Futures this morning are suggesting a lower open this morning, and although it’s down, it’s not bearish. In fact, I would say a market pullback or consolidation is a sign of a healthy trend as long as the bulls defend support levels. The Dow has rallied nearly 17% from the market lows and a full month of bullish trading without a pullback. As resilient as the bulls have been, I doubt they will give up easily and will likely fight to hold key price supports. In fact, this pullback could be very short lived as long as earnings continue to roll out positively.

If the market simply consolidates this can be a profitable time for stock pickers. If supports are defended a pullback can setup new low-risk entries into existing trends? So don’t fear a pullback embrace it because it’s the natural price action of the market. It only becomes a problem is support levels fail because that usually means significantly higher price volatility. Keep an eye on support and trend and remember Price is King.

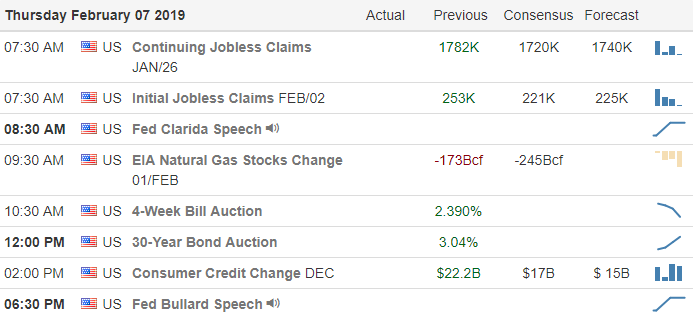

On the Calendar

On the Earnings Calendar, we have a big dig day with 230 companies fessing up to earnings results. Some of the notable today are ANGI, MT, CAH, COLM, DNKN, EXPE, GRUB, K, MAT, PENN, TWTR, TSN, WU, WWE & YUM.

Action Plan

Yesterday we saw a notable decline in bullish energy as the market slid sideways in a very choppy price action day. This morning Futures are suggesting a pullback with the Dow expected to gap down more than 100 points. Although a down day a pullback or merely a consolidation would be healthy for the overall market and does not at this time suggest bearishness. With more than 200 companies reporting today anything is possible and futures could easily change their tune by the open.

Important support levels to watch DIA 250, SPY 267, QQQ 166 & IWM 145. If bulls can defend those supports levels or above the odds of the bullish trend staying intact is very high. Breaking those levels would add a bit of complication and likely see some fear and price volatility return to the market. If the market consolidates it can be a profitable time for adept stock pickers as good patterns and trade setups will likely continue to develop. As always stay focused on price action trading the chart not your bias.

Trade Wisely,

Doug

Comments are closed.