run. Above all, consistently take profits when you have them. A good trader refuses to let greed turn their winners into losers.

Ed

Swing Trade Ideas for your consideration and watchlist: PLUG, FCEL, BB, NET, PLTR. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service