I find the hyper-confidence currently displayed by the US markets a bit puzzling this morning especially with president reportedly considering a 60-day extension of the tariff deadline. Nonetheless the bulls are in full on beast mode this morning ahead a huge day of earnings reports and government shutdown delayed retail sales numbers.

Asian markets were subdued overnight as trade negations are scheduled to continue into Friday. However, European markets are higher amid earnings result and the US Futures currently indicate another gap up open. There is not a clue in the price action suggest bearishness but this late in the rally I must admit concern about adding new long risk with the indexes so extended. Enjoy the ride and hold on tight and let’s hope the negotiations progress as positively as the market is pricing everything.

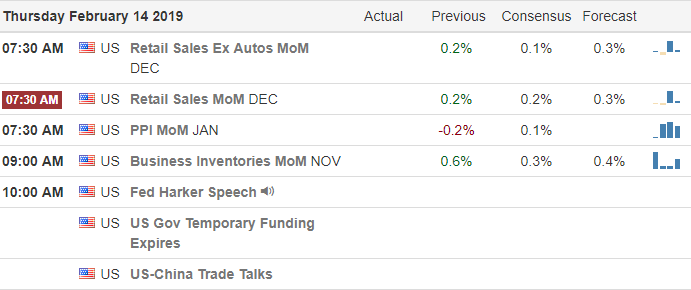

On the Calendar

On the Earnings Calendar we have more than 220 companies reporting earnings today. Watch for notable reports from NVDA, CM, CGC, AMAT, ARCH, ANET, AZN, AVP, BLMN, CBS, CC, CME, KO, CS, DUK, GEO, IRM, SIX, WM & ZTS.

Action Plan

We have another interesting day ahead of us and I have to be honest the hyper-confidence of the US Market has me nervous and a bit puzzled. First, reports are now questioning whether or not the President will sign the compromise bill which would avoid the Friday night government shutdown. I find that difficult to believe but if true I’m confident the market will react negatively if that were to occur. Secondly, the market seems to believe a Chain trade deal is imminent but the president reportedly is considering a 60 extension of the deadline.

Would that not suggest negotiations are not going that well and how is dragging this threat out another 60 days reason to gap the market higher this morning? Things that make me say Hmmm? Asian markets were very subdued overnight but European markets and US Future are still determined to run higher. Remember we have a big day of earnings and Retail Sales numbers that may move the market around before the open.

Trade Wisely,

Doug

Comments are closed.