The technical picture of the indexes has vastly improved in just five trading days, but it has also created a significant risk to retail traders. For example, yesterday’s 250 point whipsaw in the Dow demonstrated the market sensitivity to a single downgrade of Disney. Moreover, earnings season is notoriously volatile, and with prices spiking, it also creates significant risk if we see some disappointing results. Finally, it would be wise to keep in mind before rushing into already elevated stocks that inflation, high energy prices, and supply chain impacts could create substantial earnings uncertainties. So plan your risk carefully!

Overnight Asian markets were mixed but mostly higher, with Hong Kong leading the bullishness up 1.49%. European markets trade with modest gains across the board this morning, monitoring earnings results. Ahead of the earnings results and housing numbers, the premaket pump is well underway, suggesting a gap-up opening as we stretch out from recent lows. Expect considerable price volatility as we react to all the data.

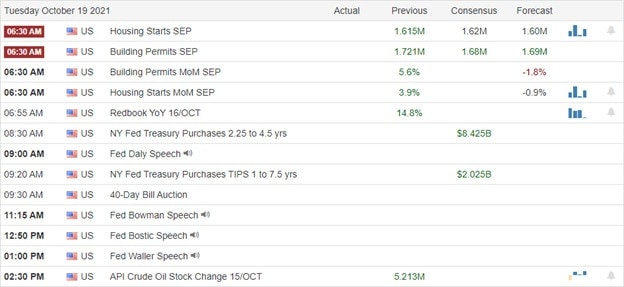

Economic Calendar

Earnings Calendar

The earnings begin to ramp up today, with our first big tech reports beginning this afternoon. Notable reports include JNJ, NFLX, BK, CNI, FITB, HAL, IBKR, ISRG, KSU, OMC, PM, PG, SYF, TRV, UAL, & WDFC.

New & Technicals’

When the Covid-19 pandemic swept the globe in 2020, the U.K. was hit hard, reporting some of the highest cases numbers and fatalities in Europe. However, the U.K.’s speedy vaccination rollout was widely praised and helped to bring cases under control. Now the situation is looking dramatically different, with the country recording close to 50,000 new Covid cases a day — giving it one of the worst daily infection rates in the world. Worries about Evergrande’s ability to repay its debt and a total of $300 billion in liabilities have put global investors on edge about potential spillover into the rest of China’s real estate industry and economy. A closer look at Evergrande revealed a company with many of the same problems as others in the Chinese property sector but didn’t act as quickly to respond to government rules aimed at resolving those issues. The company failed to address tighter regulation on debt levels and was the biggest Chinese real estate issuer of overseas high-yield bonds. Wall Street’s primary regulator released its highly anticipated report on the GameStop mania on Monday. The SEC said online brokerages, enticed to increase revenue through payment for order flow, are turning stock-trading into a game to encourage retail investors’ activity. “Payment for order flow and the incentives it creates may cause broker-dealers to find novel ways to increase customer trading, including through the use of digital engagement practices,” the agency said.

The vastly improved technical picture of indexes has inspired considerable speculation buying ahead of big tech reports. Now the big question is, can they produce sufficient results to support the elevated stock prices? The danger for traders is the recent steep rise in prices places a lot of downside risk should the earnings happen to disappoint. The DIA is more than 1200 points off the low in just five trading days, and the SP-500 is nearing 200 points. Considering the volatility of the current price action creates a siginifiant risk to traders rushing in with the fear of missing out. So plan your risk carefully, and make sure you plan your trades carefully. Remember inflation, high energy prices, supply chain issues, consumer sentiment, as well as the beginning of the Fed taper could make for uncertain earnings results.

Trade Wisely,

Doug

Comments are closed.