Bulls Look to Gap Up to End Tough Week

Markets gapped down the better part of a percent on Thursday on fears over economic slowdown. This led to the immediate start of an all-day, roller-coaster ride within a well-constructed range. The bottom of this range for the SPY was not far from the Bear Market trip line (down 20% from highs). So, we may be getting some support from traders at that level (about 383) for the broader market. At any rate, this action left us with indecisive, Spinning Top type candles across all 3 major indices. On the day, SPY lost 0.63%, DIA lost 0.78%, and QQQ lost 0.57%. The VXX fell almost 3% to 25.36 and T2122 “climbed” but still remains deep in the oversold area at 7.32. 10-year bond yields fell to 2.851% and Oil (WTI) gained 1.6% to $111.30/barrel.

During the day, Weekly Jobless Claims were reported as slightly higher than expected. However, it was the Philly Fed Mfg. Index that drew the most concern as it came in at only +2.6 (+16.0 was forecast). This means Manufacturing conditions are only slightly improving (anything above zero), less so than expected and far less so than last month (+17.6). April Existing Home Sales also came in slightly lower than expected, which falls in line with rising interest rates. KC Fed President George said “the rough week” in the market was not surprising and is just one of the ways tighter financial conditions will emerge as the Fed tightens policy.

SNAP Case Study | Actual Trade

After the close, DECK, FLO and PANW all reported beats on both the revenue and earnings lines. After-hours, DECK was up as much as 16%, PANW was up as much as 12%, and FLO was up as much as 8% on the earnings news. Meanwhile, CLZNY missed on revenue while beating on earnings. However, AMAT, ROST, and VFC all missed on both lines. After hours, AMAT was down as much as 8%, ROST was down 20%, and traded in a wide range up as much as 7% and down as much as 3% on the earnings news.

On the Russian invasion story, the EU has agreed to $19 billion in guaranteed short-term financing for Ukraine. Meanwhile, the Biden Administration approved another small ($100 mil) military aid package for Ukraine, that another 18 Howitzers. In Congress, the $40 billion Ukraine aid package passed. This aid bill includes $9 billion for replenishing US stockpiles of arms and munitions given to Ukraine. The main beneficiaries of that $9 billion will be RTX, LMT, GD, and NOC. Finland will also lose its main natural gas supply as of Saturday when Russia shuts down its supply following Finland’s refusal to pay for gas in Rubles. Finland is one of the few gas users to stand up to Putin as the Ruble hit a 7-year high on demand for that currency from gas buyers. Finally, Qatar has offered to sell LNG from its US-based plant to Germany starting in 2024.

President Biden is in South Korea today at the start of his Asian trip. Many analysts are expecting North Korea to launch a missile or do a nuclear test in order to upstage the visit to South Korea today. So, keep an eye out for that potentially market-moving news later today.

Overnight, Asian markets were green across the board with the minor exception of a flat Malaysia (-0.02%). Hong Kong (+2.96%), India (+2.89%), Shenzhen (+1.82%), and South Korea (+1.81%) led the way. However, most of the region was up more than a percent as China kept its one-year lending rate the same while cutting the 5-year rate by 15 basis points. In Europe, we also see green across the board with the exception of Russia Overnight, Asian markets were green across the board with the minor exception of a flat Malaysia (-0.02%). Hong Kong (+2.96%), India (+2.89%), Shenzhen (+1.82%), and South Korea (+1.81%) led the way. However, most of the region was up more than a percent as China kept its one-year lending rate the same while cutting the 5-year rate by 15 basis points. In Europe, we also see green across the board with the exception of Russia (-1.59%) at mid-day. The FTSE (+1.95%), DAX (+1.96%), and CAC (+1.40%) lead the way, but gains of more than a percent are seen everywhere except Russia, Greece (+0.83%), and Switzerland (+0.53%) in early afternoon trading. As of 7:30 am, US Futures are pointing toward a gap up to start the day at the end of a down week. The DIA implies a +0.77% open, the SPY is implying a +0.95% open, and the QQQ implies a +1.30% open at this hour. 10-year bond yields are up slightly to 2.875% and Oil (WTI) is also fractionally higher to $112.45/barrel in early trading.

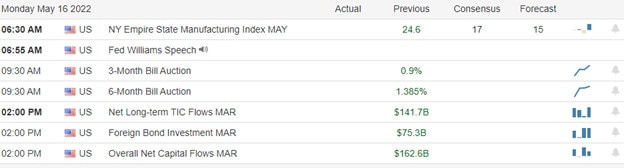

There is no major economic news scheduled for release Friday. Major earnings reports scheduled for the day include BAH, DE, and FL before the open. There are no reports scheduled for after the close.

So far this morning BAH and DE have reported beats on both lines. At the same time, FL missed on revenue while beating on earnings.

As we appear to be heading for a seventh straight week of losses (which would be the longest market losing streak since the dotcom bubble burst), Mr. Market seems to be trying to gap into a green day. Bear in mind that this is option expiration Friday and GS estimates $460 billion of single-stock options, as well as $855 billion in S&P-tied derivatives, will all expire. The point is, we may well see some volatility and/or pinning related to all those options expiring today. We also have a coming weekend new cycle to consider. So, continue to be very careful. The short and mid-term trends are bearish, the mid-term move is getting a bit long in the tooth. Plus in the short-term (as shown by T2122), we are oversold and have the potential support of a “bear market level” (down 20% from highs) in the area. So, remain nimble and hedged. Above all, don’t give in to FOMO and feel the need to chase a move or predict a reversal either way.

Trading is a job, not a lottery ticket. So, work the process. Stick with your trading rules and manage the things that you can control while trying not to worry about the things you have no control over at all. Trade with the trend, don’t chase, keep consistently taking profits when you have them, and move your stops in your favor. Also, remember that the first rule of making big money in the market is to not lose big money in the market. So, don’t be stubborn, and protect yourself from yourself. Keep in mind that nobody is right all the time. When you’re wrong, just admit it and take your loss. As they say, the best time to have taken a $500 loss is when you are now staring at a $1,500 loss.

Ed

Swing Trade Ideas for your consideration and watchlist: No Trade Ideas Today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service