Uncertainty FED Elections Trade China

Uncertainty in the air right now with the FED, Elections, Trade, and China slowing down. For most traders this has been a hard week to trade and make money, price action has mostly been choppy and hasn’t gone anywhere. Price action has gravitated to the 200-SMA and seems to be sticking around the area. Earnings have been for the most part positive, but there is a tremendous amount of uncertainty in the air right now with the FED, Elections, Trade, China slowing down and such. This is the kind of stuff the market does not like.

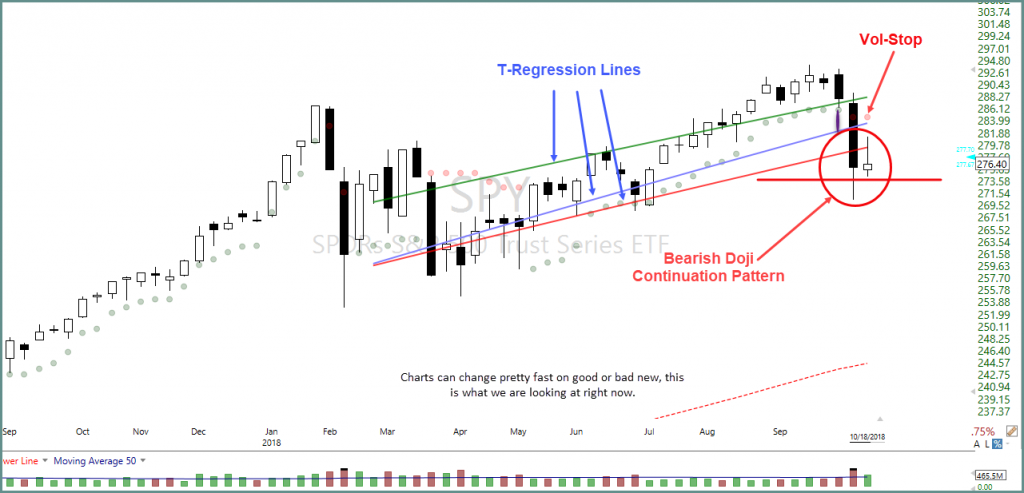

We know that charts can change pretty fast based on good or bad news, take a look at the weekly chart of the SPY. The chart pattern is a Bearish Doji Continuation pattern, the price is below all three T-Regression Lines, and the Vol-Stop is still negative. The 80/20 rule has been a valuable rule for me over the years, 80% of stock follow the SPY/SP-500, something to think about.

Past performance is not indicative of future returns

Happy Friday!

Good Trading, Rick, and Trading Team

Membership Services • Private 2-Hour Coaching

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, Right Way Option, Trader Vision 2020 or Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone.

*******************************************************************

Comments are closed.