Stock Futures Declined

US stock futures declined on Monday as investors continued to offload shares of key technology companies that have been driving the recent bull market. This sell-off has been fueled by a surge in bond yields, particularly the 10-year Treasury yield, which reached its highest level since late 2023. Investors are anticipating the start of the fourth-quarter earnings season, hoping it will bring some stability to the volatile markets. Several major banks, including Citigroup, Goldman Sachs, and JPMorgan Chase, are scheduled to report their earnings on Wednesday, while Morgan Stanley and Bank of America will release their results on Thursday.

The pan-European Stoxx 600 index traded lower this morning, with most sectors experiencing declines. Investors in the region are closely monitoring eurozone and U.K. government bond yields, which climbed to fresh multi-month highs last week. Market focus will also shift to the U.S. December consumer price index release on Wednesday morning, following the release of the December producer price index report on Tuesday. These key economic data points will provide further insights into the trajectory of inflation and potential monetary policy decisions.

Asia-Pacific markets experienced a downturn on Monday. Mainland China’s CSI 300 index declined by 0.27%, likely influenced by a record low for China’s 10-year bond yield this month. Hong Kong’s Hang Seng Index also saw a decrease of 0.73%. In India, the Nifty 50 and BSE Sensex indices fell by 0.95% and 0.80%, respectively, ahead of the anticipated release of inflation data later in the day. South Korea’s Kospi and Kosdaq indices closed lower, with losses of 1.04% and 1.35%, respectively. Australia’s S&P/ASX 200 index also experienced a decline of 1.23%. Japan’s markets were closed for a holiday.

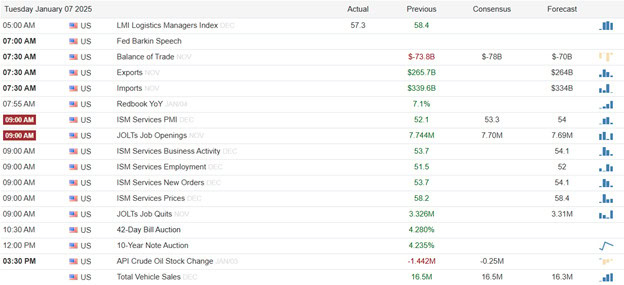

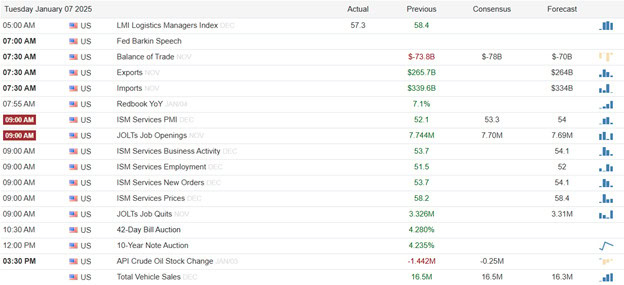

Economic Calendar

Earnings Calendar

Notable reports for Monday before the bell we have no noteworthy reports. After the bell reports include KBH.

News & Technicals’

U.S. Treasury yields climbed higher on Monday as investors braced for key inflation data releases. The 10-year Treasury yield, which had surged to its highest level since November 2023 following a stronger-than-expected jobs report on Friday, continued to rise by one basis point to 4.784%. Similarly, the 2-year Treasury yield saw an increase of three basis points, reaching 4.421%. This upward trend in U.S. Treasury yields aligns with a broader global rise in bond yields, reflecting a growing expectation among traders that interest rate cuts will occur at a slower pace this year. This cautious outlook is primarily driven by the anticipation that the U.S. Federal Reserve will proceed carefully, navigating a complex economic landscape characterized by both potential economic strength and lingering uncertainties.

The U.S. government announced new restrictions on the export of artificial intelligence chips and technology, aiming to maintain American dominance in AI by controlling its global spread. These regulations will limit AI chip exports to most countries while granting unrestricted access to U.S. AI technology for close allies. The measures, designed to prevent China, Russia, Iran, and North Korea from accessing advanced computing power, will also cap the number of AI chips that can be exported to other nations. This move reflects a broader strategy to concentrate advanced AI development within the U.S. and its allies.

In a recent podcast interview, Meta CEO Mark Zuckerberg criticized Apple for its perceived lack of innovation and the imposition of “random rules” on its platform. While acknowledging the iPhone’s significant impact in making smartphones ubiquitous, Zuckerberg expressed frustration with Apple’s current approach. He argued that Apple has not introduced any groundbreaking innovations since the iPhone’s initial release, essentially “sitting on it” for two decades. Furthermore, Zuckerberg criticized Apple for implementing arbitrary rules that hinder competition and innovation within the tech ecosystem

Blue Origin was forced to abort the inaugural launch of its New Glenn rocket on Monday due to a last-minute technical issue with the vehicle. This setback significantly impacts Blue Origin’s efforts to compete with SpaceX in the satellite launch market. The company decided to stand down the launch attempt to address the identified subsystem issue, which would have exceeded the available launch window. Blue Origin is now evaluating potential dates for the next launch attempt. The ambitious mission aimed to achieve a significant milestone by landing the first-stage booster on the offshore ship Jacklyn in the Atlantic Ocean for future reuse while propelling the second stage into orbit.

Although stock futures declined this morning, we are looking at a substantial oversold situation in the short term. Start watching for clues of a modest relief rally but keep in mind all the uncertainty we face in the days ahead that anything is possible. Expect significant volatility throughout the week.

Trade Wisely,

Doug