The bears came out to play yesterday, defending price resistance levels in the index charts but found stubborn bulls willing to defend supports, creating a wide-ranging chop zone. Though bearish candle patterns were left behind, the price action created more questions than answers, with mixed messages coming from the talking heads. For the rest of the week, Jobs data will focus on ADP and Jobless Claims today, with the Employment Situation out Friday before the bell. With more rate increases around the corner, traders should prepare for just about anything in this uncertain market condition.

Overnight Asian market struggled for direction as it reacted to gyrating oil prices. However, European markets at primarily bullish this morning, with the U.K. market closed as they wait on a decision from OPEC. U.S. futures point to a bullish open as earings roll out, and we pensively wait on jobs data. Will it inspire the bulls or the bears? Your guess is as good as mine!

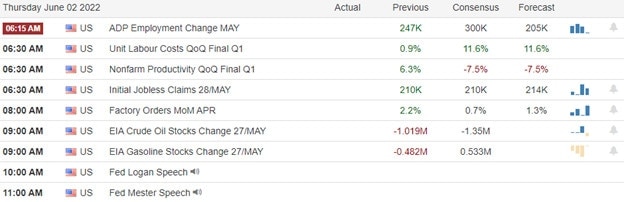

Economic Calendar

Earnings Calendar

We have just over 20 confirmed earnings reports for Thursday as retail continues as the general theme. Notable reports include LULU, CVGW, CIEN, COO, DBI, DLTH, HRL, LE, OKTA, TLYS, TTC & ZUMZ.

News & Technicals’

Senior Biden administration officials say that around 560,000 student loan borrowers who attended Corinthian Colleges will soon get their balances cleared. Formerly one of the largest for-profit education companies, the schools have been accused of predatory and unlawful practices and faced numerous lawsuits. Oil prices fell in the morning of Asia trading hours. The Financial Times reported that Saudi Arabia is prepared to raise crude production if Russia’s output significantly falls following European Union sanctions. EU leaders on Monday agreed to ban 90% of Russian crude by the end of the year as part of the bloc’s sixth sanctions package on Russia since it invaded Ukraine. That initially sent oil prices up. Sources told the FT that Saudi Arabia, OPEC’s de facto leader, has not yet seen genuine shortages in the oil markets. But that situation could change as economies globally reopen. Two main factors have Dimon worried: So-called quantitative tightening, or QT, is scheduled to begin this month and will ramp up to $95 billion a month in reduced bond holdings. Dimon’s other significant factor is the Ukraine war and its impact on commodities, including food and fuel. Oil could hit $150 or $175 a barrel, he said. “You’d better brace yourself,” Dimon told the roomful of analysts and investors. “JPMorgan is bracing ourselves, and we will be very conservative with our balance sheet.” GameStop reported its fiscal first-quarter earnings after the bell on Wednesday. GameStop has said it plans to launch a non-fungible token (NFT) marketplace by the end of the second quarter. Treasury yields dipped in early Thursday trading, with the 10-year slipping slightly to 2.92% and the 30-year trading at 3.06%.

Yesterday’s wide-ranging chop left more questions than answers as the indexes with the bears defending resistance levels but found bulls willing to defend price supports. Although chop can be frustrating for traders, it could be just what the market needs to reduce wild price gyrations. Unfortuantually, the VIX remains just above the support of 25 handles suggesting there is still a lot of work to do to improve market conditions. The T2122 indicator is also problematic, still indicating a short-term overbought condition while stock work to hold higher low levels. That leaves the hit and miss earnings and the economic reports as the possible tie-breakers to market direciton. Today we have OPEC, ADP, Jobless Claims, Productivity, Factory Orders, and oil and gas numbers to keep us guessing. Toss in some Fed talk, bond auctions, and several retail earnings reports raising the bar of uncertainty.

Trade Wisley,

Doug

Comments are closed.