With another morning chalked full of data, we have the typical premarket pump up, but anything is possible at the open as the market reacts to the data. However, with the pending Employment Situation number Friday morning, it would not be unusual to slide into choppy price action after the morning gyrations as we wait. Nevertheless, the index trends remain bullish, although the extension in the SPY and QQQ by the surge of buying in big tech is a bit worrisome that a profit-taking wave could begin anytime. That said, stay with the trend but avoid complacency should the data shift current sentiment.

Overnight Asian markets traded mixed with Australia, recording a higher than expected trade surplus in July. European indexes trade flat this morning as they wait on the pending jobs data here in the U.S. However, that is not the case in the U.S. future as the push for a bullish open ahead of trade and jobless claims numbers. So expect some morning price volatility as the market reacts.

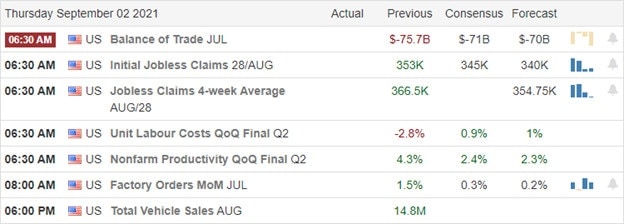

Economic Calendar

Earnings Calendar

We have our busiest day on the earnings calendar this week, with 35 companies listed this Thursday. Notable reports include SIG, AEO, AVGO, CIEN, CCEP, DLTH, GIII, GCO, HPE, HRL, JOAN, KIRK, LE, & TLYS.

News & Technicals’

The ECB will meet on Sept. 9th, but analysts think the central bank will wait until maybe December to announce a taper. One possible reason for the wait is to see what happens with the pandemic in the coming months. According to the WHO, a new variant called “mu” has mutations that can evade a previous infection or vaccination immunity. MU was first spotted in Colombia but is now being tracked in at least 39 countries. New York and New Jersey have issued emergencies after the remnants of Hurricane Ida dropped record rainfall between 6 to 10 inches bringing transit to a near standstill and shutting down parts of the subway system. This morning Treasury yields are moving lower, with the 10-year slipping to 1.2970% and the 30-year dipping to 1.9174%.

After the typical premarket pump up, the indexes spent most of the day chopping, although the QQQ did squeak out a new record high by the close. However, the technicals of the index charts remain very bullish albeit somewhat extended in the SPY and QQQ. The substantial decrease in oil reserves also helped to support the price action in IWM, which turned in the most robust performance of the day. With a busy morning of economic data that includes Jobless Claims, international trade, productivity, and factory orders, we should expect price volatility at the open. That said, don’t be too surprised after the early morning reaction if the price action returns to choppiness as we wait for the Employment Situation Friday morning. Though we see the typical premarket pump up, the open makes anything possible as the market reacts to the data.

Trade Wisely,

Doug

Comments are closed.