Traders shrugged off historic unemployment, choosing to bet on the massive FOMC and Federal Government stimulus programs and staging the biggest weekly Rally since the late 1970s. The question now is, can the bulls maintain control as we enter the 2nd quarter earnings season and witness the staggering impacts to business. Analysts estimates suggest earnings declines of 20 to 30 percent with expectations that recovery may not occur until 2021. In actuality, the numbers won’t matter nearly as much as how the market reacts to them. Anything is possible as there is no benchmark for reference to this health crisis.

Asian markets closed mixed but mostly lower as China reported more than 100 new infections attributed to foreign travelers. European markets are higher across the board this morning in reaction to the FOMC’s new 2.3 Trillion stimulus plan. After sliding more than 300 points in the overnight session, US Futures have bounced, trying hard to rally and shake off the worry of the pending earnings season. Expect the extreme volatility to continue.

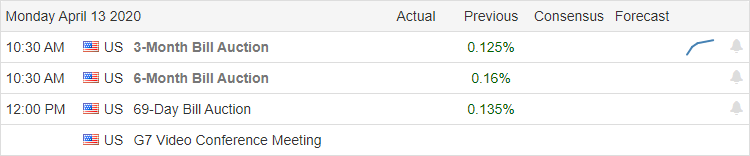

Economic Calendar

Earnings Calendar

This week we have the official beginning of the 2nd quarter earnings. We start this Monday with 46 companies reporting results.

Top Stories

Despite the rising virus infections, US Markets choose to focus on hope with the largest weekly Rally since the late 1970s. As US infections top 550,000, the President is hoping to begin reopening the economy in May, but health officials are concerned that it is too soon with a possible vaccine still more than a year away.

OPEC reached an agreement over the weekend to cut oil production by nearly 10 million barrels per day, which is the single largest output cut in history. The deal could save as many as 2 million jobs in the United States.

JPMorgan Chase said it would raise mortgage borrowing standards as the economic outlook continues to diminish due to virus impacts. New applicants will need credit scores of at least 700 and will be required to make a 20% down payment of the home’s value.

Technically Speaking

According to the T2122 indicator, we swung from extremely oversold to overbought in last week’s optimistic relief rally. As officials proclaim that the spread of the virus in the US has slowed the infections numbers swelled to more than 550,000 over the weekend with a death toll of topping more than 22,000. The big question on everyone’s mind this week, can we keep the optimistic Rally going as we begin the 2nd quarter earnings season? To this point, the market has been able to ignore the historic unemployment numbers, but as companies start to report, it will be hard to ignore the massive economic impacts of the outbreak. Only time will tell how the market will react, but we should prepare for a rough road ahead and the likelihood of a long, tough road to recovery.

Last week’s Rally significantly improved the technical appearance of the index charts, holding higher lows and establishing at least a short-term uptrend. Several price support levels were reclaimed with the QQQ leading the way managing to close the week just above its 200-day average. Even with the historic oil deal, the US futures point to a substantial gap down this morning as traders and investors attempt to price stocks. A difficult task considering there is no benchmark of reference, and no one knows how much longer this crisis could extend, making any company guidance issued nothing more than a hopeful guess. Hold on tightly, the bumpy ride of uncertainty is likely to continue.

Trade Wisely,

Doug

Comments are closed.