US/China trade optimism inspired Asian markets to close higher and currently European markets are also feeling bullish ahead of another Brexit vote later this morning. As a result, the US Futures are very happy this morning suggesting a 100 point gap up in the Dow at the open. As great as that sounds be careful chasing the morning gap because of the significant resistance levels just above. Let’s wait and is if buyers step in after the open supporting this gap.

If you have yet to take some profits this week, remember gaps are gifts and this morning may be a perfect time to reduce risk by taking some profits to the bank. Be careful not to over-trade as the market tests resistance and keep in mind the bear are unlikely to give up easily. However, the hopefulness of a US/China trade deal may be just enough to inspire the bulls to keep climbing. Stay focused on price action and give consideration to the risk you carry into the weekend.

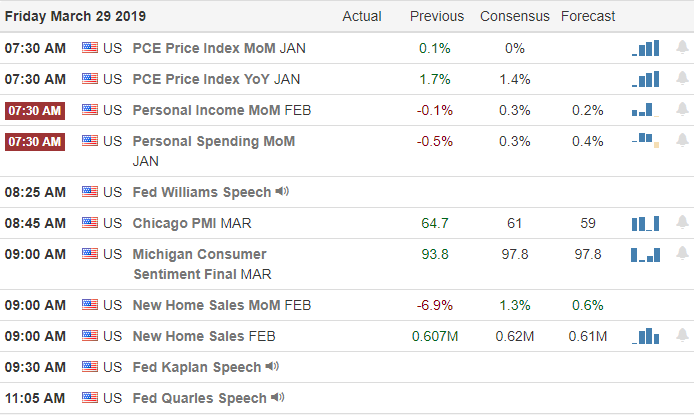

On the Calendar

On the last trading day of the first quarter we still have we still have companies more than 60 companies reporting. A good thing because 2nd quarter earnings season will kick off in about three weeks. Among those reporting BB and KMX are notable.

Action Plan

As US/China trade negotiators gave the markets a lift overnight stating the talks were productive but stopped short of providing any details. Asian markets closed higher across the board on the trader optimism. European markets are also higher across the board and later this morning the UK will once again vote on a Brexit plan that would have them leaving the EU by mid-May. That of course could create a market reaction and currencies may see some fluctuation in reaction.

Currently US Futures are also suggesting a bullish open today but except the QQQ the indexes still have significant resistance levels above. The bulls and bears have been pretty equally matched all week leaving behind indecisive candle patterns. Perhaps the positive comments on the trade negotiations is enough to inspire the bulls but they will need some significant momentum to break the bearish resistance levels above. Remember not to chase a morning gap into price resistance. Wait and see if buyers step in supporting the gap. Have a great weekend everyone.

Trade Wisely,

Doug

Comments are closed.