If the US futures are any indication of the day we have ahead we should expect price action to become a bit more volatile and challenging and the 21% one day rally in VIX seems to confirm that possibility. During the night the Dow futures were up more than 100 points shortly after the open but reversed sharply and traded more than 120 points lower as Asian markets fell sharply due to global growth concerns.

Technically both the DIA and the IWM have confirmed lower high failures at price resistance. Although Friday’s price action raises major concerns for the SPY the pullback in QQQ is only a test of support and the overall uptrend at this point. Currently the US futures are only pointing to a modestly lower open but we should expect an extra dose of price volatility so plan your risk carefully.

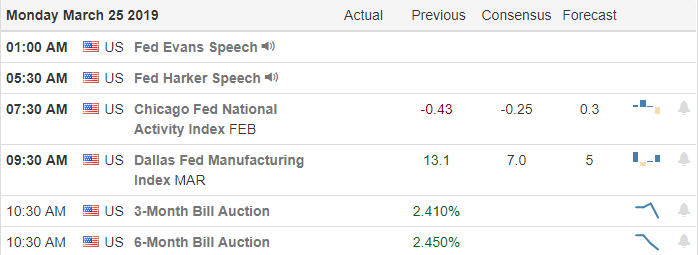

On the Calendar

On the Earnings Calendar we have over 70 companies reporting earnings today. Among the notable reports RHT 7 WGO.

Action Plan

After 2-years of investigation it would seem the Mueller findings have cleared the President of the collusion with Russia. The Attorney General also says the report did not find enough evidence to charge the president with obstruction of justice. Now one would think that mess is finally behind us but I would bet money that’s it’s far from over and will become a never-ending story in the political spin cycle. Rockets fired into Israel will cut the Netanyahu visit to the US short and raises concerns of a violent escalation in the area.

Futures have been a roller-coaster ride overnight. First the Dow futures rallied more than 100 points after the AG cleared the president. Then Asian markets opened and fell sharply with the Dow futures reversing and dropping more than 120 points. European markets are modestly lower across the board but the early morning pump has the US futures suggesting only a modestly lower open as I write this. I will not be at all surprised if both the overnight high and low get tested at some point during the day. Remember Friday’s sharp escalation in VIX suggests a bit more volatility price action is not out of the question so plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.