China Cuts Rates and Bears Roar

Stocks gave us a small gap higher at the open Wednesday. However, that was just the start of a roller-coaster “gap and crap” action that saw all 3 major indices close near their lows again. This left us with big ugly black candles in all of those indices. For the day, SPY lost 1.02%, DIA lost 0.96%, and QQQ lost 1.09%. The VXX rose another 2.4% to 20.27 and T2122 fell deeper into the oversold territory at 12.75. 10-year bond yields actually fell a bit to 1.85% and Oil (WTI) was up another 1.46% to $86.68 on reports a Russian invasion of Ukraine may be imminent.

In a follow-up to a report made the other day about PTON hiring McKinsey to evaluate costs, there were two pieces of news today. First, leaked audios came out with PTON execs are discussing cutting 41% of their sales and marketing staff, cutting some staff from their eCommerce group, and also closing 15 retail stores. Secondly, CNBC has reported that PTON insiders sold over $500 million of stock prior to the start of the big decline that started in January 2021.

In other business news, T and VZ turned on their long-hyped 5G networks nationally. Well, almost nationally. The companies voluntarily “left off” 5G in 2-mile diameter exclusion zones around the 50 largest airports. This was due to FAA fears that part of the 5G spectrum could interfere with altimeters used by planes to fly during bad weather. The FAA has cleared about 45% of the larger passenger and transport aircraft to not be impacted. However, if it had been turned on around those airports, the FAA estimated there would have been about 1,100 flight cancellations or delays per day. (TMUS 5G is not impacted because it uses different frequencies than the low-band that T and VZ use.)

On the earnings front, so far this morning AAL, FHN, FITB, KEY, MTB, SNV, and TRV have all beat on both lines. BKR and RF beat on revenue but missed on earnings. UNP and NTRS do not report until closer to the open.

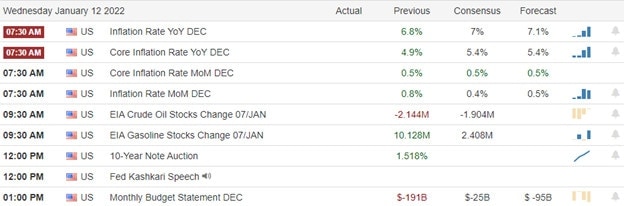

Overnight, Asian markets were mixed. Hong Kong (+3.42%) was a massive outlier to the upside as China cut lending rates. Oddly enough, mainland China exchanges closed slightly down after the news. However, Japan (+1.11%) and South Korea (+0.72%) lead the way higher in the rest of Asia. On the downside, India (-1.01%) was the only appreciable loser with half a dozen other exchanges being just on the red side of flat. In Europe, stocks are mixed on modest moves as of mid-day. The FTSE (-0.02%), DAX (+0.15%), and CAC (-0.20%) are typical of the continent. As of 7:30 am, US Futures are pointing toward a gap higher. The DIA implies a +0.45% open, the SPY is implying a +0.50% open, and the QQQ implies a +0.84% open at this hour. 10-year bond yields and Oil (WTI) are both down a bit in early trading.

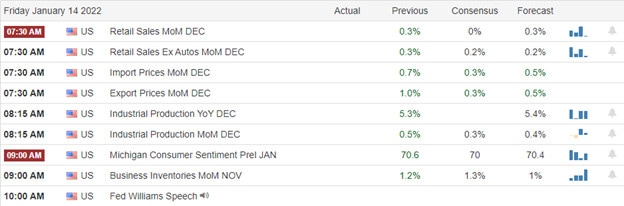

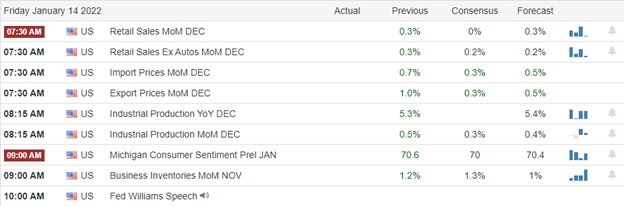

The major economic news scheduled for release Thursday includes Weekly Initial Jobless Claims and Philly Fed Mfg. Index (both at 8:30 am), Dec Existing Home Sales (10 am), and Crude Oil Inventories (11 am). Major earnings reports scheduled for before the market include: AAL, BKR, FITB, FHN, KEY, MTB, NTRS, RF, SNV, TRV, and UNP. Then, after the close, CSX, ISRG, NFLX, PPG, and SIVB report.

The Chinese rate cut overnight was the big news, but earnings and fear of inflation (and Fed reactions to it) are likely to continue to be the main US market drivers. The bulls have not given up, even as the QQQ nears correction territory. However, “mind the gap” as morning optimism is just as likely to be a “gap and crap” as it is a the bottom is in. The bears clearly still have all the momentum so far this week (and year). In short, continue to trade carefully.

Stick to your trading rules and on managing the things you can control. Don’t chase, trade with the trend, keep consistently taking profits when you have them, and move your stops in your favor. And keep in mind that the first rule of making a lot of money in the market is to not lose a lot of money in the market. So, don’t be stubborn. When you’re wrong, just admit it and take your loss. (That’s why we set stops.)

Ed

Swing Trade Ideas for your consideration and watchlist: EGO, BEKE, SWK, AU, EBAY, UAL, GDX, SAND. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service