PPI Looms as CNBC Says 3/4 Hike Likely

On Monday, the bears delivered a huge (2.2% – 3%) gap-down following Friday’s ugly gap-down black candle. We then saw bearish follow-through (of the gap) that reached the lows at about 11 am. From that point, we saw whipsaw action back and forth between the gap and the morning lows, before heading South to new lows late in the afternoon. This has left us with large gap-down Spinning Top type candles in all 3 major indices. This all happened on greater the average volume. All 10 sectors were bright red, with “growth sectors” like Consumer Cyclicals, Basic Materials, and Technology taking the biggest hits.

The 3 major indices are all now trading well below previous 52-Week Lows, but are also still 4%-8% above their rising 200sma. All 3 are also far below their T-line, meaning we may well see at least a bounce soon. On the day, SPY lost 3.83%, DIA lost 2.78%, and QQQ lost 4.65%. The VXX spiked 10.24% to 25.72 and T2122 shows us deep in the oversold territory at 1.67. 10-year bond yields absolutely screamed higher to 3.366% and Oil (WTI) gained slightly after being down 2% early in the day, closing at $120.86/barrel.

The big fear Monday was that high inflation (as typified by a much hotter than expected CPI on Friday) will lead to a three-quarter or even one-percent rate hike on Wednesday. This caused bond rates to spike, stocks to gap down and follow-through, and even crypto to selloff. Fed Chair Powell has repeatedly said he has a strong preference for only multiple half-percent rate hikes in the past. However, during the afternoon, the Wall Street Journal reported that sources tell them that FOMC voters are entertaining a 0.75% hike on Wednesday. In fact, CNBC’s Steve Liesman reported that his sources tell him a three-quarters of a percent hike is likely this week. If the Fed does this, it would be the largest hike since 1994.

SNAP Case Study | Actual Trade

After the close, ORCL beat estimates on both the revenue and earnings lines. The company said its Cloud business (infrastructure as a service and software as a service) rose more than expected and this was the key to the beats. ORCL was up 13.5% in after-hours trading.

We now have bond rate inversions (a better yield for short-term bond than long-term bond). Both the 2-year and 5-year bonds now have higher yields than the 10-year. In addition, the Dollar is incredibly strong. at its highest level against the Yen since 1998. The Dollar is up 22% versus the Yen and up 15% versus the Euro in the last 12 months.

In economic news later this week, on Wednesday, we get Retail Sales, NY Empire State Mfg. Index, April Business Inventories, Crude Oil Inventories, Q2 Interest Rate Projections, Fed Rate Decision, Fed Statement, and Fed Chair Press Conference. On Thursday, we see May Building Permits, May Housing Starts, and Philly Fed Mfg. Index. Finally, on Friday we get May Industrial Production and hear from Fed Chair Powell again.

Overnight, Asian markets were mixed, but leaned to the red side. Australia (-3.55%) and New Zealand (-2.59%) were outliers, showing by far the largest losses. Meanwhile, Malaysia (+1.12%) and Shanghai (+1.02%) were by far the biggest gainers and perhaps outliers from the other very modestly green winners of the region. In Europe, stocks are leaning heavily to the red with only Russia and Norway showing even modest gains at mid-day. The FTSE (-0.82%), DAX (-0.86%), and CAC (-1.05%) lead the way and are typical of early afternoon trading. However, Greece (-4.50%) is an outlier to the downside. As of 7:30 am, US Futures are pointing toward a modestly green start to the day. The DIA implies a +0.12% open, the SPY is implying a +0.29% open, and the QQQ implies a +0.56% open at this hour. 10-year bond yields have pulled back to 3.318% and Oil is up a half of a percent to $121.67/barrel in early trading.

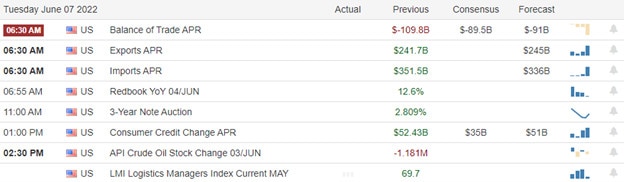

The major economic news events scheduled for release Tuesday is limited to May PPI (8:30 am). The only major earnings on the day are CNM and FERG before the open as well as ASTL after the close.

On the earnings front, this is a very slow week. On Wednesday there are no major earnings reports. Then on Thursday, we do get reports from KR, CMC, JBL, and ADBE. However, there are no earnings reports again on Friday.

If we look at the last few days of price action, we see what capitulation should look like. Significant gaps lower and big, black candles that close on their lows, pulling away from the T-line are sure signs that Randolph Duke is yelling “sell, Mortimer, sell” at his brother. And even though volume started below average, it has steadily declined over those last few days as the gaps and candles grew in size. So, even if we are not at THE BOTTOM, we need relief from extension which means we are nearing A BOTTOM. Does the bounce the last 10 minutes of the day and a modest premarket gap up this morning signal that extension relief? Your guess is as good as mine. All I can tell you for sure is that we are extended and we have seen capitulation-type selling the last few days.

The whipsaw is very real during times when we are thinking about changing trends and as we’ve seen lately, gap-chasers can get hurt. Trading is our job. So, do the work and work the process. Stick with your trading rules, trade with the trend, and consistently take profits when you have them. Always move your stops in your favor. Remember that the first rule of making big money in the market is to not lose big money in the market. So, don’t be stubborn. If you have a loss, just admit you were wrong and take it before it grows. As they say, the best time to have taken a $500 loss is when you are now staring at a $1,500 loss. Finally, remember that you get rich steadily over the long run in Trading…not by striking it rich on one or two trades. So, give up that lottery ticket mentality.

Ed

Swing Trade Ideas for your consideration and watchlist: TSLA, USO, PATH, TTWO, VLO, KHC, DPZ. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service