Market Looks to Reevaluate Fed News

Once again, the bulls gapped stocks 1%-2% higher at the open Wednesday. Then we saw a sideways meander until 2 pm. However, when the Fed announcement and presser came out, all 3 major indices sold off hard to the lows of the day before drifting back upward to close up off the lows. This left us with gap-up, big black candles with good-sized wicks on both ends across the major indices. On the day, SPY lost 0.33%, DIA lost 0.44%, and QQQ lost 0.16%. The VXX rose 2% to 24.32 and T2122 fell back into the oversold territory at 11.27. 10-year bond yields spiked again to 1.867% and Oil (WTI) rose a bit under 2% to $87.07/barrel.

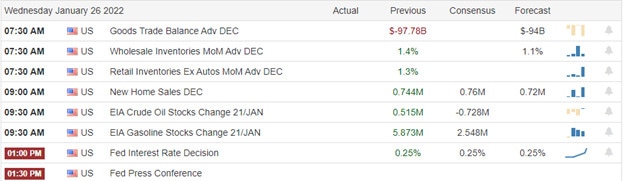

The big news of the day was the FOMC decision and Fed Chair Powell’s press conference. Oddly enough, we learned exactly what we expected to hear. The Fed signaled it will raise rates in March on an aggressive path to fight inflation, will have stopped buying bonds (completed the taper) by then, and will begin to significantly reduce its $9 trillion bond holdings over the remainder of the year. Again, none of this was anything we did not already know. So, perhaps it was Chair Powell’s refusal to rule out a hike at every meeting the remainder of the year (he was asked) that spooked markets. Regardless of the exact trigger, markets sold hard on the news, but the bears did not have the strength to close us out on the lows or to reach significantly lower levels.

After the close Wednesday, AMP, CCI, INTC, LSTR, RJF, STX, NOW, TER, TSLA, URI, VRTX, and XLNX all reported beats on both lines. However, EW, LVS, and PGR missed on both lines. Meanwhile, DRE, LRCX, MKTX, and WHR missed on either the earnings or revenue lines while beating on the other.

Overnight, Asian markets reacted to the Fed news as the region was nearly red across the board. (Malaysia +0.02% being the exception.) South Korea (-3.50%), Japan (-3.11%), and Shenzhen (-2.77%) paced the losses. In Europe, stocks are mixed at mid-day. The FTSE (+0.49%), DAX (-0.45%), and CAC (-0.34%) are typical of the spread across the region. However, Russia (+2.37%) is an outlier. As of 7:30 am, US Futures are pointing toward a slightly green open. The DIA implies a +0.04% open, the SPY is implying a +0.28% open, and the QQQ implies a +0.50% open at this hour. 10-year bond yields are down to 1.823% and Oil (WTI) is up 1% in early trading.

So far this morning, DHR, MO, MMC, DOW, MSCI, XEL, TROW, ROK, BLL, DOV, TSCO, TDY, AOS, JBLU, CMCSA, VLU, LUV, MKC, and ALK all reported beats on both lines. However, MCD and TXT reported misses on both lines. Meanwhile, SHW, NOC, IP, and KEX reported a beat on one line and a miss on the other.

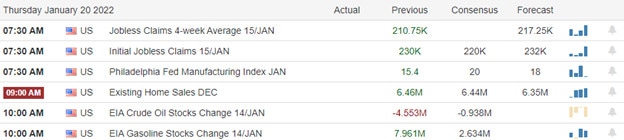

The major economic news scheduled for release Thursday includes Dec. Durable Goods Orders, Q4 GDP, and Weekly Initial Jobless Claims (all at 8:30 am) as well as Dec. Pending Home Sales (10 am). Major earnings reports scheduled for before the market include FLWS, AOS, ALK, ADS, MO, AIT, BLL, BX, BC, CNX, CMCSA, DHR, DOV, DOW, HCA, IP, JBLU, KEX, MA, MMC, MKC, MCD, MSCI, MUR, NOC, NUE, ORI, ROK, RCI, SAP, SHW, LUV, STM, TROW, TDY, TXT, TSCO, VLO, and XEL. Then after the close, AAPL, AJG, TEAM, BZH, CP, CE, EMN, JNPR, KLAC, MDLZ, OLN, RMD, RHI, SYK, X, V, WRB, WAL, and WDC report.

Traders have had a night to reconsider the Fed news. Often this leads to a reversal of the initial reaction from the afternoon of the report. In this case, that may not happen, because the news was widely expected ahead of time. Either way, it looks like markets are tepidly bullish at least before the morning economic news comes out. If we do open higher, just remember that the last two gaps higher were met with a strong selloff later in the day. So, be careful chasing unless you are hedged, small positioned, and/or very nimble.

Trade with the trend, don’t chase, keep consistently taking profits when you have them, and move your stops in your favor. Remember that the first rule of making money in the market is to not lose big money in the market. So, stick to your trading rules and manage the things you can control. Don’t be stubborn, protect yourself from yourself. When you are wrong, just admit it and take your loss. (That’s why we set stops in the first place.)

Ed

Swing Trade Ideas for your consideration and watchlist: No trade ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service